- As the Bitcoin price takes a dive, new batches of Tethers — the dollar-substitute token that Bitfinex and Tether swear is fully-backed, even if the audits they’ve been promising for months still haven’t materialised — have coincidentally been released daily for the past five days. 50 million on January 15th, 100 million on each of the 16th, 17th, 18th and today. I’m finally putting together a proper writeup on Tether; it’ll end noting (again) that Bitfinex/Tether really need to release proper audits documenting how this is all actually just fine, because as it stands I’m frankly amazed the market is still pricing these things as being equivalent to a dollar. When a central bank goes around just printing money, people question it.

- The Tether Rich List is every exchange that would be in deep trouble if the market ever stops pricing these things at around a dollar. (Here’s snapshots from the last couple of months.)

- Though there is genuine user demand for Tethers — from crypto traders using Tether to move dollar-equivalent value between exchanges, rather than going via an altcoin with thin trading and a wide spread between exchanges.

- (By the way — does anyone know why CoinMarketCap’s list of Bitcoin exchanges lists all other exchanges with only Tethers as BTC/USDT, but Bitfinex as BTC/USD?)

- Ignore the text of this article and scroll down to the pictures from angry Bitcoin men who smashed up their computing equipment when number go down.

- Just as Bitcoin crashed, the BitConnect Ponzi scheme also proceeded to shut down and exit-scam. It was an obvious Ponzi from the start — a “high-yield” investment programme whose returns on investment (40% a month) were clearly not possible or sustainable. Since this is crypto, they’ve started a new scheme, BitConnectX. They’re running an ICO.

- China doesn’t want ICOs, doesn’t want crypto exchanges and is pushing out the miners. So the new thing is “initial miner offerings.”

- Gamers are very annoyed at the crypto craze, as it sends the price of high-end video cards up. But there’s now a computer virus that targets GPU miners — it keeps them mining, but changes the payment address from yours to theirs.

- The US Treasury, with IRS examiners, is reviewing 100 “registered digital currency providers as well as others that have not registered.” There aren’t 100 exchanges in the US … this will be interesting.

- Unbanking the banked: UK customers are losing their accounts because actually, banks are super-cautious about money laundering these days. And Metropolitan Bank, which is used by a lot of crypto companies, such as Coinbase, is refusing to touch crypto wires henceforth.

- There’s something about “blockchain,” in the hype and puffery sense, that attracts the sort of consultant who presents the idea of living in a panopticon, but on the blockchain (English translation) as a good idea. In this case they’re called Daredisrupt, because the first thing anyone wants from their public services is disruption. The main thing protecting us from these people is the stupendous infeasibility of every detail. (Via Carsten Agger.)

- James Altucher, the financial newsletter writer who predicted that Amazon would start accepting Bitcoin in October 2017, now claims that he’s examined the code of various cryptos, and has found a line of computer code that can telegraph precisely when minor altcoins are going to go up and down, “WEEKS in advance” — and that he not only knows who Satoshi Nakamoto is, but reads his blog every day. Huge if true.

😭😭😂😂😂😂 pic.twitter.com/OWiil7ymjQ

— DaytradeJeffrey📈 (@DaytradeJeffrey) December 23, 2017

found a little gem on his blog

( https://t.co/iF8xEW5sQp ) pic.twitter.com/eA4vyakYca— bitcoinrick (@bitcoinrick) January 16, 2018

- Meanwhile, what actually predicts minor altcoin price rises: highly organised pump-and-dump fraud rings. If everyone’s suddenly talking up some altcoin or ICO … assuming it’s all just blatant fraud will be correct most of the time.

- KodakCoin and the Kodak KashMiner won Worst Idea in BBC Tech Tent’s CES 2018 Techie Awards. And that’s quite an achievement for all of CES.

- Martin Lewis from MoneySavingExpert writes a good post for the general reader: Should you invest in Bitcoin? Four things you need to know.

- A Twitter thread from Patrick McKenzie on financial institution computer systems — apposite to Kraken’s recent IT disaster, but widely applicable to the crypto space ever since the evening Jed McCaleb thought “I know PHP! How hard could running an exchange be?” and created Mt. Gox.

- Meshed Insights’ FLOSS Weekly Podcast is about the world of open-source and free software. This week’s is about “the Aragon project. It’s a blockchain-based system layered on Ethereum using smart contracts to support distributed ownership and operation of a company. The project is also implementing distributed political discourse, especially in support of LiquidDemocracy.” It’s interesting to hear Simon Phipps, a reasonably normal computer industry person (who has read my book) asking about the glaring problems with the very idea of DAOs and smart contracts, and getting back handwaves and bizarre extremist Bitcoin politics buzzwords and dog-whistles.

- Is Bitcoin Legal Tender In Japan? Summary: of course it bloomin’ isn’t.

- Dear crypto conferences (who I won’t name) — thank you for the speaking offers on the other side of the world! Unfortunately, I can’t spring for air fare nor accommodation. Nor do I find myself available to enhance the saleability of your conference for free. But if there’s “so much demand to speak,” I’m sure you’ll be fine with those guys!

- Also, I still have no plans to accept payments in cryptos, no really, actual money please thanks so much, what do you mean “short on fiat at present,” I thought anyone could cash out any time easily,

Ghost story: Roko's Basilisk is traded as a crypto currency. No one knows exactly which one, but if you don't have proof of stake in Roko's Currency when you die, you're doomed

— Dr. Ellie Lockhart, endure and survive (@BootlegGirl) January 18, 2018

People say that we haven’t found a good use for blockchain yet. I don’t know, I’m finding this all very entertaining.

— Duncan Weldon (@DuncanWeldon) January 17, 2018

Your subscriptions keep this site going. Sign up today!

Bitfinex had BTC/USD banking, and they claim to have re-established it (with some rural Polish bank also used by other Tether-based exchanges) sometime in November, IIRC. I’d assume CMC lists it as USD because 1) USD can be deposited at BitFinex (sort of, if you aren’t US citizen or unwilling to pony up minimum amount requirements recently instituted on fiat, and if you’re fine with never getting fiat back out from them). At least the rest of this Tether-exchange human-centipede don’t pretend to operate in real money & accept deposits of fiat for which they have no intention or ability to process fiat withdrawals since April.

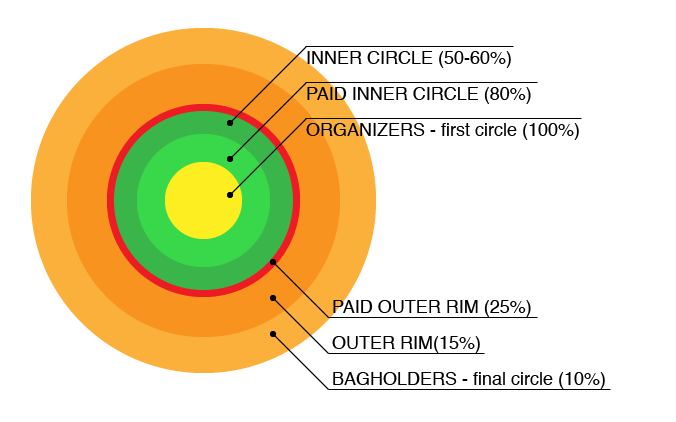

The whole bullseye chart with inner circle etc is quite accurate, it is just the numbers are even worse for the retail investor when you trade licensed securities, and you trade under the apprehension the regulator will look after you in event of market manipulation etc, when rarely that is the case.

Better to knowingly swim with sharks in the crypto sphere than think you are safe on the traditional markets and then be surprised, if you ask me.

One day a crypto advocate will come up with an excuse other than whataboutery.

I have traded the Australian share market for years, and cryptos on and off since 2013 and simply make an observation – I have been involved in shares where the directors or company have clearly breached the rules and societal exceptions by a long way and nothing ever came of it from ASIC, the Australian regulator. eg leaving the retail shareholders holding the bag after directors friends and family got out before an adverse announcement.

In addition, just as one example, we have similar rules to the USA where certain investors are classed as “sophisticated” and are able to persue opportunities that regular investors are not, this is the nature of the bulls-eye diagram.

I would argue that for many people who have the ability to research themselves and gain an understanding of crypto markets, the risk of being out of them far exceeds the risk of being in them – you just need to allocate an appropriate % of your capital or disposable funds relative to the potential risks and rewards and your personal circumstances.

e.g. if you can risk 1% of your capital to gain a return that multiplies it by five, ten or a hundred then it may well be worth the risk of losing the entire 1%, depending on your personal circumstances and stage of life. it all comes down to risk management. Currently the odds of this are way better than a lot of lotteries and many seemingly intelligent and educated people buy lottery tickets.

As usual in these sort of things, early adopters usually fare best, but also those with nothing to lose and little or no access to investment markets can gamble a small amount and there is an intersection of these types that means for some the crypto democratisation of capital and transfer of wealth from the top to the bottom is immense and it is almost dreamlike for them.

Maybe one day someone who chooses not to participate in crypto markets will respect that some people choose to take that particular risk that may not be palatable to yourself, and for some of them it has transformed their lives (not that money solves all your problems by any means).

I personally know half a dozen, and yes they have cashed out to fiat enough to not care what happens in crypto next.

I assume it would be easier for those who choose not to participate to respect those who do if the cryptospace were not dominated by people who (a) try to evangelise everybody into buying cryptos and then (b) ridicule the freshly converted, unsophisticated investors as “weak hands”, “noobs” or “not having done enough research” when they inevitably lose money.

Wanting to have it both ways, or perhaps “this is just for people who know what they are doing, so why don’t you let them take their own risk?” is motte and “crypto is the future, get all in grandma before it is too late” is bailey?

Regular markets are full of exactly the same stuff, it is a way of making the “club” exclusive, not unique to crypts at all.

Interestingly, the term “weak hands” comes from card playing according to some.

Nothing is for sure, or black and white, it is all Bayesian.

Don’t be afraid to ignore the subtle undertone, the whispers that we hear in school and working in many jobs, that tell us the rules are fixed and the way you win is by playing within those rules towards a known end.

Yeah, and all the regulations to protect investors and the holders of bank accounts are just a conspiracy by the reptile shapeshifters from hollow earth really meant to keep the sheeple down, I see.

I will never get this I need to get rich quick, there has to be a trick for that mentality. I earn a salary and do useful work, and although I will never be rich that seems to work well so far.