By Amy Castor and David Gerard

- We haven’t slept since Tuesday, and we’re writing on the Sam and Caroline plan. Send us money! Our work is funded by our Patreons — here’s Amy’s, and here’s David’s. Your contributions help greatly!

“All crypto exchanges can be considered as being in a quantum state of Quadriga: until you open the box it is impossible to know if the money is inside or not, but it definitely won’t be by the time anyone decides to look.” — Michal Sinak

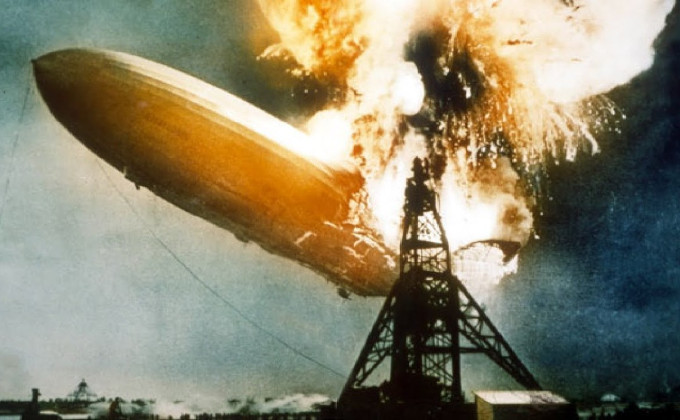

Crypto as a whole has been bankrupt since May. There are very few actual dollars coming in. All these firms claiming millions and billions of dollars’ value in crypto are puffing themselves up to pretend they’re not bust. The zeppelins are flying high, waiting for a single spark to set them off. As happened this week to FTX.

FTX was the second-largest crypto exchange. In days, it exploded into flames and collapsed into a heap of smoldering rubble, leaving behind a bunch of flummoxed investors and signaling the fall from grace of its boy-wonder founder Sam-Bankman-Fried.

FTX was a balloon full of expanding gas and worthless altcoins — and yet it was propped up by media and investors who couldn’t be bothered to do due diligence.

We wish we’d set up a webcam on Tuesday with a picture of SBF and a cucumber to see which would last longer.

If only Tom Brady hadn’t deleted this tweet!

Mr. Bank Man, fry me a bank

FTX lent billions of dollars in customer funds to its sister trading firm Alameda Research. Using customer funds to prop up your trading desk is illegal in pretty much every jurisdiction, for good reason. [CoinDesk]

The Securities Commission of the Bahamas — where the two firms are headquartered — froze all assets on the crypto exchange and called for a liquidator on November 10. [Twitter; Decrypt]

On November 11, FTX Trading Ltd. filed for Chapter 11 bankruptcy in Delaware, US. FTX and Alameda, along with every other entity in SBF’s crypto empire, are substantially owned by one Delaware entity, Paper Bird. [FT, paywalled, archive]

The filing lists 134 entities — including FTX.com, FTX US, and Alameda Research. According to the petition, assets and liabilities range between $10 billion to $50 billion (!) each, and there are over 100,000 creditors. [Twitter; Petition]

SBF told his American customers on FTX US that they were safe, and that FTX and FTX US were completely separate entities. That turned out not to be true, and now all FTX US funds are frozen as well. Every FTX US customer is an unsecured creditor. [Twitter, archive]

SBF has stepped down as CEO of FTX, and John J. Ray — the same lawyer who cleaned up Enron — has stepped in to take his place. [Bloomberg]

According to an investor document, FTX had $900 million in liquid assets against $9 billion in liabilities. Of the liquid assets, $470 million were in shares in Robinhood.

The largest asset on FTX’s balance sheet was $2.2 billion in Serum (SRM) tokens — another project where SBF is a cofounder. The free float on SRM is currently $70 million, according to CoinGecko, meaning this was more volatile gas to suspend the airship. [FT, archive]

Just as FTX creditors across the globe were absorbing the magnitude of their loss on Friday night, a “hacker” siphoned a further $473 million in crypto off the exchange. [FT]

This week’s MF Global of crypto

The collapse of FTX-Alameda has been compared to Enron and Lehman Brothers. But Dan Davies, the author of Lying for Money, compares it to MF Global. The commodities brokerage firm went belly up in 2011 after making the same fatal mistake: failure to separate customer funds. MF Global was the eighth-largest bankruptcy protection filing in the US at the time. [Twitter]

In March 2010, the ailing MF Global installed Jon Corzine, a former Goldman Sachs chair, as their new CEO to turn the company around. Corzine, who had a penchant for risky bets at Goldman, began aggressively overhauling MF Global into a full-service brokerage.

As part of his restructuring plan, Corzine took on the role of both CEO and head trader — two functions that should remain separate. The company also lacked meaningful risk controls, setting up a recipe for disaster. Corzine drove MF Global into risky bets. Problems arose when hundreds of millions in customer funds could not be located.

After the bankruptcy, $1.6 billion of segregated client money was missing. The bankruptcy trustee found that customer funds had been wired to various banks and trading partners of MF Global to meet overdrafts and collateral calls — but the details of how it happened never really became clear.

The Department of Justice declined to prosecute Corzine. But as part of a settlement with the CFTC, Corzine paid a $5 million fine and was banned for life from CFTC markets. [Reuters]

Filling your right pocket from your left pocket

Segregation rules require that a broker or a financial institution keeps customer assets and investments separate. Failure to do so is subject to civil and criminal penalties. The Commodity Exchange Act of 1936 makes it a crime to “embezzle, steal, purloin, or with criminal intent convert to such person’s use or to the use of another, any money, securities, or property having a value in excess of $100” from a customer of a commodities broker. The maximum penalty is 10 years in prison and a fine of up to $1 million. [Findlaw]

Risk controls are how you make sure this never, ever happens — because if it does, you’re toast.

Dipping into customer funds is pure fraud — no different than robbing a bank with a gun. Davies calls it amateur-hour stuff: “It’s bound to be caught eventually and it can’t be dressed up to look like a legitimate transaction.” [Twitter]

“If there is a party who is responsible for prop trading and who is also able to authorise movement of client funds, you are putting temptation in the way. Funds segregation and front office/back office split are hard won lessons,” said Davies. [Twitter]

As it turns out, SBF implemented a “backdoor” for transferring funds without triggering any auditing systems. This setup allowed him to alter the company’s financial records and transfer billions of dollars in customer funds to Alameda without triggering internal compliance or accounting red flags at FTX. [Reuters]

In the 1973 book Other People’s Money, Donald Cressey says that three elements need to exist for a white-collar crime to occur: opportunity, incentive, and rationalization. He calls this the fraud triangle. Opportunity exists when risk management controls are ineffective, or when one person has too much power.

Personal incentives might include the desire for wealth or fame or a gambling addiction. Rationalization is to psychologically distance yourself from the crime — i.e., telling yourself that this was just a temporary fix, and you’ll pay it back as soon as the markets recover.

The Financial Times tried to make sense of all the separate boxes into which Bankman-Fried scattered his clients’ money and his legal responsibilities. [FT]

We suspect that in the bankruptcy, the US Trustee will appoint an examiner to get a better look behind the curtain. The Celsius bankruptcy made the crypto world aware that creditors can ask for an examiner as well. It took Enron’s examiner 18 months and $90 million to come out with a full report. [Washington Post]

(sucker voice) “I’m in!”

Anyone who bothered pulling back the curtain on FTX would have seen this company was a mess. But there was more money to be made by taking care not to look.

In January, FTX raised $400 million in a Series C round that brought its total funding to $2 billion and its valuation to $32 billion. Those numbers also got FTX a lot of press coverage. [CNBC]

Investors in FTX were among some of the most powerful and sophisticated venture capital firms in the world: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Sequoia Capital, SoftBank, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock, and Thoma Bravo. [Twitter]

Yet none of them conducted the proper diligence on FTX that would justify their overinflated evaluations. They couldn’t possibly have. There’s no sunlight in the offshore world of crypto trading — no oversight. Theses firms were throwing money into a dark hole, the same way investors had thrown money into companies like Uber, Theranos, and WeWork.

In investor meetings, SBF offered a take-it-or-leave-it approach and told investors he planned to operate the exchange with little oversight. In an investor meeting last year, he gave a presentation while simultaneously playing a video game. This was, of course, lauded as evidence of his quirky genius. [NYT]

All of these investors will now need to write their investments down to $0. In a bankruptcy, shareholders typically lose everything.

- Crypto investment firm Paradigm put $278 million into FTX. It has now informed its backers that the investment was likely worthless. [NYT]

- The Ontario Teachers’ Pension Plan, which sunk $95 million into FTX, said, “Not all of the investments in this early-stage asset class perform to expectations.” [OTPP]

- Sequoia Capital wrote down its $213 million investment in FTX to zero. The VC firm also took down its SBF hagiography. Fortunately, the internet has a memory. [Twitter]

Sequoia’s hilarious paean to Sam Bankman-Fried, Boy Genius is worth closer examination: [Sequoia, archive]

“I’m very skeptical of books. I don’t want to say no book is ever worth reading, but I actually do believe something pretty close to that,” explains SBF. “I think, if you wrote a book, you fucked up, and it should have been a six-paragraph blog post.”

Adam Fisher, the writer, assumes that SBF coming across as a gloating moron here must be Fisher failing to understand that Sam, the boy wonder genius, is on a level above his:

Since SBF is obviously a genius, I should simply assume that, compared with me, SBF will always be playing at level N+1. This makes my analysis of the intent behind SBF’s “books are for losers” idea to spiral into infinity and crash, like a computer program stuck in a loop.

No, Sam was the shallow fool he appeared to be; and this was all a cover for nonsense. Sequoia threw money into the bonfire because crypto was in a bubble, number was going up, and they needed to get in while they could. You can get away with the most arrant nonsense while number is going up, and the VCs did. FTX hid behind bubble economics as much as possible.

When you turn out to have financed a bankrupt crypto exchange, Davies says that “you can either put the tombstone on your desk as a memento mori and reminder to do diligence, or you can pretend it never happened.” Sequoia is pretending FTX never happened. Remember this if you ever deal with Sequoia going forward. [Twitter]

These VCs were fools playing a fool’s game. Their backers should hold them accountable.

FTX has sent your money to an orphanage in India

When QuadrigaCX, Canada’s largest and most trusted crypto exchange, went belly up in 2019, the true story turned out to be vastly worse than anyone had imagined — fake accounts, fake money, and the CEO using customer funds as his personal slush fund.

The history of cryptocurrency teaches us, over and over, that crypto companies have two states:

- Quadriga. They steal everyone’s money and explode.

- Quadriga — but they haven’t exploded yet.

You should expect all exchanges to abuse their customers as much as they think they can get away with.

Even Coinbase, the largest crypto exchange in the US, ran an entire fake market in litecoin for a few years. On some days, 99% of trade was one Coinbase employee — probably Charlie Lee — just trading with himself.

All crypto firms are as Quadriga as they can get away with. All of them.

After Quadriga crashed, Canada rolled out a framework to regulate crypto exchanges to the same standard as regular exchanges and broker dealers. You can expect that Coinbase has a tough future ahead of it.

Who’s next?

FTX was solid until we found it was a hollow shell. Applying the Iron Law of Quadriga, we should expect that everyone else is the same.

So who’s looking shakiest? We were particularly struck by some deadpool candidates:

- Binance: We would be amazed if Binance was not a hollow shell like FTX. They went to considerable effort to bamboozle regulators. But also, the secret ingredient is crime — specifically, Reuters caught Binance allowing international sanctions evasion, and we would also be amazed if the exchange wasn’t turning a blind eye to laundering by others. And once you’re the laundromat for the bad guys, it’s a difficult job to quit and keep the same number of functioning limbs.

- Crypto.com: Their asset reserve is 20% dog money, LOL. Customers are withdrawing their assets. [CoinDesk; WSJ, paywalled]

- Coinbase: As a publicly-traded company, Coinbase is not allowed to make material misstatements or material omissions. This is a crippling disadvantage in crypto. Also, the SEC is rumored to be looking to score an easy victory off them.

Centralized exchanges are currently doing a performative round of “proof of reserves” — to show they’re not just another FTX. This is solvency theater — none are supplying evidence of liabilities to show that their holdings add up to cover what their customers should have on account. Crypto.com, Huobi and Gate.io are raising eyebrows in particular.

In fact, it looks like several of the exchanges doing proof-of-reserves are passing the same pile of ETH around between them — and keeping it just long enough for the snapshot attestation. [Web 3 Is Going Great; Twitter]

Thus, crypto yet again emulates the original stablecoins: wildcat bank notes, where the banks would pass around the same barrel of gold between themselves, just ahead of the auditors:

Gold and silver flew about the country with the celerity of magic; its sound was heard in the depths of the forest, yet like the wind, one knew not whence it came or whither it was going.

Your subscriptions keep this site going. Sign up today!

Great post David

You talk about VCs

“These firms were throwing money into a dark hole, the same way investors had thrown money into companies like Uber, Theranos, and WeWork.”

In Theranos most investors were not professional VCs which can explain the lack of DD.

Uber and WeWork were both Softbank-backed and they’re known for their lunacy.

So what do you think happened to all the other VCs, that are “pros” with a great track record?

PS: and how did a16z not make the FTX list? 😂

So, if I’m reading this right…

All we have to do is get everyone to agree to never look in any of these boxes, then the magic thing will keep working and we can all get free money forever? Man, these guys are smart.

a series of bigger and bigger shells, as you try to keep the pea-word covered

Living as I do in Thailand, I’ve come to realize the central flaw in my analysis of Bitcoin and the rest. I seriously thought about buying some of the aforementioned in 2012, when I inherited 20K Sterling, and was living in London. My reasoning against was that it was so obviously a Ponzi, and that if contemporary print commentators, podcasts, and the like had cottoned on to this, it wouldn’t be long until the inevitable collapse. What I had failed to grasp was my ‘Western’ myopia. In the intervening decade this insanity has become a global phenomena, and thus its room for expansion has been many, many orders of magnitude greater than I naively calculated way back when. Then, I assumed it would burn-out in the Anglo-sphere, but sadly that isn’t the case. This hydra has a long, long way to go yet.

Just a small nitpick, but you use i.e. when you should use e.g. in the section about Other People’s Money.

oh I dunno, either works I think. Anyway, we wrote it so it’s correct now, like Shakespeare.