- Part 1: KodakCoin announced, stock price rockets

- Part 2: KodakCoin restrictions, the KashMiner scam

- Part 3: KodakCoin presale, prehistory, hot takes and harsh realities

- Part 4: Kerrisdale Capital’s crypto pre-mortem for Kodak

- Part 5: The KodakCoin ICO Light Paper

- Part 6: KodakCoins on sale, and the Reg A+ escape route

- Part 7: The KashMiner that never was

WENN Digital have finally sent through an email announcing their long-awaited KodakCoin ICO Light Paper! (archive) They’re doing a professional photo licensing site called KodakOne, a competitor to Getty Images and so forth. KodakCoin is a token to be used as a private currency on the site.

The announcement

Dear Potential KODAKCoin ICO Investor,

Thank you for registering and expressing your interest in the KODAKOne Platform.

Click here to view the KODAKOne Light Paper.

If you would like to check to see whether you are an “accredited investor” eligible to participate in the offering of rights to be issued KODAKCoin via Simple Agreements for Future Tokens (SAFTs), please follow the link below to access and complete the investor survey.

https://kodakcoin.com/survey.php

After completion of the survey, we will request that you provide us with additional information through to confirm your status as an “accredited investor” under the US securities laws for participation in the SAFT offering.

Thank you,

Your KODAKOne TeamPlease note that the SAFTs being offered by WENN Digital have not been registered under the US Securities Act of 1933 (the “Securities Act”) or the securities laws of any other jurisdiction. Accordingly, WENN Digital is offering the SAFTs only in exempt transactions to “accredited investors” (as defined in Rule 501(a) of Regulation D under the Securities Act) pursuant to Rule 506(c) of Regulation D under the Securities Act. Offers and sales of the SAFTs outside the United States will also be made in accordance with the laws and regulations of the relevant jurisdictions.

Following the offering, the SAFTs will be subject to significant restrictions on resale and transfer in addition to those traditionally associated with securities sold pursuant to Rule 506(c) of Regulation D under the Securities Act.

Please note that all information and documentation submitted will be reviewed and verified in order to ensure that you satisfy the legal investor qualification requirements in the applicable jurisdiction.

They tacked on the end:

The content of this email is confidential and intended for the recipient specified in this message only. It is strictly forbidden to share any part of this message with any third party, without a written consent of the sender. If you received this message by mistake, please reply to this message and subsequently delete the message, so we can ensure such a mistake does not occur in the future.

— but you don’t get to do something as stupendously newsworthy as everything about this has been and expect a disclaimer like that to stick.

(This is one of those occasions where a cut-and-paste quotation of 100% of a work unambiguously constitutes fair dealing under UK law and fair use under US law for purposes of research, criticism and reporting. It turns out not much of copyright enforcement can be fully automated in legal safety.)

Simple Agreement for Future Tokens

This paper is the prospectus for the sale of 100,000,000 KODAKCoins. KodakOne have gone for the Simple Agreement for Future Tokens (SAFT) model — where people give you money (or cryptos) and you agree to supply them with tokens for use on a network, if and when the network launches.

SAFT is an attempt at a framework for ICO-style token offerings that’s compliant with regulation — in the wake of the SEC’s bombshell announcement in July that The DAO was a security, as was pretty much every offering on the same model.

(As was obvious to every observer who wasn’t up to their necks in crypto — per the ICO section of chapter 9 of the book.)

As with everything in crypto, the formal SAFT model was launched with a white paper, written mostly by Cooley LLP fintech lawyer Marco Santori, after his horror at some inept and terrible early SAFTs.

If a SAFT is available to US purchasers at all, it’s only available to accredited investors, who have more than a certain level of income or assets — the assumption is that if you’re rich, then taking care of your money is your problem. (I wrote up the WhenHub SAFT, promoted by Scott Adams of Dilbert fame, in October.)

As it turns out, saying “SAFT” isn’t a magic ward against regulators — the SEC’s recent bout of ICO subpoenas seems to have targeted several SAFTs as well, per the Wall Street Journal:

The SEC scrutiny is focused in part on “simple agreements for future tokens,” or SAFTs, which are used in some of the most prominent crypto-fundraisings, according to the people familiar with the matter.

The agreements allow big investors and relatively well-off individuals to buy rights to tokens ahead of their sale. The rights can be traded, or flipped for profits, even before the sale begins.

The SEC is concerned that such agreements are potentially being used to trade like securities without conforming to the strict rules that apply to securities.

A pile of KodakCoin tokens were pre-sold cheap in early January to Global Blockchain Technologies. This is common practice in ICOs — you pre-sell a pile of tokens to an investor, you release the token and pump it, then the pre-sale investor dumps theirs and cashes in. Note that this is the precise arrangement the SEC has just expressed concern over. Whoops.

Trading in KodakCoins is further restricted:

The SAFTs will be subject to significant restrictions on resale and transfer in addition to those traditionally associated with securities sold pursuant to Rule 506(c) under the Securities Act, including a contractual restriction providing that any purchaser in this offering may not transfer any SAFT unless (a) WENN Digital provides its prior written consent and (b) the transfer is made in accordance with applicable securities laws. In addition, the terms of the SAFTs impose a contractual lock-up of the KODAKCoin issuable thereunder for a period of one year from the date of the relevant SAFT.

The one-year lockup is in general accordance with how the SEC expects 506(c) offerings to be traded … though it’s only exempt until there are 500 accredited, or 2000 non-accredited, holders. (This is the same loophole Uber uses to sell their stock without being a public company.) After that, it needs to be registered and operates under far more stringent rules.

Note how every transaction has to be approved by WENN Digital. This is not so good if you also want the tokens to be a currency.

WENN Digital call KODAKcoins “genuinely functional utility tokens for use on the platform” — but calling your offering a “utility token” and selling it under 506(c) doesn’t mean it isn’t a security. But they’ll figure out that bit later:

While WENN Digital intends for the KODAKCoin issuable under the SAFTs to be classified as utility tokens rather than securities tokens, WENN Digital will be required to make a final determination of the tokens‘ status as one or the other prior to the time that the KODAKCoin are issued pursuant to the SAFTs. In conjunction therewith, WENN Digital may decide to seek formal or informal input from the staff of the US Securities and Exchange Commission. If it is ultimately determined that the KODAKCoin are “securities” for purposes of the Securities Act, the KODAKCoin will be subject to significant restrictions on resale and transfer in the absence of registration under the Securities Act unless an exemption from registration is available.

Translation: “We’ll take your money, then we’ll find out if these were securities, okay. If they are, then sorry lol.”

WENN Digital

Page two outlines the company and the offering — WENN Digital, a collaboration between paparazzi agency WENN Media and attempted image licensing company Ryde GmbH. They’ve licensed the name “Kodak” from Eastman Kodak, the flayed and tattered hide of what was once a famous film company.

They aim to release the KodakOne platform in Q2 2019, with “a minimum of 10 million images” to be available for licensing.

WENN Digital also offer some fabulous technology from Ryde:

Proven proprietary systems: The KODAKOne Platform’s proprietary Big Data Architecture and SWARM 1 web crawling technologies, which Ryde began operating in 2016, are designed to increase revenues for photographers, agencies and archives from post-licensing use of protected images.

Per the early 2017 version of Ryde’s website, their “post-licensing use” model was: you ask Ryde to review your site for copyright violations, and they’ll kindly send you a bill! Amazing they had to pivot to ICOs, really.

The Market: The Image Economy

The ICO template is:

- State a problem;

- assert that ERC-20 tokens on the ethereum blockchain will solve it;

- there aren’t any other steps.

This section of the paper outlines steps one and two — why photographers will want to sign up to sell their photos on KodakOne:

- Money: KodakOne’s AI-powered Big Data infringement detection — an automated copyright trolling engine — will pay you instantly! In KodakCoin.

- Trust: Every transaction and license agreement “immutably stored in our decentralized registry”!

- Time: Distribution is work. Our decentralised platform will be your central one-stop shop!

Not answered: why a centralised registry benefits from decentralisation, how the magic AI pixie dust works, or — a question not answered at any point — why professional photographers would want to be paid in a minor crypto that can’t even be legally traded, rather than actual money.

They don’t even offer to redeem these untradeable objects for cash, though you’ll be able to buy things from WENN Digital with them in the future:

KODAKCoin tokenholders will have no right to return KODAKCoin to WENN Digital or to receive a refund or otherwise require WENN Digital to exchange any amount of KODAKCoin for fiat currency. However, holders of KODAKCoin will have the ability to use them to purchase goods and services on the KODAKOne Platform’s marketplace.

Business Model

Photo licensing sites abound. Why should anyone use this one?

They say “community” a lot — “we intend our community to become a sustainable economy.” An economy has a currency:

The functionality and adoption of our KODAKCoin are of utmost importance to WENN Digital’s management. We plan to establish KODAKCoin as the currency of this image economy.

Well, yes, it is of utmost importance — but they can’t be legally traded for a year after the sale, after that there can’t be more than 500 accredited or 2000 nonaccredited holders in total … and the flow of cash might be hampered by the bit where every transaction has to be approved by WENN Digital.

Summary: lol

Kerrisdale Capital’s report on Eastman Kodak NYSE:KODK was as vicious as you’d expect a writeup by a hedge fund that just shorted the stock in question to be — but it had the facts 100% on its side:

The use of blockchain in operating an image copyright platform accomplishes nothing. KODAKOne intends to utilize smart contracts and a crypto-asset to solve the problem of copyright infringement, but the business idea is flat-out silly. Cryptographically hashing an image into a blockchain doesn’t prove the provenance of intellectual property, a blockchain does not reduce the resources necessary for copyright enforcement, no photographer would rather be paid in KODAKCoins over real money, etc. … This is all unsubstantiated hype designed to entice investors.

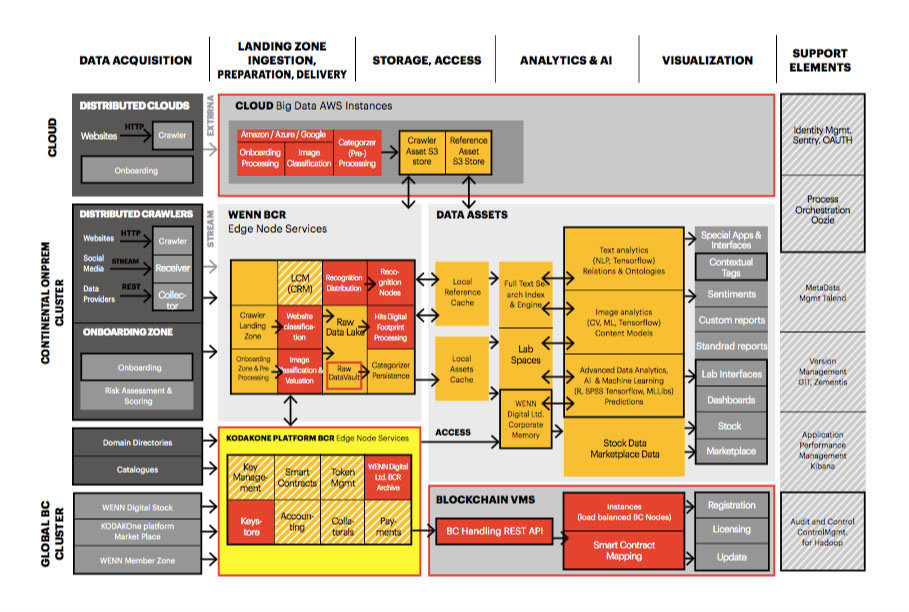

The KodakOne platform has no use for a blockchain except buzzword compliance, in an attempt to cash in on the hype. In the diagram they gave the New York Times in late January, the “blockchain” part is literally an extra bit hanging off the bottom:

If you look closely, you’ll see they misspelt “standard”

This ICO is better than many other ICO offerings:

- it’s in association with a NYSE-listed company, who know very well how one is expected to comport oneself as a listed company, and how to work with regulators;

- they’ve tried very hard to get their legal ducks in a row;

- the actual pitch isn’t less implausible than many other “let’s start a private currency” ICOs.

If you’re deep in the throes of ICO speculation, you don’t mind holding for a year and you think KodakCoins will still have value by then — go for it. But I’m pretty sure the restrictions on trading will be a serious problem for its value as a speculative asset.

Everyone else: I would recommend you let this one pass.

Your subscriptions keep this site going. Sign up today!