Why has the price of Bitcoin gone up? If you do some basic technical analysis, you’ll see it’s a triangular Fibonacci double-reacharound formation, moderated somewhat by both Makemake and Haumea being in Libra, of course. Obviously.

The actual mundane reasons aren’t because people like Bitcoin more now, but because someone just profited from the price being at that level. But it’s been a heck of a week for crypto:

- Tether is in trouble with the New York Attorney General

- So people are getting out of Tether, and using it to buy bitcoins — number go up!

- massive price premium on Bitfinex, the exchange that runs Tether

- it turns out that a substantial proportion of the US crypto-to-fiat system was literally one guy, and he got arrested

- Binance just got hacked too and shut off deposits and withdrawals for a week

- the price is whatever the biggest margin gamblers need it to be to make money today — the actual number doesn’t matter to them, only how it changes.

https://twitter.com/Bitfinexed/status/1126841882791882752

Bitfinex has replied to the NY Attorney General’s reply to their first memo, and Amy Castor correctly summarises it as “It wasn’t me, you can’t prove it, and anyway, nobody was harmed by the thing I totally didn’t do.”

The judge, Joel M. Cohen of the New York Supreme Court, says that the NY AG’s preliminary injunction is “amorphous and endless” and should be narrowed — he’s told the parties to hammer out a more restricted scope.

In the meantime, Bitfinex’s price for Bitcoin (BTC) has been excluded from Coinmarketcap — because it’s still at a ridiculous premium over the price on the other exchanges purporting to deal in US Dollars. The odd bit is that this story ran in Coindesk — with no comment on the fact that Coindesk still includes Bitfinex in their Bitcoin Price Index. I suppose it makes the number look bigger for the general public …

Bitfinex’s billion-dollar exchange token offering is go! Here’s the first offering document, and here’s the white paper. Rather than those tawdry “generally accepted accounting principles of any jurisdiction,” they’ve used (p11 footnote) the vastly superior “iFinex accounting principles.” The private sale ends tomorrow — hurry, hurry!

Robert-Jan den Haan has done a complete timeline of Bitfinex’s adventures with Crypto Capital.

Amy also discusses the Bitfinex and Tether mess with Sasha Hodder on HodlCast, and Robert-Jan discusses it on Laura Shin’s Unconfirmed podcast.

https://twitter.com/Bitfinexed/status/1124886221514256384

Bitcoin transaction volumes are up again, at nearly December 2017 levels — though SegWit allows more transactions in a block, so fees are still low.

There’s another attempted crypto ETF — the USCF Crescent Crypto Index Fund. Here’s the full Form S-1 prospectus — they propose to track the price of a combination of Bitcoin and ether. The prospectus mentions the SEC’s concerns over Bitcoin price manipulation — which have sunk all previous Bitcoin ETFs — and addresses them by … just saying under “Other Risks” that “The absence of trading regulation on most cryptocurrency exchanges makes it likely for price manipulation to occur frequently.” Sounds great.

Fully 90% of blockchain supply chain projects are in trouble — because they can’t figure out why a blockchain is useful for the job. Mostly because it really obviously just isn’t.

The World Economic Forum isn’t giving up on blockchain for supply chains, though — they’ve released what they call a “toolkit” for deploying blockchain technology. This “toolkit” is actually a 12-page white paper, which they’ve called “Blockchain Beyond The Hype,” because it’s made of hype — one use case is distributed computing on the blockchain, and the other is medical insurance on the blockchain. The project plans to release two more white papers each month!

Geoff Golberg versus the XRP Army.

Multiply certified computer security expert Prof Dr Dr Craig S. Wright turns out to be really bad at text redaction. In Kleiman v. Wright, he was asked by the judge to submit a list of his own personal early Bitcoin addresses. He submitted them in proportional text, blacked-out. It turns out this list precisely matches the line lengths of the first 70 Bitcoin block reward addresses. And also, the submitted PDF “contains stray metadata (orphaned URL annotations) for the last 45 addresses, which at some point during editing were probably hyperlinks to blockchain.com.”

Ben Munster at Decrypt on how to pitch your blockchain startup to journalists, with collected wisdom from a pile of us who suffer these things in our inboxes.

Bostrom meets Bitcoin — Friendly AI, right, but on the Blockchain. With smart contracts for the hard bits. It’s like this document was custom-constructed to torment me … obviously I needed to donate more to the Basilisk.

I seem to have provoked ex-Breaker journalist David Z. Morris into writing a book about crypto.

I liked this nice Emin Gün Sirer interview in CoinTelegraph.

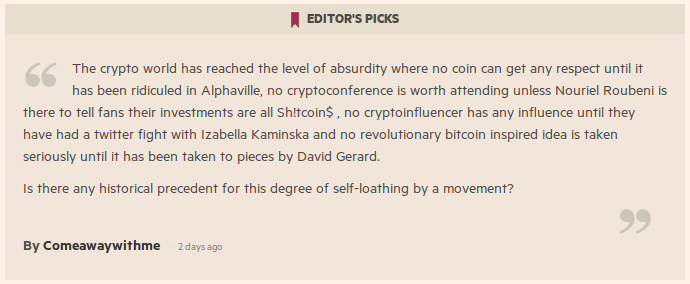

From Financial Times FT Alphaville — the kind of reputation I want:

Today I was privileged to witness the absolute nadir in after-talk questions. It began: 'if you'll indulge me, I've actually written a poem about this topic…'. And then it was somehow even worse than you think it was.

— Sarah Clegg (@Eatingartefacts) May 3, 2019

Using crypto is easy!

You just need:

– 2FA on everything

– Ledger for cold storage

– Key recovery plan

– New browser extensions

– Wallet for phone

– An exchange account

– Know terms like "gas"Oh & 95% of coins are scams & hackers are always trying to steal your money

Easy!

— Ryan Sean Adams – rsa.eth 🏴 (@RyanSAdams) May 8, 2019

https://twitter.com/karbonbased/status/1126509525383540736

Your subscriptions keep this site going. Sign up today!