By Amy Castor and David Gerard

- We need your support to keep these posts coming. Send us money! Here’s Amy’s Patreon, and here’s David’s. Sign up today!

- Our patrons can also get a couple of “Bitcoin: It Can’t Be That Stupid” stickers just by messaging one of us and asking.

- David has signed author copies of his books for sale.

- Sign up on Amy’s blog to see every new post she makes as it goes up, and click here and enter your email address for every new post on David’s blog as it goes up.

John Jay Ray III, the CEO of FTX in bankruptcy, and his team have spent several months sifting through the smoldering wreckage of FTX for whatever paperwork and money trails they can find. Their aim is to get as much back for creditors as possible.

Last month, Ray released the second interim report and filed lawsuits against FTX counsel Daniel Friedberg and venture capital firm K5 Capital. He has filed a pile more actions to reverse transfers.

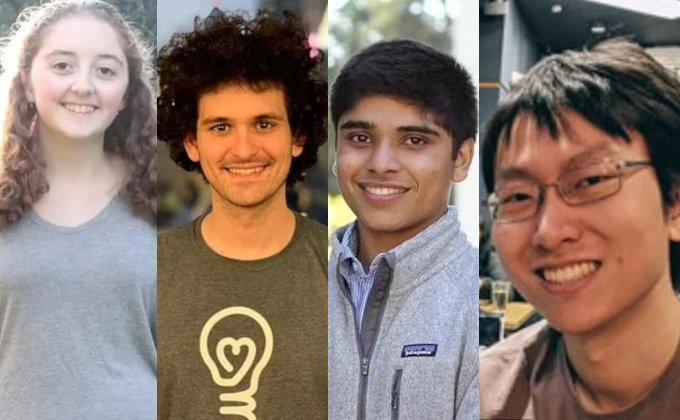

Caroline Ellison, Sam Bankman-Fried, Nishad Singh, Gary Wang

Milking the company

Ray is suing the old FTX inner circle — Sam Bankman-Fried, Caroline Ellison, Gary Wang, and Nishad Singh — to claw back $1 billion in misappropriated funds. The complaint was filed on July 20. [Doc 1186, PDF]

The normal clawback period for bankruptcies is 90 days, or one year for corporate insiders — but for fraudulent transfers, the lookback period is up to two years. These avoidance claims stretch all the way back to February 2020 because Ray alleges the transfers were crimes — the FTX inner circle was treating FTX and Alameda as their personal piggy bank. [Section 548, Bankruptcy Code]

Much of the complaint rests on crimes that Ellison, Wang, and Singh have already pleaded guilty to.

Ray is asking for an order finding that these transfers were fraudulent, the return of the transferred money or property, damages, and attorney fees. He is also asking that any bankruptcy claims made by the FTX inner circle are subordinated to the claims of innocent creditors.

The report is 84 pages. The first 18 pages set the scene, recapping stuff you’ll already know if you’ve been following the FTX saga. The fun starts on page 19, detailing the specific malfeasance. Pages 35 to 82 detail the forty-eight specific causes of action in law.

Political purchases

The inner circle made over $100 million in political donations. The money was typically funneled from Alameda as “loans” before being donated personally:

- Singh donated $500,000 to the People for Progressive Governance PAC — run by Michael Sadowsky, who also ran SBF’s Protect Our Future PAC.

- SBF put $35 million into Guarding Against Pandemics, run by his brother Gabriel. GAP “frequently funded pet projects of the Bankman-Fried brothers that, needless to say, did nothing to prevent pandemics.”

As we now know, FTX insiders donated to both Democrats and Republicans who they thought would put pro-crypto legislation into place. SBF also spent $11 million trying and failing to parachute Carrick Flynn, his fellow Effective Altruist, into a Democratic primary in Oregon. [OPB, 2022; MarketWatch, 2022]

Effective Altruism and the Island of Dr. Bankman-Moreau

The FTX Foundation was a front put up by the inner circle to look charitable. Being LessWrong rationalists and Effective Altruists, their idea of charity was, as Ray put it, “frequently misguided and sometimes dystopian.”

Ray’s second interim report already mentioned the $300,000 grant to an individual to “Write a book about how to figure out what humans’ utility function is.” This is a question that is extremely important in Eliezer Yudkowsky’s LessWrong rationalist philosophy of how to avoid the future artificial superintelligence turning us all into paperclips.

Another $400,000 grant went to pay for animated videos on YouTube related to “rationalist and EA material,” including videos on “grabby aliens.”

And then there’s the doomsday bunker. This one’s a doozy:

One memo exchanged between Gabriel Bankman-Fried and an officer of the FTX Foundation describes a plan to purchase the sovereign nation of Nauru in order to construct a “bunker / shelter” that would be used for “some event where 50%-99.99% of people die [to] ensure that most EAs [effective altruists] survive” and to develop “sensible regulation around human genetic enhancement, and build a lab there.” The memo further noted that “probably there are other things it’s useful to do with a sovereign country, too.”

The island of Nauru, halfway between Australia and Hawaii, has been completely trashed by superphosphate mining, their pivot to money laundering didn’t work out, and the country is now mostly dependent on Australia. Everything down to the water has to be imported too. So with sufficient money, you probably could buy your way into effectively owning a very small sovereign country.

There is the minor detail that the most significant oncoming deadly “event” is climate change, with a strong prospect of Nauru sinking beneath the waves in its entirety. Perhaps Gabe was thinking of the rogue superintelligence doing the paperclip thing.

Building a bunker for the Effective Altruist in-group to experiment with eugenics after the apocalypse is clearly the most charitable cause in the world. We can’t tell you how much we want a copy of this memo.

Safe as houses

The FTX companies spent $243 million on real estate in the Bahamas:

Defendants caused the FTX Group to purchase more than 30 properties, including a $30 million, six bedroom penthouse in the Albany resort community in the Bahamas in January 2022. The property, known as the Orchid Penthouse, was home to Bankman-Fried, Wang, Singh and Ellison prior to the FTX Group’s collapse.

FTX paid for the condo complex — but Bankman-Fried, Wang, and Singh had the deeds conveyed to themselves personally and not to the company.

Buying the company with the company

The FTX inner circle borrowed from FTX to buy FTX entities for themselves. They wrote promissory notes for hundreds of millions of dollars to the FTX companies — usually Alameda — that would never be paid back. They then “spent” this “money” to buy shares in the companies.

No actual money ever moved — it was all paper shuffling. Ray alleges the inner circle abused their control to drain the companies of client funds and put those funds in their own pockets.

SBF and Wang bought $546 million of shares in Robinhood in the same way. Alameda had bought the Robinhood shares, then SBF and Wang wrote themselves a loan and bought the shares from Alameda with Alameda’s own money.

Even former FTX counsel Daniel Friedberg said: “it is just a round trip — from AR Ltd to Sam/Gary to Emergent back to AR Ltd.”

Sam also looked out for his family. He moved $10 million of crypto from an Alameda account on FTX US to his personal account, then to his father Joseph Bankman’s account on FTX US. Joseph then moved $6,775,000 out to his accounts at Morgan Stanley and TD Ameritrade. Joseph seems to have been using this money to fund Sam’s criminal defense.

Ellison paid herself a $22.5 million bonus, apparently just because she could. She used $10 million of that to buy shares in an “artificial intelligence safety and research company” — and the “safety” thrown in there suggests it’s Yudkowsky nonsense rather than technology that exists, so that’s more money to the rationalist cult. She paid herself another $6 million on top of that.

The FTX inner circle knew the company was insolvent

All of this happened while the inner circle already knew FTX was insolvent — and that makes this knowing fraud.

Remember that FTX’s software specifically allowed Alameda to run a negative balance on the exchange without collateral. This line of free credit to Alameda was by itself a large factor in FTX’s huge deficits:

By March 2022, Ellison privately estimated that the FTX exchange had a cash deficit alone of more than $10 billion.

Emphasis in original.

“For PR and political reasons it’s really important to do bio things”

In a separate complaint filed on July 19, Ray’s team is suing the FTX Foundation, its front company Latona, and the six life sciences companies Latona invested in for $71.5 million. The transfers were made under the guise of Effective Altruism. [Doc 1881, PDF]

In January 2022, FTX created a company called Latona Biosciences Group, a “sham” nonprofit organized in the Bahamas, as an arm of the FTX Foundation. SBF said that Latona would:

support promising new drugs transition from ideas to reality. We anticipate devoting substantial funding to support the necessary processes; building out an efficient, safe clinical trial process in The Bahamas; and developing robust supply chains, both for production and distribution of potentially life saving medication.

Of course, all the money Latona funneled into life sciences companies was Alameda customer money.

To run Latona, SBF hired Ross Rheingans-Yoo — who he met while working as a trader at Jane Street. Incidentally, Ross’s younger brother Dunan was one of the founders of the obscure hedge fund Modulo Capital, which got $400 million from FTX. Modulo returned that money in February. [NYT]

The six life sciences companies that benefited from Latona’s generous donations included Platform Life Sciences, Lumen Bioscience, GreenLight Biosciences Holdings, Riboscience, Genetic Networks, and 4J Therapeutics.

Platform Life Sciences got the biggest slice of the pie — over $53 million.

FTX got no monetary benefit from these investments, just looking good politically. They conducted near-zero due diligence on the life sciences companies. SBF said in an internal document: “for PR and political reasons it’s really important to do bio things, and to do some public/networky bio things.”

Rheingans-Yoo told the CEO of Platforms Life Sciences: “In general, our [Latona’s] participation should be described as ‘FTX Foundation’ in all public-facing communication” and “we’d prefer not to mention the discussion terms of the equity stake at this point, to avoid pulling the public narrative to speculation about profit motive.”

SBF, Rheingans-Yoo, and Nick Beckstead, the CEO of FTX Foundation, set things up so they would personally receive any profit upside from the investments — never mind Latona being a nonprofit. Beckstead wrote: “Main thing: if it makes a ton of money, how open do we need to be about that?”

Embed Financial Technologies: “I get a sense that they are [cowboy emoji] over there”

Ray also filed in May to recover $237 million from Michael Giles — the former CEO of Embed Financial Technologies, a stock clearing startup that Alameda acquired in 2022 — and Embed’s former shareholders. [Complaint, PDF; Case docket]

FTX US bought Embed to set up FTX Stocks, a proposed stock trading platform for US customers. FTX approached Embed in March 2022 and finalized the deal on September 30, 2022 — six weeks before FTX declared bankruptcy.

Embed’s software never actually worked. FTX employees noted in June the “Embed platform’s inability to handle approximately 600 new user accounts as part of the gradual release of FTX Stock.”

Again, FTX didn’t bother with due diligence — “the FTX Insiders prioritized speed above all else” — and just accepted Giles’ terms, including paying $157 million to Giles himself. “I get a sense that they are [cowboy emoji] over there,” said one Embed employee to another.

As of March 2022, Embed had $37 million in assets and just $25,000 in net revenue.

When Ray’s team tried to sell off Embed in the bankruptcy, the only bid was $1 million from Giles himself.

FTX and Genesis will be settling

In other news, FTX in chapter 11 and Genesis in chapter 11 both have claims against each other. The lawyers for both sides have told the court that they have a settlement in principle and will be sending in the details shortly. FTX previously claimed that Genesis owed it about $2 billion. [Doc 555, PDF]

The battle to unseal the FTX creditor list

The top 50 creditors in the FTX bankruptcy are owed $3.1 billion. These aren’t individual creditors, but large institutional creditors. They have asked Judge John Dorsey to keep their names sealed — which is against all normal bankruptcy practices. In November, Judge Dorsey allowed the creditors’ names to be withheld.

Several media companies are battling to make the FTX creditor list public. The New York Times, Dow Jones (Wall Street Journal), Bloomberg, and the Financial Times argue there is no legal basis to keep the creditor list private. The US Trustee has joined in. Appeal briefs are due by August 21. [Doc 6, PDF; Doc 11, PDF; case docket; case docket]

My girlfriend is a neoreactionary race scientist, your honor, but consider: she is very emotional and whiny about it

Over in the criminal case, SBF just won’t stop messing around. He leaked excerpts from what is purportedly Caroline Ellison’s diary to the New York Times, which ran a tawdry story on “the private writings of Caroline Ellison,” quoting some of her doubts about the state of FTX and Alameda in its last months. [NYT]

The prosecution is fed up with Sam’s efforts to “taint the jury pool” and discredit a key witness. On the same day the New York Times story was published, the government wrote to Judge Lewis Kaplan asking for tighter bail restrictions: [Doc 176, PDF]

When the Government learned this week that this Article was forthcoming, defense counsel confirmed that the defendant had met with one of the Article’s authors in person and had shared documents with him that were not part of the Government’s discovery material.

In a court conference on July 26, lawyers for both parties discussed whether SBF’s bail conditions were adequate. Now the prosecution wants the judge to revoke Sam’s bail.

It turns out that Sam has been drip-feeding the New York Times for a while: [Doc 184, PDF]

Prior to the conference on July 26, 2023, the Government analyzed the data from a pen register on the defendant’s phone and email, and learned that over the last several months, the defendant sent over 100 emails to members of the media, had over 1,000 phone calls with members of the media, and had over 100 phone calls with one of the authors of the Article, many of them lasting for approximately 20 minutes. Many of these communications occurred prior to the publication of other articles about Ellison, including by the same author.

Sam has a First Amendment right to speak — but not a right to taint witnesses in the trial against him. Particularly given he already tried to suborn another witness in January.

We’re pretty sure Sam is headed back to a cell, where he’ll learn Morse code just so he can tap out more crimes on the water pipes.

Your subscriptions keep this site going. Sign up today!

Correction: the vast majority of Nauru is a plateau at least 20m above sea level, so Nauru sinking beneath the waves isn’t going to happen anytime soon, even in the worst case scenario for sea level rise. Perhaps you were thinking of the Maldives? This map from 1910 predates much of Nauru’s phosphate mining, but you can still clearly see how high most of the island is. (The central plateau is nonetheless a toxic wasteland, but it’s a toxic wasteland well above sea level!)