By Amy Castor and David Gerard

- Put your fiat currency into our Patreons in confidence — here’s Amy’s, and here’s David’s.

- Our patrons can also get a couple of “Bitcoin: It Can’t Be That Stupid” stickers just by messaging one of us and asking.

- David has signed author copies of his books for sale — freshly restocked. International posting from the UK is still slightly delayed after the Royal Mail got ransomwared. [BBC; Royal Mail]

- Sign up on Amy’s blog to see every new post she makes as it goes up, and click here and enter your email address for every new post on David’s blog as it goes up.

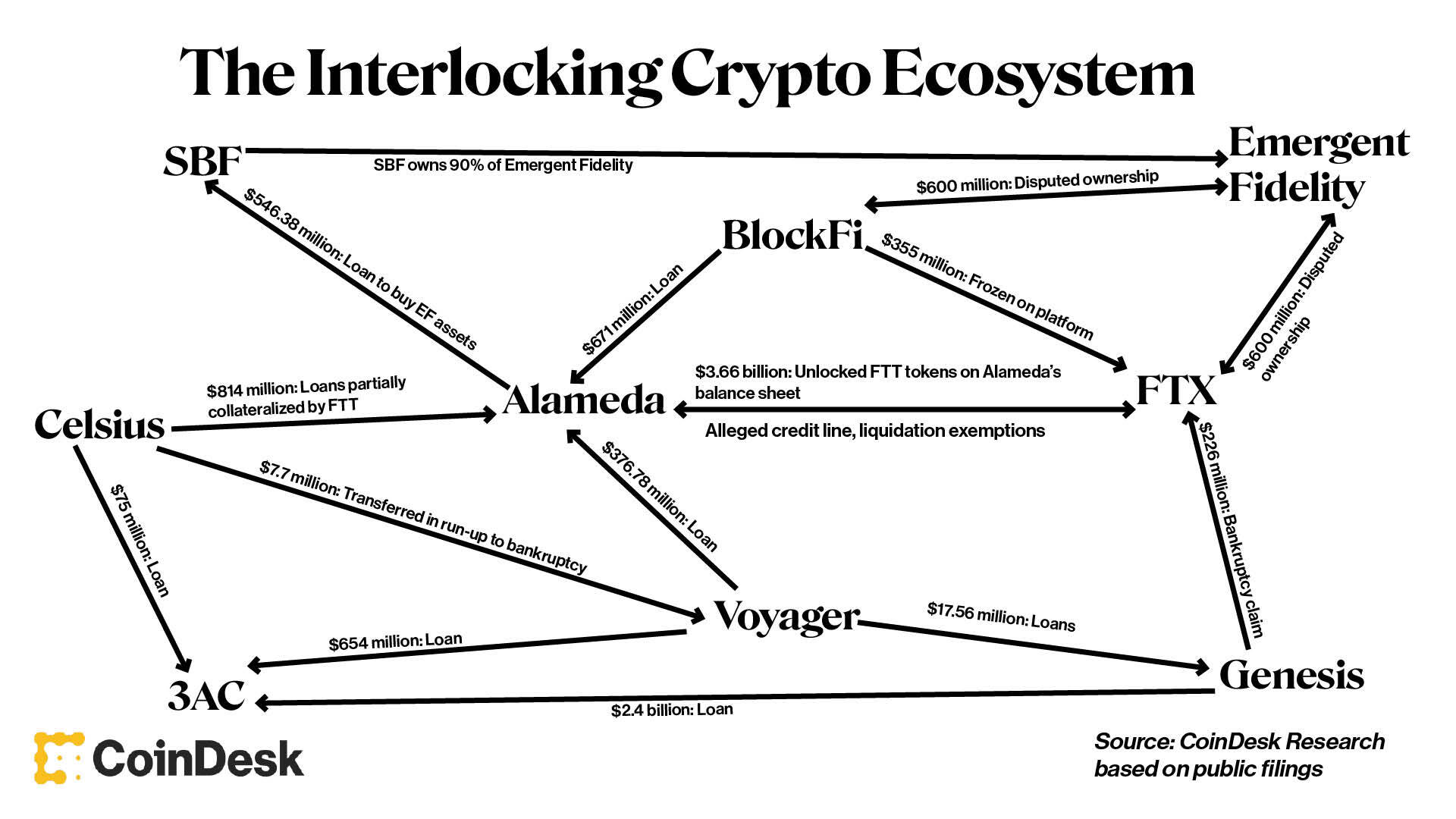

We’ve been saying for a while now how everyone in crypto is in everyone else’s pockets — and how that makes the 2022 crypto collapse very like the 2008 financial crisis. In an article lamenting the problem, CoinDesk has provided a helpful diagram! [CoinDesk]

The SEC wants to change crypto custody rules

The SEC wants crypto to get with the grownups and operate like real finance. Specifically, the SEC wants to update the “2009 Custody Rule” such that almost any assets that an adviser might hold in a client’s name — including cryptocurrencies — must meet the qualified custodian requirements. [Press release; fact sheet, PDF; proposed rule, PDF; FT, archive; WSJ]

If you give your bitcoin to someone else for safekeeping — or even for trading on your behalf — they’ll need to meet the standards to be a “qualified” custodian.

A qualified custodian is a federal or state-chartered bank or savings association, a trust company, a registered broker-dealer, a registered futures commission merchant, or a foreign financial institution. The definition is in 17 CFR § 275.206(4)-2. [LII]

Qualified custodians need to keep all assets in custody properly segregated into individual accounts per customer. Advisors and qualified custodians need to enter into written agreements. Custodians also need to undergo annual audits, provide account statements, and provide records upon request.

These rules apply even when the assets themselves aren’t securities — because the rules are about investment funds, which are firmly under SEC jurisdiction.

National banks have been able to custody crypto since the OCC allowed it in July 2020. This allowed existing custody giants like Fidelity into the crypto custody market. But banks are now being actively dissuaded from touching crypto in any form.

The new rule uses legal powers granted to the SEC under Dodd-Frank in the wake of the Madoff Ponzi scheme collapsing.

The SEC proposal talks about “recent events in crypto assets markets” — the failures of Voyager, Celsius, FTX, and others, where customers thought they owned their crypto, but it turns out they did not, and their funds ended up as part of the bankruptcy estate.

Another reason is that crypto is extremely brittle, so it’s hard to custody. When you have a crypto asset, what you have is the cryptographic key to an address on a given blockchain — that key is the crypto. The proposal notes that keys are very hard to custody safely. Transactions are irreversible — one error or hack and your cryptos are gone. You need to be careful with backups because every backup is also the keys. And every hot wallet is an attack surface.

Custody is big business in crypto. It’s also how crypto has managed to lure in billions in institutional money. As of January 2022, the top five US crypto custody firms were Coinbase ($100 billion in assets in custody), BitGo ($40 billion), Gemini ($30 billion), Kingdom Trust ($12 billion), and NYDIG ($7 billion). Other US firms are on the list but don’t disclose assets in custody. [FintechNewsCH]

Coinbase insists that its Coinbase Custody Trust Company is already a qualified custodian. Though this doesn’t square with cryptos in custody possibly being part of the estate if Coinbase went bankrupt. But we’re sure that Coinbase Custody will get itself into order as absolutely quickly as possible. [CoinDesk]

The tricky question is what happens with crypto sitting on an exchange for trading, such as at Coinbase, Gemini, or Kraken. Does the exchange have to be a qualified custodian? If it’s trading assets on behalf of the customer, then it almost certainly would. The new Canadian rules in the wake of FTX require all exchanges to keep customer cryptos segregated in individual accounts at a custodian.

We suspect crypto custody will reach the stage where you deposit cryptos with a custodian and what you trade on an exchange are claims on the crypto in that account, similar to how stock trading works.

In stock trading, all the stocks are owned by the Depository Trust and Clearing Corporation. Your broker owns a claim on that stock from DTCC, and you own a claim on that stock from your broker. This arrangement was put into place precisely so that stockbrokers didn’t have to send around paper certificates all the time just to trade — which is where crypto is presently stuck at.

You might wonder why you would bother with the blockchain bit. The blockchain was sold as bypassing all these middlemen by trading these bearer assets directly. But it turns out that’s a bad idea, and the middlemen do useful things.

Gary Gensler wrote up the changes to the 2009 Custody Rule and posted a video! It’s a great explainer if you don’t mind the dad jokes. [SEC; Twitter]

SEC Commissioner Mark T. Uyeda writes that this is a blanket ban on crypto as an investment — “The proposing release takes great pains to paint a ‘no-win’ scenario for crypto assets. In other words, an adviser may custody crypto assets at a bank, but banks are cautioned by their regulators not to custody crypto assets.” But he supports the move anyway. [SEC statement]

Commissioner Hester Peirce doesn’t like a new rule about crypto, of course, and has handwaved various objections. Of the five commissioners, Peirce is the only one who voted against the changes. [Statement]

The new rule won’t be in place any time soon. The proposal will be published in the Federal Register, there will be a 60-day comment period, and then SEC staff will work on the final version of the rule.

Binance — the mystery of Catherine Coley

After former Binance US CEO Catherine Coley was abruptly replaced in May by former Comptroller of the Currency Brian Brooks in April 2021, she vanished. Coley was not heard from in public after her last tweet on April 19, 2021. As recently as last month, crypto outlets were still asking: whatever happened to Catherine? [Cointelegraph]

Now some clues have surfaced. In the months before her sudden disappearance, Coley had been asking questions about large transfers of money out of Binance US to CZ’s other companies. [Reuters, archive]

Binance has claimed that Binance US is separate from Binance international. This is not the case. CZ drained $400 million from Binance US and sent the funds to his market-making firm Merit Peak via Signature Bank. The money started moving in late 2020. The SEC is also looking into these transactions. [WSJ, paywall]

Nobody is quite sure what that money was for — but Coley knew something was wrong. She wrote to a Binance finance executive in late 2020 asking for an explanation, calling the transfers “unexpected” and saying “no one mentioned them,” and asked, “Where are those funds coming from?”

We assume Coley just got the hell out of crypto and sees no benefit in talking to the press. We also assume she is talking to the authorities.

BUSD — why you can’t cash out

Paxos is shutting down BUSD. Now it has to allow for orderly redemptions of its $16 billion $13.3 billion stablecoin. This is creating fresh problems.

Paxos will only redeem the official Ethereum BUSD token. If you have a wrapped BUSD issued by Binance, those are not redeemable.

If you do have Paxos-issued BUSD and can’t pass know-your-customer checks, you can’t redeem them either.

Customers who can’t redeem their Binance BUSD are using them to buy bitcoins or tethers, or whatever liquid coin they can get their hands on. This is why bitcoin is pumping again and is now bouncing around the $24,000 range.

Paxos keeps its backing reserve cash with Silvergate, Signature, State Street, and BMO Harris. All of these banks are feeling the pain of BUSD redemptions. Silvergate already got hit with $8 billion in withdrawals in the panic that followed the FTX implosion and had to get bailed out to meet withdrawals.

Paxos BUSD’s backing is not fully insured, according to Paxos. “Not all deposits are covered by the FDIC or private insurance, and Paxos may still incur losses in the event of a bank insolvency.” [Paxos, archive]

SEC charges Terraform Labs

The SEC is finally charging Terraform Labs and Do Kwon with securities fraud. [SEC press release; complaint]

The SEC alleges that Terraform and Kwon marketed a range of unregistered “crypto asset securities” as investments to retail customers in the US, lied knowingly and repeatedly in the promotion, lost everyone’s money, and stole the reserve bitcoins at the end.

Luna fits all prongs of the Howey test, so it’s a security. Wrapped luna is a receipt for a security, so it’s also a security. Luna’s 2018 ICO and 2019 bulk sales of luna were obvious offerings of securities. And Kwon pumped luna to retail hard.

Terraform’s Mirror Protocol “mAsset” tokenized stocks were security-based swaps, hence under SEC jurisdiction. MIR tokens were promoted by Terraform as the best way to invest in the Mirror Protocol.

UST was a dollar stablecoin — but from September 2020, Kwon and Terraform heavily promoted it as a “yield-bearing” stablecoin, the ticket to an investment opportunity in the Anchor Protocol, paying 18-20%. About 74% of all UST was in Anchor.

According to the complaint: “Many domestic retail investors purchased UST for the sole purpose of earning a return on the Anchor Protocol developed and maintained by Defendants.”

UST could also be freely converted at any time to or from luna, making it a security in turn.

But Terraform didn’t just break SEC registration rules. Kwon and Terraform knowingly and actively misled investors.

UST’s $1 peg was maintained only with great effort. In May 2021, Terraform got a third-party trading firm — apparently US-based Jump Capital [The Block] — to secretly buy a pile of UST to pump the price. Jump was paid with luna tokens at $0.40 when the market price was over $90, and apparently made $1.28 billion on the deal. Terraform said this showed how UST/luna would “automatically self-heal.”

When Anchor couldn’t make its interest payments, it was topped up from the Luna Foundation Guard, the “decentralized” non-profit behind the collapsed Terra “ecosystem” — run by Kwon.

Terraform falsely claimed that Korean mobile payment app Chai used the Terraform blockchain. Terraform then used this false claim of backing Chai to promote its crypto assets in the US.

In fact, Terraform had access to a server with Chai’s transaction stream, and replicated Chai payments from that stream onto the Terraform blockchain! Until early 2020, Kwon had been on the board of Chai, and Terraform and Chai shared office space.

When all Terraform’s cryptos crashed in May 2022, Kwon and Terraform took over 10,000 BTC out of Luna Foundation Guard. They’ve been depositing bitcoins from this pile into a Swiss bank account ever since, and have withdrawn more than $100 million from this account since June 2022.

Many retail investors lost everything. Institutional investors lost billions — and that marked the end of the 2021 crypto bubble and started the great crypto collapse.

Voyager — up in smoke, almost

Is the Voyager purchase by Binance US going through? The numbers just didn’t add up. And CZ said on Twitter that Binance has “pulled back on some potential investments, or bids on bankrupt companies in the US for now”. [Twitter, archive]

A spokesperson for Binance US insists the Voyager deal has not been abandoned: “We want to be clear that Binance.com was not involved in the bidding process, and the Binance US-Voyager deal continues to move forward with all the necessary review processes.” [FT, archive]

FTX — SBF back in court

Nishad Singh, former head of engineering at FTX, is nearing a plea deal with prosecutors, “according to people familiar with the matter.” No other detail as yet. He’ll be the third FTX insider to turn against Sam. [FT]

Judge Lewis Kaplan has had to review Sam Bankman-Fried’s bail restrictions for a second time in two weeks, and he’s running out of patience. The judge doesn’t buy that Sam needs a VPN to watch football, and we don’t either. He wants the lawyers to work out tighter bail restrictions — tighter even than the US government has asked for. [CNN]

Nicholas Weaver has submitted an amicus letter to Judge Kaplan explaining VPNs. [Amy Castor, PDF]

The lives of Gary Wang and Sam Bankman-Fried, high school math whizzes. Brotherhood and betrayal! [Bloomberg]

Other good news for bitcoin

Blockchain.com has a $270 million hole in its accounts from the collapse of Three Arrows Capital and is scrambling to sell off assets to fill the hole, according to multiple sources. Blockchain.com denies everything, and says it’s “an asset buyer, not a seller.” [Decrypt]

Coinbase is about to file yet more detailed numbers with the SEC on how utterly crashed the crypto market is. Coinbase’s 2022 revenue will be less than half of its 2021 revenue. [CoinDesk]

Caitlin Long’s Custodia Bank is suing the Kansas Federal Reserve to get a Fed account, claiming that the Fed does not have discretion about whether or not it grants banks Fed access. [CoinDesk; American Banker]

Long tweeted about notifying unspecified authorities last year about unspecified malfeasance on the part of an unspecified collapsed crypto company. Therefore, regulators should give Custodia Bank everything it asks for, or they’re shooting the messenger. It’s not as if there were a pile of people who were saying this was all trash that was going to explode, but who weren’t also starting a dodgy crypto bank. [Twitter, archive; blog post, archive]

The FDIC is annoyed at the CEX.io crypto exchange claiming that customers’ deposits are FDIC-insured. This is, of course, not the case. [FDIC]

The SEC has charged and settled with basketballer Paul Pierce for his part in pumping Ethereum Max, similar to the case last year against Kim Kardashian. Pierce is paying a disgorgement of $244,116, prejudgment interest of $15,449, and civil money penalty of $1,150,000. [press release; complaint, PDF]

New article by Martin Walker: “Decentralisation is simply a technological veneer over the for-profit organisations that exist in the industry and exercise a high degree of control.” [Thomson-Reuters]

Your subscriptions keep this site going. Sign up today!

someone please tell me wtf is cold & hot wallets. aren’t these cryptos on the blockchain? if they are on the blockchain than they can be moved with the right password & shouldn’t matter if the wallet is connected to the internet or not? because everything happens on the blockchain? i don’t understand

yeah, a “hot wallet” is on a computer that’s connected to the internet. This makes it easy for you to send a transaction out into the network to move coins, and it also makes it easy for someone else to take your cryptos if they get into your computer.

a “cold wallet” is not connected to the internet. Could be on a computer, could be just an address and its key on a USB stick or even written on paper.

for things to “happen” on the blockchain, you need to be able to send a transaction out into the world, i.e. a hot wallet.

hope that’s a bit clearer.

I remember coming across kits on Amazon for etching a cryptographic private key on a piece of metal, like a dog tag. (IIRC this was miscategorized under “USB keys”—I wanted a USB drive that would work on a keychain.)

not really. if everything is on the blockchain than the crypto is not on my wallet. it’s on the blockchain. if i know the address (always public) and the password for that i assume that is enough to transact. or do i need a wallet (which is some kind of software?) and without that i cannot move cryptos? for example we know satoshis adresses if someone guess the passworld correctly, can he/she move them or do he/she needs something else?

everything about this is on the internet, so if you want to do things, then that happens on the internet

that’s why i cannot understand wtf is cold wallet

it just means the key is stored somewhere that isn’t connected to the internet.

Yes you’re correct, but the difference between a hot and cold wallet makes the former a much easier target for thieves. A hot wallet is a piece of software connected to the internet with the “key already in the lock” so to speak. It’s designed to make crypto transactions easier… Software + the internet = countless possible attack vectors. The attacker wouldn’t even need to know your key to steal your coins, they’d just have to compromise your device. Happens every day.

Contrast that with a cold wallet, which stores the SHA-256 key (a theoretically uncrackable string of random letters/numbers) in a device not connected to the internet, but instead buried in your backyard or something. An attacker now only has one option to attack your crypto: find your device, dig it up, and break into it.

My advice? Don’t use either because it’s all dumb and pointless.

Hopefully that helps.

There seem to be a lot of journalists covering Crypto. David does it very short and snappy, byte chunks. Perhaps he needs to go full on hopefully find sponsors who will fund a YouTube channel.

I pulled out of Crypto ages ago, as a retail investor I simply have inadequate funds, but still love reading about it. My sense is it’s for corp investors who have time and other people’s money to invest in a volatile market. Retail investors in the main don’t have the knowledge or skills in the main & seem to get burned the most. All looking for high returns #getrichquick. I simply need to learn a subject in depth B4 I get involved. Crypto requires more than just trading on an exchange. You need an exit strategy, as exchanges have a habit of preventing withdrawals without any warning when it’s convenient. Also Crypto needs attn everyday. Unless you’re huddling, if you don’t keep your on the ball within a few hours you could be out of pocket. Crypto is fast and you need contacts. who have your back and will contact you to buy, sell or cashin and run before the shit hits the fan be and it’s all gone in a flash. Oh and hackers that’s another headache. Thanks

writing is quite enough work, I’m definitely not up to doing my own YouTube channel properly 🙂 Though if others want me on theirs, I generally answer yes!

Is there any U.S. bank that will accept fiat from sale of crypto or fund a crypto exchange without closing your account?

I fully expect Coinbase to hold on till the bitter end, since they’ve thus far managed to avoid the worst SEC action, and most of their business is flipping VC coins onto the American public, which doesn’t have to involve any sketchy overseas entities.

(Yes, this business has probably already dried up, and it will probably become more explicitly illegal soon enough, anyway, but Coinbase has thus far done better than any other exchange at mostly coloring between the lines, so they’re the most likely to retain literally any long-term access to USD banking lol.)

Anyway it’ll be fun to watch Coinbase turn into the same sort of weird subcultural creepy small town that Second Life has been for over a decade…

One thing to hot and cold wallets: either way you can’t set a stop loss. You have to transfer your crypto to an exchange first.