El Salvador has passed President Nayib Bukele’s bill to make Bitcoin legal tender in the country! The bill passed 62–19, with three abstentions, at around 8pm local time on 8 June.

The El Salvador Bitcoin plan is blitheringly obviously a scam, and the only question is the details of the scam.

The prize here would be a small country’s stash of genuine US dollars. At least $150 million will be extracted via a trust that’s being set up as an interface between dollars and bitcoins.

Strike, the payment network that El Salvador is working with, runs on tethers — a barely-backed substitute dollar token used in the crypto trading markets — and the “dollars” in a Strike account in El Salvador are actually tethers. Fake dollars go in, real dollars leak out.

The law

President Bukele tweeted the text of the law in Spanish and English: [Twitter; Twitter; FREOPP]

Art. 1. The purpose of this law is to regulate bitcoin as unrestricted legal tender with liberating power, unlimited in any transaction, and to any title that public or private natural or legal persons require carrying out.

What is mentioned in the previous paragraph does not hinder the application of the Monetary Integration law.

Art. 2. The exchange rate between bitcoin and the United States dollar, subsequently USD, will be freely established by the market.

Art. 3. Prices may be expressed in bitcoin.

Art. 4. Tax contributions can be paid in bitcoin.

Art. 5. Exchanges in bitcoin will not be subject to capital gains tax, just like any legal tender.

Art. 6. For accounting purposes, the USD will be used as the reference currency.

Art. 7. Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.

Art. 8. Without prejudice to the actions of the private sector, the State shall provide alternatives that allow the user to carry out transactions in bitcoin and have automatic and instant convertibility from bitcoin to USD if they wish. Furthermore, the State will promote the necessary training and mechanisms so that the population can access bitcoin transactions.

Art. 9. The limitations and operations of the alternatives of automatic and instantaneous conversion from bitcoin to USD provided by the State will be specified in the Regulations issued for this purpose.

Art. 10. The Executive Branch will create the necessary institutional structure to apply this law.

Art. 11. The Central Reserve Bank and the Superintendency of the Financial System shall issue the corresponding regulations within the period mentioned in Article 16 of this law.

Art. 12. Those who, by evident and notorious fact, do not have access to the technologies that allow them to carry out transactions in bitcoin are excluded from the obligation expressed in Art. 7 of this law. The State will promote the necessary training and mechanisms so that the population can access bitcoin transactions.

Art. 13. All obligations in money expressed in USD, existing before the effective date of this law, may be paid in bitcoin.

Art. 14. Before the entry into force of this law, the State will guarantee, through the creation of a trust at the Banco de Desarrollo de El Salvador (BANDESAL), the automatic and instantaneous convertibility of bitcoin to USD necessary for the alternatives provided by the State mentioned in Art. 8.

Art. 15. This law will have a special character in its application concerning other laws that regulate the matter, repealing any provision that contradicts it.

Art. 16. This decree will take affect ninety days after its publication in the Official Gazette.

This is skimpily drafted — “bitcoin” is not defined — gives the Executive branch way too much power to implement the needed institutions as it pleases (probably a feature as far as Bukele is concerned), and Art. 15 looks like a time bomb. But anyway!

The Act goes beyond the usual meaning of “legal tender,” which covers payment of debts. Businesses will be required to accept Bitcoin, even for purchases … unless they don’t have the technology.

Accounts will still be kept in US dollars, the official currency of El Salvador — bitcoins will be, explicitly, a dollar substitute.

Obviously, the law doesn’t detail the operational structure. Bukele did a Twitter Spaces call where he explained a bit about how they expected it would all work. In fact, bitcoiners had set up the call independently; Bukele happened to call in, and they noticed and started asking him questions. [YouTube, one-hour Bukele segment; YouTube, full three-hour session]

If you have an hour spare and some handy forks to stab into your ears, I recommend Bukele’s Spaces call. He was making up new parts of the plan in real time. The plan to do Bitcoin mining using volcano power — El Salvador gets 25% of its power from geothermal — was an idea someone put to Bukele on the call, and he later tweeted that it was policy now. [Twitter]

The Trust

Per Art. 14 of the Act, El Salvador is setting up something like a currency board, sort of, to interface between bitcoins and US dollars. Merchants will be required to accept Bitcoin — but the Trust will make up for Bitcoin’s awful volatility, as Bukele explained on Spaces:

[05:16] This law speaks about a trust fund that the government is going to put up in place so it would assume the risk of the merchants.

[05:36] For example, if there’s an ice cream parlor, and the owner of the ice cream parlor, he doesn’t really want to take the risk. I mean, he has to accept bitcoin, because it’s a mandated currency, but he doesn’t want to take the risk of the convertibility. He might win money, he might lose. So he wants dollars deposited in his banking account. So when he sells the ice cream, he can ask the government to exchange his bitcoin to dollars. Of course, he can do that in the markets also, but the government would have a fund to do it immediately. So it’s not that volatile because the government is going to take the risk of the minutes or half an hour that it’s going to take for him to do his transaction.

[06:29] So we’re going to put up a trust fund to do that, and we’re willing to risk some money, that we might earn some or we might lose some, but that’s going to be done to help people with the risk. And that’s a separate law that’s going to go to be approved in the assembly later.

The trust will be set up by the national development bank, BANDESAL — not by the central bank — with $150 million, in actual dollars.

The central bank’s total reserve is $2.5 billion. Bukele admitted on the Spaces call that $150 million was a lot of money to El Salvador.

The trust fund will assume all the risk that the price of Bitcoin goes down. If the fund is limited to $150 million, that’s not a recipe for utter disaster. But all the trust is doing is providing cover for Bitcoin’s ridiculous volatility.

The trust is being set up in partnership with Strike, so I suspect it won’t be paying out in dollars, but in tethers — but we’ll get to that part of the scheme shortly.

Launderettes ahoy!

Bukele plans to gradually replace the dollars with bitcoins that have been accepted by merchants, and the trust will end up holding $150 million in bitcoins. That is: El Salvador will launder $150 million of bitcoins. From the Spaces call:

[54:29] At the end we’re going to hold at least 150 million dollars equivalent of bitcoin, but that hasn’t been bought yet, because it’s going to be bought in the small transactions of 0.0001 bitcoins, so at the end we’re going to hold 150 million dollars equivalent in bitcoin. But right now, we’re not holding any bitcoin.

There is absolutely no way to run Know-Your-Customer to international standards on Bitcoin transactions, and also have Bitcoin treated like legal tender. So they’re setting up a gateway for questionable bitcoins.

The bitcoins are not going to come from merchants 0.0001 BTC at a time. They’re going to come from holders with large bags of dirty bitcoins, dumping them for cash.

El Salvador has a surprisingly okay record on anti-money-laundering (AML), especially given it’s got a massive problem with gangs shipping cocaine through the country. It’s a member of the Caribbean Financial Action Task Force, the local branch of the FATF. [FATF] El Salvador is not on the FATF AML Deficiency List.

UIF, El Salvador’s Financial Investigations Unit, was suspended from the Egmont Group of international financial intelligence units in 2018 — though it was reinstated in 2019.

But El Salvador’s AML status is directly endangered by the adoption of Bitcoin. This then becomes a question of how long the rest of the world wants to keep doing business with them — and what that does to incoming remittances.

How well does Strike work?

“Bitcoin Beach” was set up in the village of El Zonte, as a proof-of-concept for a circular Bitcoin-based local economy. This is subsidised by “an anonymous bitcoin whale.” [CoinDesk]

Associated Press looked into Bitcoin Beach. You’ll be unsurprised to hear that it’s an artificial experiment that doesn’t work as advertised. Those associated with the project talk it up — but when AP spoke to ordinary people, they turned out not to go near the Bitcoin system. (Includes some quotes from me.) [AP]

Remittances: pay dollars, send tethers

Frances Coppola hypothesised that Bukele will create a US dollar stablecoin and debase its backing, rather than using actual dollars — as a way to print money:

He can’t possibly guarantee the BTC risk any other way. I would take the announcement of a ‘trust’ as clear evidence of intention to print USD equivalents, personally. But I am ultra-cynical … Creating scrip currency to steal real money has been done by corrupt governments all over the world. [Twitter; Twitter; Twitter]

Coppola’s guess was very close. Strike uses tethers to transmit US dollars from the US to El Salvador — and the balance at the other end stays in tethers.

A tether is a US dollar-equivalent stablecoin. Tether Inc. used to claim tethers were backed one-to-one by US dollars in a bank account; this was a brazen lie, so Tether now claims they’re backed by squirrels and confetti. There has never been a verifiable redemption of tethers for the dollars supposedly backing them.

Jack Mallers, CEO of Zap, who runs Strike, describes Tether as “a synthetic digital dollar” on your smart phone. With the minor issue that tethers are absolutely not dollars.

Here’s Mallers explaining how it works: [Medium]

Let’s walk through a user story. I want to send $1,000 to a friend of mine in El Salvador:

• When I initiate the $1,000 payment, Strike debits my existing USD balance.

• Strike then automatically converts my $1,000 to bitcoins ready for use in its infrastructure using its real-time automated risk management and trading infrastructure.

• Strike then moves the bitcoins across the Gulf of Mexico where it arrives in our Central American infrastructure in less than a second and for no cost.

• Strike then takes the bitcoins and automatically converts them back into USDT (synthetic digital dollar known as Tether) using its real-time automated risk management and trading infrastructure.

• Strike then credits the existing user with the USDT to their Strike account.

What if your family back home wants the, you know, dollars that you worked hard for in the US, and thought you were sending to them?

Well, that’s easy — you can cash out your USDT balance as US dollars at a Strike-operated Bitcoin ATM!

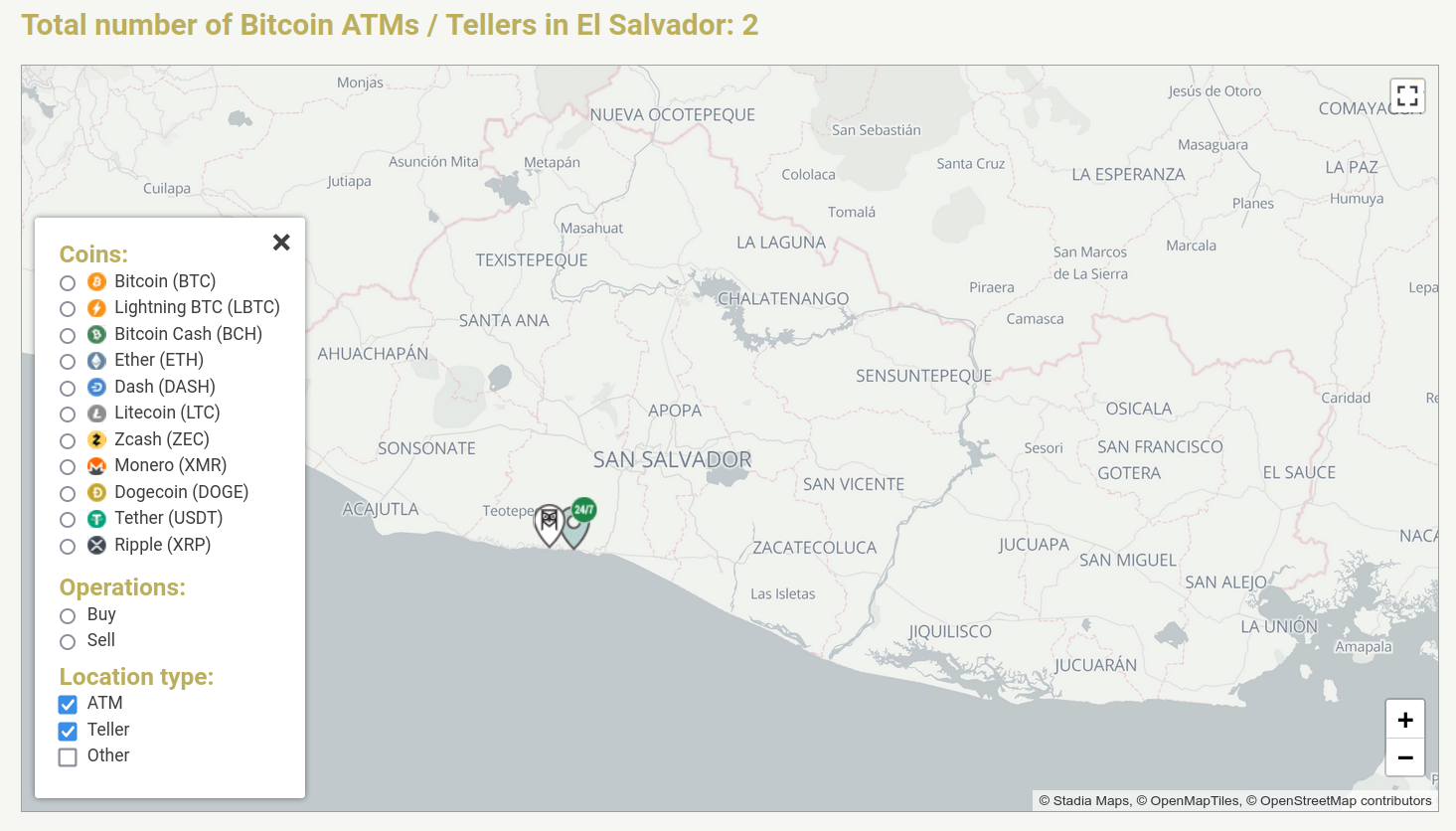

How many Bitcoin ATMs are there in El Salvador?

Two. Both are in Bitcoin Beach — at El Sunzal and El Zonte. And none in backwaters like, er, San Salvador. [Coin ATM Radar]

The Strike system — supplied by the government for everyone — will default to tethers, and try to keep you using and circulating tethers.

Strike, meanwhile, still has the actual US dollars that were put in at the sending end.

My own private Lightning

Notice how in Mallers’ remittance example, the Bitcoin bit doesn’t do anything — Strike buys bitcoins for dollars, and immediately sells them for tethers. The “less than a second” suggests this is sent over Strike’s private Lightning Network.

I described the Lightning Network last time. The public LN basically doesn’t work, and can’t work. Strike tried using the public mesh network — but lost a lot of payments.

Strike now only allows LN connections from “close partners”. Rahul Bile from Strike explained in the company’s public Slack channel: [Twitter]

In order to facilitate high volumes of payments strike have closed their nodes to outside parties.

Mallers tweeted in October 2020: “Leaving our nodes open to any incoming connection allowed anyone to open channels to us. Almost all of these channels were bad channels and resulted in difficulties for our nodes.” [Twitter]

Strike just settles between parts of Strike using its own isolated Lightning Network. I suppose that solves the path-finding problem.

Apparently, this private LN instance is good news for the Lightning Network.

All politics is local

Bukele is genuinely very popular — his approval rating is over 90%. He’s funded this popularity by increasing spending without increasing taxes. But El Salvador can’t print US dollars to make up the deficit. Bukele also habitually governs by the seat of his pants, rather than with coherent plans.

El Salvador is heavily funded by foreign aid from the US — to make up somewhat for how thoroughly the US screwed El Salvador over in the 1980s. [The Atlantic] But the US is not happy with Bukele’s authoritarianism and corrupt cronies, and has redirected its funding to civil society groups. [Reuters]

Bukele has been funding the deficit by issuing bonds — but the market has priced these at a huge discount, on the order of 7–9%. [Reuters]

Bukele met on Thursday 10 June with the International Monetary Fund, who he was hoping to borrow $1 billion from. The Bitcoin plan was a major part of the discussion. The IMF held a press conference beforehand; they refused to be drawn on the many Bitcoin-related questions, but politely indicated that they were more than a little dubious about the scheme: [IMF]

Adoption of bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis. We are following developments closely, and we’ll continue our consultations with the authorities.

FT Alphaville thinks the Bitcoin plan is a backup option in case the IMF loan falls through altogether. [FT, free with login]

Bukele likely wants to get hold of the dollars coming in as remittances — Strike won’t get 100% of remittances, senders will still use Western Union, MoneyGram and so on — and adding tethers to the economy in place of dollars would allow him to effectively print money that he couldn’t print otherwise.

The Galt’s Gulch opportunity

There is also a sub-plan to attract gullible libertarians to El Salvador. On the Spaces call, Bukele offered permanent residence in El Salvador for 3 BTC:

[10:37] You could become a sanctuary country for crypto, I think a lot of bitcoin entrepreneurs, everybody would come there, and because you know the banking system would be friendly, everything would be friendly.

This is not enough to buy you a secured enclave where you won’t have to see local poor people, or get shot by the gangs. Also, the local murder rate is stupendous.

There’s a small cottage industry in central America in scamming gullible libertarians with colonialist inclinations. In the Honduras charter city scheme, a few libertarians thought they could come into a country, take over an area, and run it as an enclave with private laws. The rich got richer, the local poor were screwed over, the charter city scheme was eventually ruled unconstitutional, and the investors’ money went up in smoke. [Reason; Open Democracy]

The Bitcoin bros seem to seriously think Bukele is a naïve rube they can take for everything he’s got, and not a successful politician.

I’m pretty sure both Bukele and the bitcoiners who sold him this scheme are each convinced they’re going to screw over the other. It’s possible both will lose, of course.

I’m going to write a novella where a disaffected American takes his 3 BTC and moves to El Salvador, only to lose it all in volcano mining. So he starts walking north and learns the meaning of life right before being shot at the border by the libertarian who intro’d him to bitcoin

— Troy Esquivel (@Troy_IRL) June 9, 2021

One-dimensional chess

Don’t expect the El Salvador Bitcoin plan to be a well-constructed long con put together coherently by smart people. This is a barely-planned smash-and-grab.

The $150 million trust will be drained immediately. There will be near-zero consumer use of bitcoins. Tethers will circulate as dollars until people realise these things are not redeemable. Strike will somehow collapse.

The international financial community will treat El Salvador as a money-laundering state. The IMF is likely to attach severe conditions to any further loans.

The Bitcoin bros will lose their money and their bitcoins. The people of El Salvador will be even more screwed over.

Bukele, who knows? He might wriggle out of this one — blaming the outsiders is the obvious move, for example. He’s definitely clever enough to have an escape plan already lined up.

Just assume the El Salvador Bitcoin thing is absolutely as dumb as it looks, and you’ll make correct predictions.

Update: My piece in Foreign Policy on how I think Bukele wants his side of this to work.

At that point I'm expecting next crash Bukele to exit scam by vanishing right after officially changing his country flag with a giant penis flag.

This Sir, would be the strongest evidence we're living in a simulation.— TDoge (@TDoge_) June 9, 2021

Your subscriptions keep this site going. Sign up today!

To be fair the Bitcoin ATMs charge a quite reasonable 30% or so, compared to the 8% that money remitters charge for sending actual dollars.

I wonder if anyone reading this has actually used the Bitcoin ATMs in El Salvador, and what the exchange rates and percentage are like.

I have. The fee was 5 percent.

We did. The ATM actually tells you to come back later and get your money. Just don’t lose the receipt it gives you else you won’t get your money out… later. Story below:

https://www.nanalyze.com/2021/09/real-story-bitcoin-el-salvador/

I live in El Salvador. I have not use the ATMs , but I plan to use them soom, just to find out what the exchange rates are.

So bitcoin is legal tender. But Strike sends me tethers. So I have tethers to buy ice cream with (and food) and no dollars and no bitcoins. I’m sure they just forgot to say tether is also legal tender because nobody is running a scam or anything.

The whole crypto space is built on Tether.

The whole crypto space is built on fraud.

House of cards.

Indeed, it keeps amazing me it still hasn’t collapsed and still gets some positive press.

A couple of months ago I went to the beach to see a bitcoin ATM and I saw a woman putting in the ATM the maximum amount of dollars per operation to have bitcoins, no paperwork, no questions of origin, just putting a lot of money without any control. .. I will leave you wondering where a lady can get so much money in a country where you pay gangs to have a business and be able to live.

I think something important to point out is that USDT is not included in the law meaning that companies are not required to accept USDT. They can only accept USD or BTC!

P.S. tether should die!

Strike and Mallers consistently call tethers “dollars” in their messaging, which is why I suspect they’re going to try to pull a fast one there.

how would that go down?

don’t know. Though I suspect we’re at the stage of having done more coherent and joined-up thinking about how the scheme could possibly work than its perpetrators have. I expect they’ll come up with new parts of the scheme off the tops of their heads in the coming week.

I did use a bitcoin ATM here in El Salvador, and the rates are around 3% plus the fee tour wallet is will charge

Could you give more detail about the cost of gas and other fees per transaction? I haven’t found any information about it anywhere.

Bukele is WAGGING THE DOGS TAIL BIG TIME! This is just a huge smoke cloud to try to hide / distract the media away from all the corruption that the OAS / CICIES has discovered from Bukele’s officials during the pandemic , where they manipulated / stole USD $2 Billion .

When faced with having to decide if someone is acting out of ignorance or intrigue it has been my experience that it is way more often ignorance.

Two additional thoughts

First I have not had cash in my pocket for over a year. Between debit and card cards and eInteract, all my currency is already digital.

Second, if they wanted digital currency, they could have launched their own governmwnt run blockchain with no mining, no anonymity and no volitility.

So they didn’t want digital currency, what they really must have wanted was anonymity so ya, money laundering and scams. Poor El Salvador 🙁

in crypto, you should never assume competent malice when you could assume incompetent malice

they just announced that they’re completely off Tether now.

https://www.coindesk.com/strike-usdt-tether-jack-mallers-el-salvador-bitcoin

According to this first-hand source, Tether was a stop-gap solution, but was removed later, and it is nowhere in the picture anymore.

https://www.whatbitcoindid.com/podcast/el-salvador-the-whole-story