- Here’s a webcam shot of Arya, assisting me as she best knows how. Sign up to get email of all posts to this blog, as they happen! With cat pictures! Tell your friends and colleagues!

Story unavailable — insert 5 JPEG tokens to continue

The Joint Photographic Experts Group mostly does useful things like maintaining the stupendously popular JPEG image standard — which has been pretty stable for thirty years, and doesn’t really need much work.

This means all sorts of opportunities for bureaucracy climbers, chancers and just plain weird people, who want to put a trusted name on their bad ideas — like the long-running plan, two years in the making, to put Digital Rights Management on JPEG images and media streams. The Ad Hoc Group on Blockchain’s been at this since 2018.

Some of you may remember that time in 2015 when JPEG first proposed DRM for JPEG images — that was these guys too. [EFF]

Here’s the current version of the Ad Hoc Group’s plan for DRMed JPEG imagery, on the blockchain They would like your feedback. [Announcement; Media Blockchain Use Cases and Requirements, PDF]

It’s an improvement on the 2018 white paper draft — it doesn’t list a pile of vendors who are defunct, or ones who never produced anything at all.

Below is an image from a January 2020 presentation by the Ad Hoc Group on Blockchain, on how they envisage the new DRMed blockchain Web. [presentation, PDF]

BlockFi makes DeFi more transparent

Completely centralised “decentralised” finance provider BlockFi suffered a data breach on 14 May, which they finally told the world about on 19 May — an attacker SIM-swapped an employee, got in via SMS two-factor authentication, and copied a pile of their customers’ personal information.

The attacker got “less than half” of all retail customers’ account activity information, email addresses and postal addresses. But not funds, not social security numbers, and not images of client ID for know-your-customer. So that’s nice — the attacker will just know who you are, where you live, and that you have enough of a crypto holding to be getting into serious speculation. [BlockFi Incident Report, PDF; The Block]

Many of the accounts will be duplicates — BlockFi’s fee structure incentivises users to run multiple accounts. Apparently, BlockFi’s investors really like “account numbers go up.”

HODLers in ties with Chromebooks

Some normal investors really are getting lured to crypto, with promises of stupendous interest rates in these low-return times — from “crypto hedge funds,” as well as DeFi providers!

It tends not to end well — it turns out that high interest means high risk.

Vlad Matveev of Moscow, supposedly a fund manager turned private investor, lost 98.5% of his money believing the fabulous claims of crypto hedge funds — in this case, Cryptolab Capital, who blew everyone’s money gambling on BitMEX in April. “I don’t really know what happened. They said they had a diversified set of strategies.”

The story covers several other crypto hedge funds, and has Michael Novogratz of Galaxy Digital bigging up the sector. Mr Novogratz bought up big into crypto in January 2018, and has so far lost hundreds of millions of dollars on this “attractive portfolio hedge against currency debasement and inflation.” [Financial Times, paywalled]

My Twitter readers suggest that “diversified” means holding bags of multiple minor altcoins, or perhaps using three models of Chromebook.

“We minimize risk by diversifying over dozens of Ponzi schemes. Investing in just one Ponzi scheme would be stupid. But allocating a few percent of your money into every Ponzi scheme out there, is what’s called smart investing.” — Trolly McTrollface. [Twitter]

“I was led to believe the different colours and shapes of tulip would insulate me from systemic failure” — Toby Pinder. [Twitter]

Let’s build a DAO

The developers of Ethereum mixer TornadoCash have destroyed their admin keys, turning the privacy tool into permissionless code — no longer susceptible to human interference or compulsion: [Medium]

In just a few days, after we ensure that everything works as intended, we will set the operator address to 0x0000000000000000000000000000000000000000 so that no one ever will be able to modify it. This will make tornado.cash fully trustless, decentralized and forever unstoppable!

Or, in security terms: a sitting duck for attackers, where security holes literally can’t be fixed.

I wrote about “the steadfast iron will of unstoppable code” (emphasis in original) in chapter 10 of Attack of the 50 Foot Blockchain — it seems Ethereum developers have already forgotten Ethereum’s first really huge disaster, The DAO. Get to work, kids — there’s a mixer to exploit!

The purpose of a crypto coin mixer is to obscure your transactions, even though they’re on a public blockchain. Coincidentally, this happens to constitute do-it-yourself money-laundering.

So coins going through mixers are often presumed tainted by the authorities, and by those who have to provide Anti-Money-Laundering information to the authorities. Because, as FinCEN has told everyone — and told CoinDesk afresh when they asked — mixers explicitly count as money transmitters under US law.

Cryptography works well when you do everything right. But it’s super-easy to make a tiny mathematical slip-up, and leave your backside hanging out. So Chainalysis and similar outfits can pretty much always trace the average user through mixers — from user error, and just because not many people use them. [CoinDesk]

ICO, ICO

The “dead Kodak bounce” — the corporate zombie revenant wearing the flayed and tattered skin of beloved video game company Atari ran its ICO in April, and has just announced a team-up with the Litecoin Foundation. This Atari is planning to release a video console in September 2020, three years after they first announced it, which you’ll be able to buy games on with their token. [ICO press release; Litecoin Foundation]

Remember how EOS ran a $4 billion ICO in 2017, and got a mere $24 million fine from the SEC in 2019? That SEC action doesn’t preclude private action — and so a class action lawsuit has been filed against Block.One over the EOS ICO. [complaint, PDF; The Block]

Stephen Palley says: “The new lawsuit against Block One and its founders has surprising teeth, and presents peril to the defendants that the SEC settlement did not resolve. Plaintiff will argue that the SEC order conclusively establishes that the token sale was an unregistered securities offering and the tokens securities. (Non-mutual offensive collateral estoppel, if we are going to be fancy about it.)” [Twitter]

DefendCrypto.org stopped working a couple of weeks ago. So I emailed the Blockchain Association to ask about this — and the official word is: “The Defend Crypto effort has not expired, just the website.” Er, OK!

I’m pretty sure I’m the very first person ever to try to email the Blockchain Association via the link at the bottom of their web page — because both the text and the email link originally spelt their own domain name wrong (“assocation”), until I emailed and let them know. [archive]

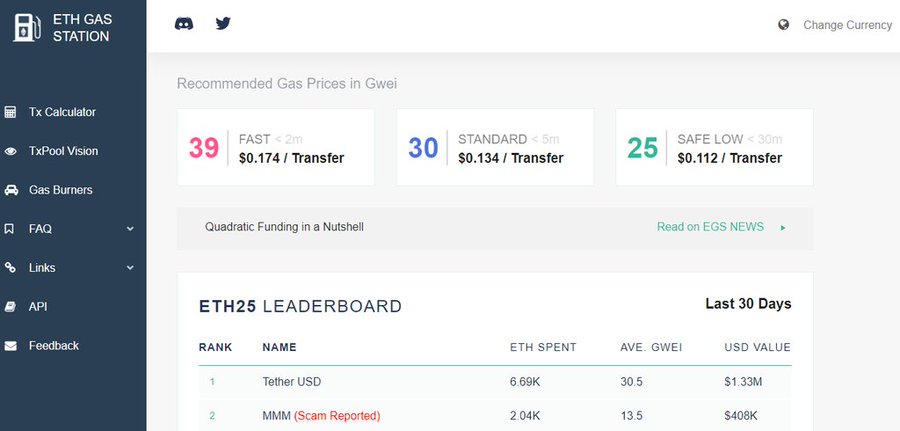

What does your Ethereum gas (transaction fees) buy? Number 1 use case for Ethereum: Tether. Number 2: a Ponzi scheme, named after a historical Ponzi scheme. [ETH Gas Station]

A place in the Sun

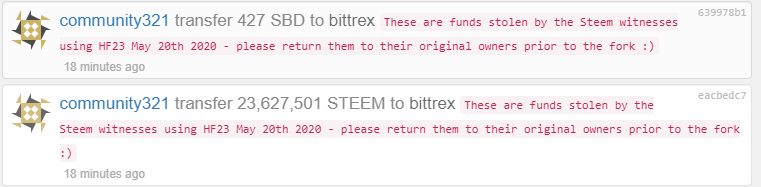

In March, Justin Sun of TRON became the totally decentralised proprietor of the totally decentralised Steem blogging platform blockchain. Steem works by Distributed Proof of Stake — you pledge your coins to your desired transaction validator, and they have all manner of power over the chain. Sun did this by buying Steem tokens himself — and by convincing his friends on exchanges to pledge their customers’ Steem tokens to support him as the rightful king of Steem. His goal was to hard-fork the Steem chain to work more to his liking. The Steem community said “bugger that,” and promptly forked the chain, forming Hive.

So, as far as I can work out the story — and I welcome correction: Sun’s Steem hard-fork took effect yesterday — taking $5 million of tokens from accounts that Sun accused of various crimes. [Decrypt]. The coins were put into an account called “community321” — and then someone drained that account, and sent the coins to Bittrex. [SteemD witnesses]

The Hive community is amused. [Steem Block Explorer] Sun is most upset, and says he’s calling in law enforcement. [Twitter; Decrypt]

Good news for Bitcoin

A block of 50 BTC mined in February 2009 just moved for the first time. [Blockchain.com] This is apparently the first block of early bitcoins to have moved since 2017.

The 50 BTC are not thought to be part of the Satoshi stash, though — even though this is one of the blocks that Craig Wright claimed in Kleiman v. Wright to have mined in the early days. Perhaps that’s why the owner moved them now. [Decrypt]

If you could put two flies crawling up a wall on the blockchain, I’m pretty sure crypto day traders would bet on fly futures. FTX is launching futures on BTC mining difficulty — you can bet on the Bitcoin hash rate. The claimed use case is for miners to hedge against hash rate changes. [blog post]

Who’s buying all the miners’ bitcoins? Grayscale Investments has bought 60,762 BTC between 7 February and 17 May — or about 34% of the amount of BTC mined in that time, if not literally the miners’ fresh coins. That’s an arseload of bitcoins Grayscale is buying, at current prices. They’ve also bought ETH equivalent to 48% of all ether mined in 2020. [Reddit, Reddit]

Attack of the 50 Foot CryptoKaren — incentivising companies to have a tickbox for “are you interested in Bitcoin?” and refusing orders from anyone who ticks “yes.” This time, it’s Francis Pouliot harassing free-software phone and laptop vendor Pine64. I detailed how badly this approach to recruiting Bitcoin merchants worked in the early days in chapter 7 of the book. [Twitter, archive]

So did the guy who made the must watch two-hour video claiming that Adam Back was Satoshi Nakamoto, inventor of Bitcoin, ever put his argument down in writing, for detailed critique in depth? Given that all we have of Satoshi is text. [Decrypt]

Argumentum ad YouTube tries to convince viewers with the presentation, instead of the arguments — which is why it’s the favoured medium for conspiracy theorists. It’s why claims of 5G towers causing Covid-19 tend to be presented in video, rather than written form — it’s vastly better for convincing the gullible.

(“You gotta see this video!” “No, I don’t. What’s the argument?” “Look, just watch the video.” “Can you please describe the arguments, in words.” “DO YOU HATE VIDEO OR SOMETHING” “I do now. Use your words.”)

Refusing to put your supposedly killer argument in easily-dissectable written form is a standard hallmark of flimflam artists and gibbering nutters — set out your arguments if you’ve got ’em. [The Atlantic]

A class action lawsuit has been filed against BitMEX by BMA LLC, alleging money laundering and market manipulation. [The Block] BMA LLC was formerly known as Bitcoin Manipulation Abatement LLC — a special-purpose vehicle for crypto lawsuits, which filed a suit against Ripple Labs a couple of weeks ago,

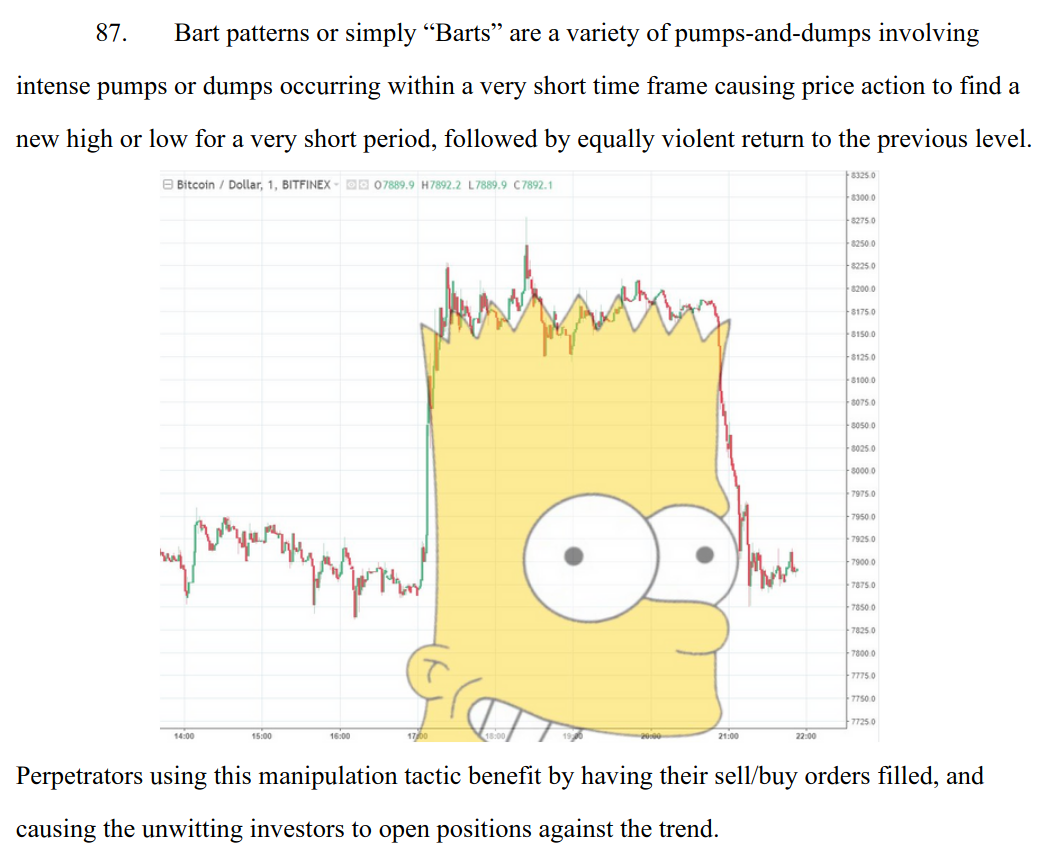

The complaint is well worth a read. Here’s a picture of Bart Simpson, from page 40. [complaint, PDF, case docket]

Things happen

Stupid no-leafers, failing to see the fabulous economic potential of plant cuttings — there’s a bubble in philodendron cuttings in Australia at the moment. Suburbanites, going nuts cooped up at home, are paying AUD$2,000 for a clipped off bit of a plant — precisely the sort of thing that normal people give their neighbours for the asking. It’s great when people never learn from history, ever. [Twitter]

Libra has hired Robert Werner as general counsel. Amongst other jobs, he used to be Director of FinCEN. [Press release]

Myanmar officially recognises cryptos! The Central Bank of Myanmar has announced that trading crypto-assets shall be subject to imprisonment, a fine, or both. [CBM, PDF]

CoinMarketCap was bought by Binance — and, by sheer coincidence, has changed its exchange metric to claimed web traffic, which makes Binance the top exchange! CMC also coincidentally removed “Adjusted Volume” — a metric they’ve had since July 2018 — that just happened to show a ton of wash-trading and blatantly faked volume on Binance. [Decrypt]

Marketers of useless BS warn the US military that it’s falling behind China and Russia in the all-important Useless BS Arms Race — Accenture and IBM are trying to panic the US into hiring them to blockchain all the things. [CoinDesk]

Ben Munster: The Men Who Stare At Charts — and sell other suckers on what they’re claiming to see. “Most likely, he’ll engage in a sort of meta-play: making predictions based on the credulity of those who do believe TA speaks to some sort of ineffable cosmic principle.” The only thing this article is missing is the word “Bart.” [CoinDesk]

Sometimes, /r/cryptocurrency delivers. [Reddit]

How bitcoin twitter think they look explaining bitcoin to @jk_rowling vs. how they actually look. pic.twitter.com/pux83Fh8ih

— Steven (@Dogetoshi) May 15, 2020

Imagine the highlight of your day being a celebrity mentioning Bitcoin

— Cryptofungus (@crypt0fungus) May 17, 2020

if Craig Wright ever appears in front of a jury they're going to hate his guts. pic.twitter.com/aHkk0TkJEf

— Palley (@stephendpalley) May 20, 2020

Your subscriptions keep this site going. Sign up today!