Bullish on USD

Bitcoin crashed, just as the real market crashed. The US Federal Reserve deployed the money printer — the original sin of fiat currency that provoked Bitcoin. This was Bitcoin’s big moment — surely the Fed’s betrayal of fiscal prudence meant investors would flock to Bitcoin!

And … the pump lasted about an hour, and not even 250 million Tether fake dollars could keep Bitcoin afloat. All the narratives turned out to be sweet stories. [FT Alphaville, free with login]

The important lesson from the past week: crypto has literally always been comical nonsense. The Buttcoin Foundation started taking the piss out of Bitcoin in 2011, and everything they ever said still applies. [Buttcoin Foundation]

The rich developed countries suddenly find themselves running a war economy just to keep their citizens fed. Everything beyond shelter, food and stopping the spread of Covid-19 is trivia.

Nobody cares about Bitcoin when s—t gets real.

Investors are rushing for the market exits even in things that have sustainable value — they want actual-money fiat dollars. Novelty collectibles like bitcoins are meaningless dross.

You can’t buy pies with bitcoins. Or respirators.

To be clear: I fully expect Bitcoin to linger for decades. Bitcoin is too stupid an idea to die — it’s a virus perfectly attuned to a particular species of delusionary.

In the 2060 climate apocalypse hellscape, the last two bitcoiners will be swapping Internet pogs and maintaining the hardest money.

But as far as Bitcoin and the real economy go, we have the answer to the Bitcoin experiment:

- in good times, the real economy treats Bitcoin as an interesting toy.

- in bad times, Bitcoin can just bugger off — we have real problems.

CoinDesk assures me that this is good news for Bitcoin:

Kyle Samani from Multicoin analyses what happened when Bitcoin crashed last week — a miner was caught short and dumped all their coins, and then BitMEX was overloaded a few hours later. “At one point, there were only ~$20M of bids left on the entire BitMEX order book and over $200M of long positions to liquidate. This means the price of BTC could have briefly crashed to $0 had BitMEX not gone down for ‘maintenance.'” [Multicoin]

Michael Novogratz and Tyler Winklevoss are both tweeting to try to restore confidence in their massive Bitcoin bags, and are asking — what is the meaning of Bitcoin, anyway? “If bitcoin isn’t gold 2.0, then what is it?” It’s gambling. It always was gambling. Pretending it wasn’t gambling is just something bagholders say to try to lure in fresh suckers. [Twitter, Twitter]

Here’s previous asset bubble veteran Inch the Inchworm, his Ty slightly askew, hitting the sauce after having seen what his crypto portfolio did in the past week.

More good news for Bitcoin

You’ll be as cheered as I am to hear that Bitcoin miners are suffering! The price crash means a pile of hash rate has gone offline — much as it did in late 2018 — and then there’s the “halvening” in two to three months, when the reward for successfully mining a block of transactions halves from 12.5 BTC to 6.25 BTC, and they’re even less economically viable. [Decrypt]

Quite a lot of the Chinese miners got themselves into trouble by being greedy. The miners thought the Bitcoin price would go up with the halving — and took out loans to buy mining equipment. Then many of them held their mined bitcoins, instead of cashing them in. This left them broke, and they had to dump their coins — sending the price down further. [Decrypt]

(The real “halvening” was the self-actualised captains of industry we exit-scammed along the way.)

When I hear the words “ransomware gang,” the concepts “kind-hearted” and “public spirited” don’t quite spring to mind. But Bleeping Computer got in touch with a few ransomware gangs — you can contact them, they even provide customer service because bitcoins are so hard to use (see Attack of the 50 Foot Blockchain, chapter 7) — and several promised they wouldn’t attack health organisations in this difficult time. So that’s nice. This is after Champaign-Urbana Public Health District was hit by ransomware last week. [Bleeping Computer, News-Gazette]

Why ransomware is Bitcoin’s biggest problem, by JP Koning — “Any payments network is subject to a calculus of legitimacy. Once the percentage of illicit transactions reaches a certain percentage, the system becomes stigmatized.” [CoinDesk]

Bad news for Bitcoin — the Lamborghini factory is closing due to Covid-19. [Autocar]

All hail Corona-chan

Tim Draper, Bitcoin entrepreneur — “When the world comes back, it will be Bitcoin, not banks and governments that save the day.” He also tweeted, “Stay open for business. If not, so many more people will die from a crashing economy than from this virus.” Won’t someone please think of my portfolio? [CoinTelegraph, Twitter]

Remember that Tim Draper is the man stupid, craven or both stupid and craven enough to shill for Theranos on CNBC — after it had been exposed as a blatant and dangerous medical fraud. Wearing a Bitcoin tie. [CNBC]

The Ethereum Community Conference (EthCC) in Paris in early March appears to have been a hotbed of Covid-19 — seventeen confirmed cases so far. They did try not to shake hands and so on, but this virus is contagious. There was a public spreadsheet, but it’s locked now. [Decrypt]

New York Blockchain Week was shut down when New York banned large public gatherings. CoinDesk say this will not result in any layoffs, and they’re still hiring! This suggests Digital Currency Group is happy to take CoinDesk to a fully subsidised patronage model. [Decrypt]

Just before they were forced to cancel, CoinDesk were still pushing their prospective plague pit as hard as they could. I got an amazing promotional email from CoinDesk, which I corrected a bit:

MakerDUH

You’ll be shocked to hear that Decentralised Finance, like so many clever crypto schemes, only works while number goes up.

The price of Ether — the coin used in Ethereum — crashed on March 12. Tokens used in DeFi, which are pretty much priced in ETH, crashed with it. MakerDAO is a pile of smart contracts for stupid humans — so everything blew out, and people are screaming.

The popcorn festival went something like this, as far as I can make out: [Glassnode, Medium, Medium]

- Prices collapsed, triggering defaults on DeFi loans which used the collapsed coins as secured collateral.

- Ethereum, the platform all of this was running on, clogged, because traders and investors were rushing for the exits.

- The collateral was sold at auction. Because Ethereum was clogged, nobody could join the auctions. Quite a lot of the collateral was sold for bids of zero DAI.

- The people who defaulted on their loans when their collateral collapsed lost everything — $8 million in total, sold for 0 DAI. They are not happy.

- Price oracles, which made prices available to DeFi contracts, shut down during the crash, because gas prices — Ethereum transaction fees — went way up. This left DeFi apps not knowing the prices of things.

Preston Byrne pointed out a couple of years ago that collateralising crypto with crypto will always collapse as soon as number goes down. He called out MakerDAO in particular. [blog post]

Things happen

“Over the next two months we expect to contact as many as 350,000 individuals who have traded in cryptocurrency in the last few years,” an Australian Tax Office spokesman said last Wednesday. [News.com.au]

There’s not much happening in Kleiman v. Wright — but the court awarded attorney fees of $165,800.09 against Craig Wright personally, for how much he messed the Kleiman estate about in discovery. This is about a quarter of what Kleiman’s attorneys asked for. [Fees order, PDF; docket]

The SEC sued ICOBox and its founder, Nikolay Evdokimov, for unregistered offerings of securities — that is, ICO tokens — and being unregistered brokers. Evdokimov didn’t bother responding — so the SEC has obtained a default judgement. [Press release]

Voatz — the dubious voting-on-the-blockchain startup — used hard-coded cryptographic keys that they had copied from an answer on Stack Overflow to protect the ballot receipts. Amongst many other security issues, as revealed in a new report by Trail of Bits. [Trail of Bits; report, PDF]

Bespoke watch dealer Luke Wilson is being chased by at least 17 people for £2 million, after the luxury watches they ordered and paid for never arrived. FT Alphaville wrote up Mr Wilson in May 2019, and his “prestigious LGC-Coin cryptocurrency.” You might remember the picture below. [Daily Mail archive; FT Alphaville, free with login; FT Alphaville]

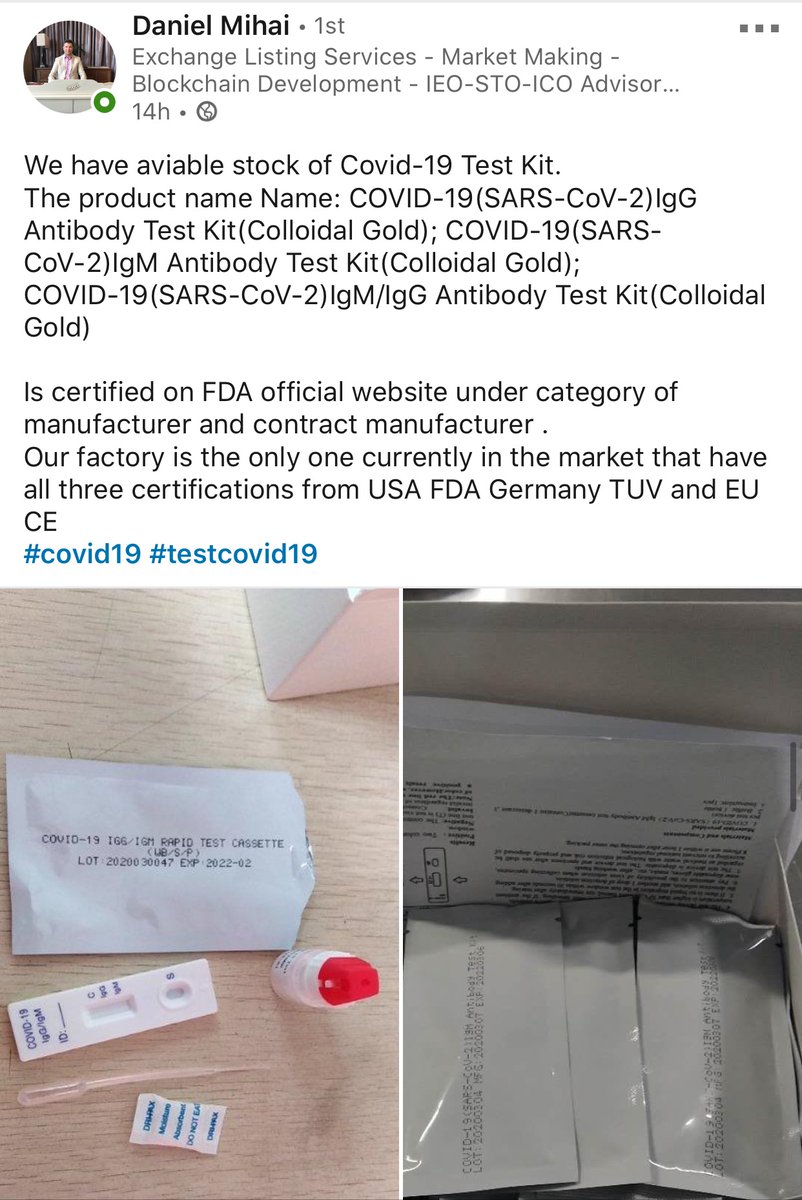

Does anyone remember ICO and IEO advisor Daniel Mihai of Coinsby? He’s pivoted to selling fraudulent Covid-19 testing kits. On LinkedIn. So, moving up in status I guess. The testing kits apparently work through “colloidal gold” and claim to be FDA-approved.

The Bank of England has posted a working paper on Central Bank Digital Currencies. It’s worth reading as official word on the topic — but I’m impressed at the dancing to avoid mention of the word “Libra” at any point whatsoever. [Bank of England, PDF]

Cas Piancey: Crypto Capital Corp were the money launderers for large chunks of the crypto economy, and they haven’t really been covered in much depth by the crypto press. [Medium]

Not crypto — but this paper from 1999, “Pricing free bank notes” by Gary Gorton, details just how wild and stupid the US “wildcat” free banking era was. “Banknotes” were not very currency-like — they were a bit like hundreds of varieties of prepaid phone card, of varying acceptability to merchants. The paper even refers to wildcat banknotes as “securities.” This is the world that the ICO token boom aspired to — hundreds of sort-of-currencies, none very usable. [Journal of Monetary Economics, PDF]

Slow down COVID-19 by putting it on the blockchain

— Ittay Eyal (@ittayeyal) March 12, 2020

This makes me realize that if america was attacked by aliens, our first response would be to lower interest rates

— Michael Nguyen (@itsmicnguyen) March 17, 2020

Your subscriptions keep this site going. Sign up today!

Luke Wilson looks like a character in a Chris Morris bit.

It’s a pity the old comment system is still down on FT Alphaville, because those were glorious, with deep analyses of his outfit and Luke attempting to flame his detractors