Blockchain for International Development — John Burg of USAID used to be a huge blockchain advocate. Then he went looking for really clear examples of success in the field, to convince his skeptical colleagues! And …

We documented 43 blockchain use-cases through internet searches, most of which were described with glowing claims like “operational costs… reduced up to 90%,” or with the assurance of “accurate and secure data capture and storage.” We found a proliferation of press releases, white papers, and persuasively written articles. However, we found no documentation or evidence of the results blockchain was purported to have achieved in these claims. We also did not find lessons learned or practical insights, as are available for other technologies in development.

We fared no better when we reached out directly to several blockchain firms, via email, phone, and in person. Not one was willing to share data on program results, MERL processes, or adaptive management for potential scale-up. Despite all the hype about how blockchain will bring unheralded transparency to processes and operations in low-trust environments, the industry is itself opaque. From this, we determined the lack of evidence supporting value claims of blockchain in the international development space is a critical gap for potential adopters.

The Register article, “Blockchain study finds 0.00% success rate and vendors don’t call back when asked for evidence,” is slightly ginned-up. Burg’s post is just a blog post — it doesn’t have a detailed writeup of their findings as a study. But it rings true with my experience of trying to get detail out of blockchain promoters:

- press release in my inbox with remarkable claims;

- contact PR person asking really obvious questions;

- they know nothing, and refer the question to the tech lead — who is on tour, unavailable, or perhaps in another dimension this month;

- tumbleweeds.

The SEC’s latest ICO administrative orders target celebrity ICO promoters — Floyd Mayweather and DJ Khaled both promoted a securities offering, the Centra ICO, without revealing they were getting paid. This is already illegal. Just as a reminder, here’s the SEC’s guide to celebrity ICO promotions from last November.

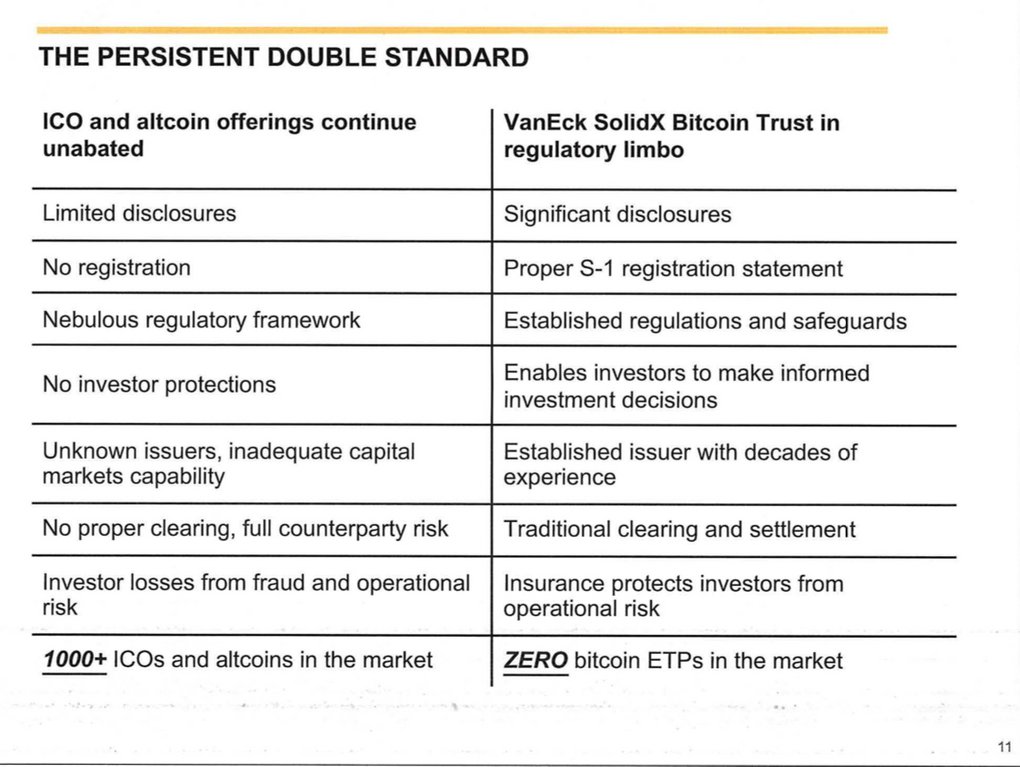

The perennial bitcoiner argument is “but what about those other guys” — Van Eck and SolidX met with the SEC in October to argue for a Bitcoin ETF. Their argument was, literally, that ICO fraud exists, so, despite the extensively documented manipulations in the Bitcoin market, their thing should be allowed. They argued this to the SEC.

In August, Larry Cermak posted a Twitter thread of Bitcoin price predictions for 2018. Just a few more weeks until it hits $100,000!!

My rule is: never make fun of Bitcoin bagholders after a short-term price drop.

Because what always happens in these situations, is the price keeps plunging, ripping their faces off, while you’ve already used your best jokes and can’t really rise to the occasion anymore.— Trolly🐴 McTrollface 🌷🥀💩 (@Tr0llyTr0llFace) November 30, 2018

Today in “literally no blockchain or crypto scheme should be assumed to exist until it exists” — remember DPW Holdings, who were totally going to revive a small hydro plant in upstate New York for crypto mining? It turns out they didn’t pay for their miners after all.

Two Bitcoin addresses, controlled by Iranian nationals Ali Khorashadizadeh and Mohammad Ghorbaniyan, who perpetrated the SamSam ransomware, have been added to the US Treasury sanctions list — and the ShapeShift exchange has cut Iran off entirely, and Bitcoin users worry about accidentally taking tainted coins.

Bitfinex gets a new bank — and it appears to be Currenxie Limited (archive), a new Hong Kong fintech. Except that Currenxie’s terms of service prohibit accepting payment connected to “Bitcoin and other cryptocurrencies.” I wonder if they know who this customer is.

Now that Bitfinex is floating Tether for trading, /r/buttcoin applies Technical Analysis to the price of Tethers. “The price ceiling is virtually unlimited, but let’s be conservative and say that Tethers could go up to at most 1000 dollars each.”

Attempt to sabotage international trade by getting the WTO interested in “blockchain” detected — another white paper composed of extruded hype product, and a notable lack of technical detail.

Remember Butterfly Labs from 2013, who took people’s money for mining hardware, and ran it for six months themselves before sending it out? (And buying buttcoin.org — thus getting the FTC to say “buttcoin.”) Someone appears to have dumped a complete list of email addresses and plaintext passwords for Butterfly Labs customers.

Bitcoiners claim terrible media bias against all the good news about Bitcoin! Congratulations to FT Alphaville for keeping the Financial Times’ numbers in order.

Satoshi Nakamoto is warning us that Bitcoin was a mistake and Nouriel Roubini is correct in all his concerns. [citation needed]

Lobbying disclosure — today I met with Eddie Hughes MP and Steve Baker MP at Portcullis House. Eddie wrote a blockchain white paper that I got stuck into a bit — and he’s seeking to educate himself on the area. We talked about protecting retail investors, whether cryptocurrencies will ever really be viable, and what a blockchain brings to enterprise and administrative use cases. My opinion: not much — my takeaway: magic doesn’t happen. Steve Baker stopped by as well — he has a degree in computer science, so knows what a blockchain actually is, and isn’t very impressed; he’s also into Austrian economics, and isn’t very impressed by the gold-like qualities of cryptocurrencies. I gave Eddie a book, and got another MP photo for the collection. Yet again, the MP isn’t the guy with the tie on. If you’re a politician or a politician’s staffer, and would like an expert sceptical opinion, do please drop me an email.

It’s actually because they don’t care about anything other than the price going up and thus lust after the dream of institutional investors pumping them to the moon. https://t.co/yqjCM3TkMP

— Buttcoin (@ButtCoin) December 2, 2018

https://twitter.com/ummjackson/status/1068932954787848193

Your subscriptions keep this site going. Sign up today!

David Gerard is probably the most rational studied voice in this fascinating crypto space