- Part 1: KodakCoin announced, stock price rockets

- Part 2: KodakCoin restrictions, the KashMiner scam

- Part 3: KodakCoin presale, prehistory, hot takes and harsh realities

- Part 4: Kerrisdale Capital’s crypto pre-mortem for Kodak

- Part 5: The KodakCoin ICO Light Paper

- Part 6: KodakCoins on sale, and the Reg A+ escape route

- Part 7: The KashMiner that never was

KodakCoin

You know how the KodakCoin ICO from yesterday is being done as a proper security offering under SEC rules, sold as a private placement to accredited investors only — $200k income or $1m assets, and Kodak undertake to actually check this — 506(c) restricted, and so on?

Matt Levine from Bloomberg notices that restricted securities are restricted in who you can sell them to in turn. Also, the SEC isn’t very keen on people selling restricted offerings at all:

You should not expect to be able to easily and quickly resell your restricted securities. In fact, you should expect to hold the securities indefinitely.

So if you’re a photographer who puts photos up on KodakOne:

- The only people who will be able to buy KodakCoins, to buy your photos, will be accredited investors.

- You may be able to be paid in KodakCoins if you, the photographer, are not an accredited investor yourself. (The law is not entirely clear on this, but lawyers who’ve been asked about this think you probably can.)

- When you are paid in KodakCoin, you will not be able to sell them for real money — nobody will be able to buy them from you unless they are accredited investors. Also, you may not be able to sell them at all unless you’re an accredited investor yourself.

This is slightly at odds with Kodak’s claims on the KodakCoin page:

Our marketplace enables coin holders to buy, sell and book products and services such as flights, hotels, models, venues and studios with their coins. The marketplace will also create kickstarter opportunities for startups and service companies.

Levine contacted Kodak asking about all of this; it’s unfortunate they couldn’t find time to get back to him.

Kodak have not as yet guaranteed to redeem KodakCoins for real money. They will be setting up some sort of exchange.

The actual KodakCoins will be tokens on the public Ethereum blockchain, “plus its own proprietary technology.” The details aren’t clear, but they don’t really matter given the whole scheme is laughably unworkable.

Update: KodakCoin turns out to be a slight rebranding of a paparazzi-photographer-based ICO that WENN Digital were floating — and that they may have been founded in November in order to float.

Kodak KashMiner

I mentioned cloud mining in chapter 4 of the book, in the section listing Bitcoin scams. I realise I’m going so far as to brand something offered by a NYSE-listed company a “scam,” but … this pretty much is.

What Kodak’s brand licensee Spotlite are doing is charging you $3400 to rent — not buy — a Kodak KashMiner for two years. It appears to be a rebranded AntMiner S9, the most efficient commercially available Bitcoin miner.

The KashMiner photos aren’t consistent — the BBC photo from CES (left) and the flyer photo (centre) appear to be slightly different devices, and neither is quite identical to an AntMiner S9 (right).

You can just about come out ahead mining Bitcoin with an AntMiner S9, before it’s rendered obsolete by the ever-increasing hash rate — if your electricity is super-cheap, if you paid the $2320 that BitMain currently sell it directly for, and if you … actually get to keep all the money it makes.

Spotlite and Kodak will install the miners at Kodak’s site in Rochester, New York, and run them off spare capacity from Kodak’s in-house coal-fired power plant. They will then send you half the proceeds, keeping the other half.

Even as Kodak owns the power plant, the coal — and hence the electricity — won’t be free, or even cheap enough for the customer to compete, particularly if they only get half the money. I can’t see how anyone signing up for a Kodak KashMiner can possibly make back their money over the life of the contract.

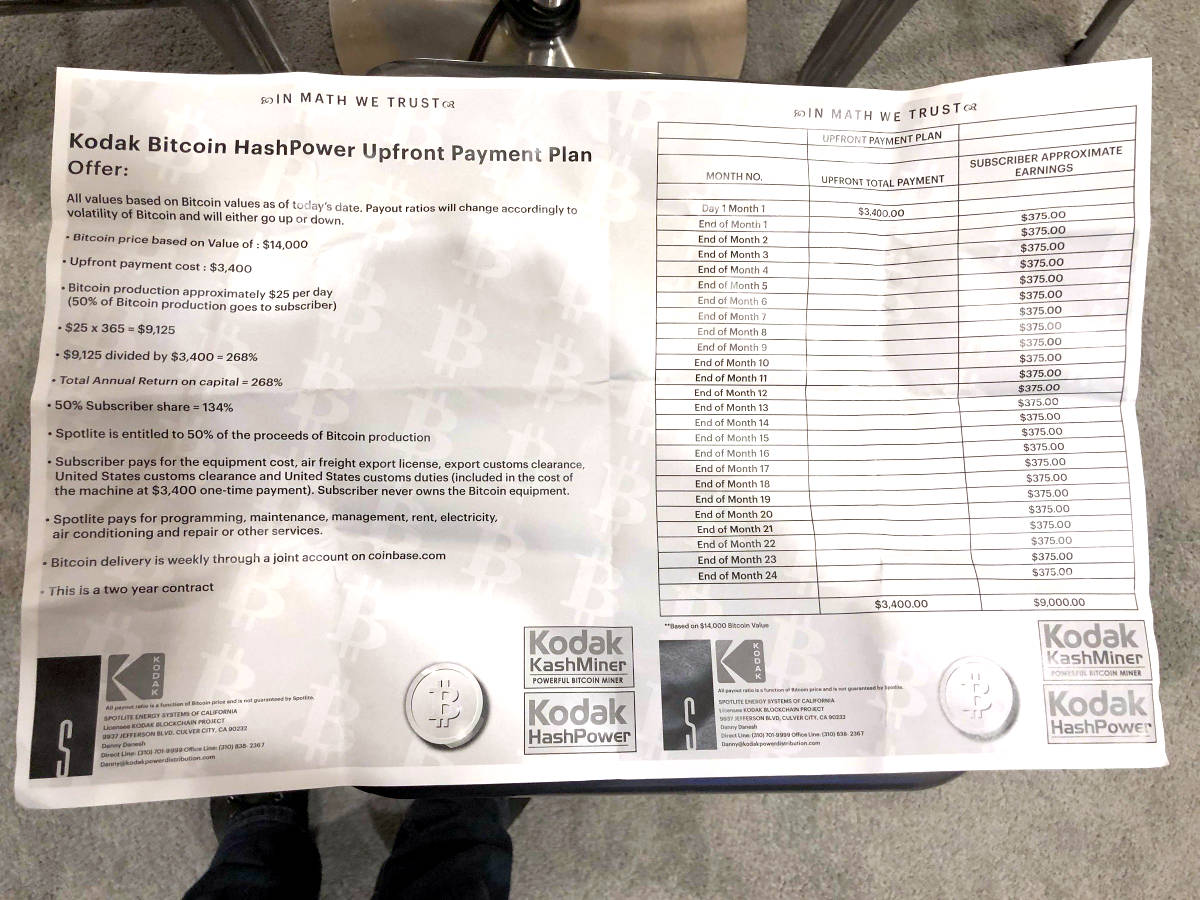

Here’s a photo of the flyer Kodak were distributing in Las Vegas, from Matt Weinberger at Business Insider. They’ve set out a full-page chart showing a steady monthly return of $375 over 24 months, for a total of $9,000:

But don’t worry! The facing page says:

All values based on Bitcoin values as of today’s date. Payout ratios will change accordingly to volatility of Bitcoin and will either go up or down.

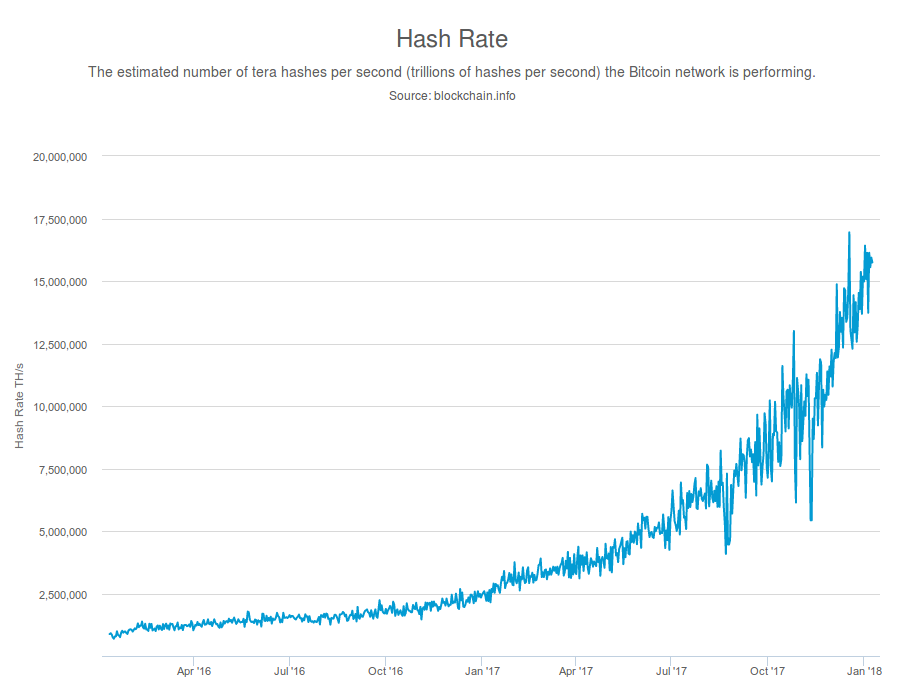

There’s one other thing it depends on — and that’s hash rate. Per chapter 1 of the book, Bitcoin is set up so that miners eternally compete to be the one to mine the block and get the mining reward — and if blocks are getting mined too fast, mining gets harder, to keep it at one block every ten minutes.

So the KashMiner’s output is all but certain to go down over the next 24 months. Here’s the hash rate over the past 24 months, during which time it multiplied 18-fold:

They are selling this using the Kodak brand name and the Bitcoin buzz, and there’s no way they can reasonably claim they didn’t know that this can never make a profit for the customer:

Kodak has now become a Bitcoin mining scam. Look closely, they are flat-out lying about the returns of their miners because they neglect to mention the small detail that the difficulty rises and the output drops! https://t.co/cAUtL0GD6N

— Saifedean.com (@saifedean) January 10, 2018

Allowing for the 15% difficulty adjustment, the actual returns on the Kodak miner will be $2,457 on a $3,400 investment.

SFYL but please be sure to take a selfie with your non-Kodak cellphone camera while holding the miner for the Ultimate Kodak Moment!— Saifedean.com (@saifedean) January 10, 2018

You’ll be unsurprised to hear that the mining contracts are selling so fast they can’t keep up. “At this time we have 80 miners, and we expect another 300 to arrive shortly. There is a big pile-up of demand.”

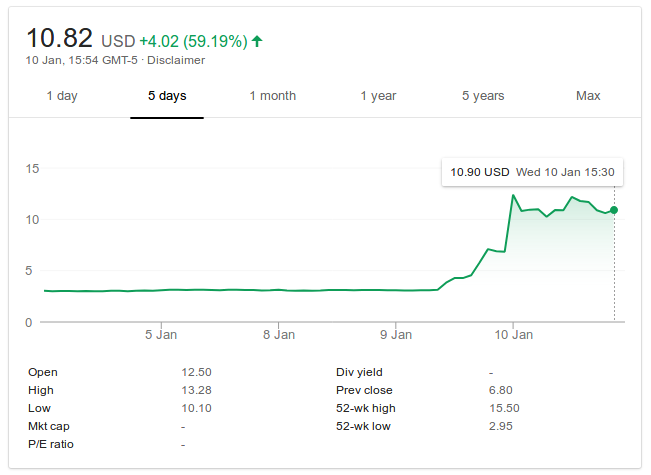

There must be some reason any of these terrible schemes seem like a good idea … oh yeah, the stock price:

Did nobody tell them that "dumpster fire" was a metaphor and you don't have to create machines that will set actual fires to achieve it

— ee ramone (@bizmarkiedesade) January 10, 2018

Your subscriptions keep this site going. Sign up today!

I’m going to make so much money paying Kodak to burn coal on my behalf.

The share price is still 30% below where it was a year ago and a third of four years ago so they still have a long way to go to make up for not making cameras people will buy.

“At this time we have 80 miners, and we expect another 300 to arrive shortly. There is a big pile-up of demand”

Wow. In just one site in China, Bitmain have 21,000 S9 and T9 Antminers which was 3.5% of the BTC mining network last summer. 380 miners/customers is nothing in comparison.

You called it.

https://www.bbc.com/news/technology-44845291