By Amy Castor and David Gerard

- ONE WEIRD TRICK they don’t want you to know: Send us money! Here’s Amy’s Patreon, and here’s David’s. Sign up today!

- Our patrons can also get a couple of “Bitcoin: It Can’t Be That Stupid” stickers just by messaging one of us and asking.

- David has signed author copies of his books for sale.

- Sign up on Amy’s blog to see every new post she makes as it goes up, and click here and enter your email address for every new post on David’s blog as it goes up.

We’re still on the SEC’s complaint against BAM Trading (Binance.US), Binance.com, and Binance CEO Changpeng Zhao (“CZ”). It’s a good complaint! [complaint, PDF; case docket]

In part one, we introduced the SEC complaint; the “Tai Chi” plan; the SEC’s proposed asset freeze; and how the Binance money funnel works.

In part two, we covered BAM CEOs Catherine Coley and Brian Brooks; some securities that Binance.US offered trading in; some securities that Binance and BAM issued and made available to US entities; and Binance’s claim that SEC chair Gary Gensler had a conflict of interest in suing Binance.

The consent order, again

Just after our last post, the SEC and Binance agreed a consent order to protect Binance.US customer assets. Judge Amy Berman Jackson signed off on the agreed order. [Doc 71, PDF]

The consent order requires Binance Holdings Limited and CZ to send Binance.US customer assets (cryptos and cash) back to BAM Trading for custody in the US. John Reed Stark explains how this is extremely strong for an SEC consent order. [Twitter]

It’s possible that BHL and/or CZ will mess around on repatriating the assets — but this would attract some drastic penalties, risk losing the case, and destroy Binance’s remaining access to the US market.

The SEC issued a press release about the order. Binance has now gone into high dudgeon about the press release. [SEC; motion, PDF; proposed order, PDF]

Binance claims the SEC’s press release is “misleading” where it says that the consent order was “essential to protecting investor assets” because, the SEC says, “Changpeng Zhao and Binance have control of the platforms’ customers’ assets and have been able to commingle customer assets or divert customer assets as they please.”

Those are entirely true and relevant statements — but Binance claims the statements seem “designed to introduce unwarranted confusion into the marketplace” and even risk tainting the jury pool. They want Judge Jackson to agree that the statements are “misleading” and rule that the SEC “cannot make misleading extrajudicial statements.”

This reads very much like the stupendous array of high-powered lawyers that Binance is throwing at this case are scrabbling about for ways to justify the expense of hiring them. Stark estimates that Binance’s legal fees are on the order of a million dollars a day. [Twitter]

The real story is still the Verma declaration, which we covered in part 1. This used information the SEC got directly from Silvergate Bank, Signature Bank, and FedWire to show how Binance has set up a money funnel to scoop up billions of actual dollars from Binance.US and send them off … somewhere. That’s what the SEC wants to stop with this consent order. [Doc 21, PDF]

VIPs on VPNs

After Binance.US launched, American customers were only supposed to use the US site. But the SEC claims Binance.US was just a front. CZ and his team made sure to allow high-value US customers — “VIPs” — to trade on their larger and unregulated Binance.com platform.

Samuel Lim, Binance’s then-compliance officer — the guy who said “we are operating as a fking unlicensed securities exchange in the USA bro” — understood the stakes: “its either we do it, or [rival exchange] huobi does it.” [Doc 17-7, PDF]

CZ reportedly told Binance executives in a June 2019 meeting:

We do need to let users know that they can change their KYC on Binance.com and continue to use it. But the message, the message needs to be finessed very carefully because whatever we send will be public. We cannot be held accountable for it.

(The first rule of crypto club is: always take notes on a criminal conspiracy.)

CZ told his staff to ignore their US VIPs coming in from US addresses in June 2019, and to gently encourage US VIPs to submit new know-your-customer information that didn’t mention the US. This was also detailed in the CFTC’s March complaint against Binance.

The SEC filed an internal Binance chat discussing how to tell US VIP customers to change their IP address and KYC identity info without news of this hitting the media. [Doc 13-6, PDF]

CZ was very clear to senior Binance officials in June 2019 on the VIPs’ importance:

We don’t want to lose all the VIPs which actually contribute to quite a large number of volume. So ideally we would help them facilitate registering companies or moving the trading volume offshore in some way — in a way that we can accept without them being labeled completely U.S. to us.

Of the top 22 US VIP customers, 19 either changed to non-US KYC, changed the IP address they accessed the site from, or both.

Wash trading

Wash trading is where you trade with yourself to make it look like a commodity or security has a lot more volume than it really does. Wash trading has long been a part of crypto market manipulation — Mark Karpeles even admitted in court to setting up wash trading bots on Mt. Gox to pump up the price of bitcoin in 2013.

Wash trading has long been thought to be endemic on Binance. It turns out that wash trading was literally just something that Binance’s trading engine let you do — anyone could trade with themselves.

BAM and Binance.com executives knew this — and they just didn’t do anything about it!

Before Binance.US even launched, one Binance executive had told Catherine Coley that “the current matching engine allows a user to trade with themselves.” He asked her: “Please make sure this is OK with whatever US/SEC regulations we have to follow.” [Doc 18-6, PDF; Doc 18-7, PDF]

He told her not to stress, though: “this is mainly a compliance or regulation issue. If some US compliance or regulation says we must prevent this, we will. Otherwise we will not.”

Why encourage wash trading? Because nobody will trade a dead coin. You want excitement on your exchange!

Sigma Chain was the main market maker for Binance.com and Binance.US. It was owned by CZ and operated by Binance employees. Sigma Chain had “dozens” of accounts that all traded with each other. Sigma Chain was also an important channel to funnel money out of Binance.US.

Just between January and June 2022, Sigma Chain wash-traded 48 out of 51 newly-listed tokens. On some coins, Sigma Chain trading with itself was up to 99% of trading volume.

The Binance.US equity offering

The crypto industry routinely claims that SEC regulations are unclear. But one thing that’s squarely in the SEC’s ambit is equity offerings — even private ones.

This is the SEC’s cause of action against FTX, for instance — not that Sam Bankman-Fried defrauded customers, but that he defrauded equity investors.

Wash trading has been illegal in the US as market manipulation since 2010 under Dodd-Frank. The SEC complaint alleges that the wash trading on Binance.US is a fraud against the investors in the private equity offering that BAM ran from September 2021 to April 2022.

BAM promised investors it had proper controls against illegal trading on Binance.US, including wash trading — and it just didn’t. Coley even made this claim at a CoinDesk seminar. This was at a time when she couldn’t access even basic trading data for Binance.US, because Binance.com wouldn’t give her access to it.

BAM touted the value of the trading volume on Binance.US in the pitch to equity investors — the volume that was substantially just Binance entities trading with themselves.

Guangying Chen: “the real CFO”

The SEC complaint mentions a “Back Office Manager” who set up and executed the fake trading. That’s Guangying “Heina” Chen, whose usual job title at Binance is “finance director.” Nobody knows much about Chen, though Forbes scraped together what little there is earlier this month. [Forbes]

Patrick HIllman, Binance’s PR person, once described Chen as “an employee who worked on our admin team.” This is true, but incomplete. [Twitter]

After questions from journalists, CZ posted in 2022 about Chen. He starts with a 1,375-word rant about how rude and culturally insensitive it is even to ask who the person is that controls so much of Binance’s money. [Binance, archive]

CZ says he first met Chen in 2010. In 2015, CZ brought Chen into Bijie Tech, a company founded by CZ that made cloud-based software for exchanges. Chen managed the back office.

CZ states that Chen “does not own Binance and she is not some secret Chinese government agent.” He describes her role as “admin and clearing.”

It turns out that CZ is considerably downplaying Chen’s involvement in his businesses. Forbes discovered that CZ was the listed CEO of Bijie — but Chen held 93% of the shares and was listed as both founder and sole legal representative.

Forbes found that the corporate filings when Binance was first established in China listed Chen as the legal representative and holder of 80% of the shares.

Chen is the usual co-signer on the various bank accounts for Binance entities. She is a director of eight Binance companies and was a signer for most of Binance’s accounts at Silvergate and Signature. The only person at Binance with their name on more corporate entities and bank accounts is CZ.

One former Binance executive told Forbes that “Heina had all controls. He [CZ] trusted very few people with access to money.”

Chen would routinely sign regulatory filings. “It’s all with her,” another source told Forbes. “She was the one needed when it came to fund transfers or fund confirmation letters, whatever — because she is the authorized person for all bank accounts. She was the real CFO.”

Other eyebrow-raising details

BAM formed a strategic partnership with FTX in 2020. From May 2020 to February 2022, Alameda Research — FTX’s proprietary trading desk — was often the only counterparty at Binance.US’s OTC trading desk. [FTX announcement, 2020, archive]

As well as Guangying Chen, another common Binance bank account signer is Kaiser Ng, formerly an allegedly unpleasant manager at Kraken.

What happens next?

This is life or death for Binance.US — and it could seriously wound Binance.com.

Binance says it intends to defend itself “vigorously” and that “the SEC’s actions undermine America’s role as a global hub for financial innovation and leadership.” Innovation! [Binance, archive]

The trouble is that the facts in the SEC complaint are very bad facts. The best that Binance is likely to manage in this case is to throw up chaff for a time.

Look at the SEC case against Ripple. The facts in that complaint are terrible facts, and Ripple is clearly guilty as sin. But Ripple also has a billion-dollar war chest, so that case is now into its fourth year of Ripple throwing up chaff to claim that laws don’t apply to them.

It’s important to note that CZ did all of this to himself. FTX was a house of cards, but CZ chose his own moment to knock it down. Did he think that would save him from getting any on himself? If so, he was wrong.

(Dirty Bubble reminds us that he told us all so in December 2022.) [Dirty Bubble]

It’s nice to see regulators finally acting to protect investors from the crypto scam. But the SEC is a bit too used to the institutions under its purview taking it seriously. It isn’t really ready for a whole sector that blatantly has no intention of following the law and has resented the very concept of regulation since bitcoin was born.

The political will is here at last. But every SEC legal action is bespoke and artisanal — and expensive to put together.

Zeroing in on Coinbase deals with one end of the problem neatly — everyone across the world in crypto wants US dollars, and Coinbase is the biggest US dollar exchange. It’s the cashier’s desk at the crypto casino.

Going after Binance takes out the other end of the problem — it’s the main offshore unregulated casino.

This would also deal with Binance’s sanctions-busting, and that would likely enhance the SEC’s reputation with the rest of the US government.

We’ve said for several years that if you want to take out the problems with crypto, you take out the on-and-off ramps to actual dollars. Not “regulate” them — but take them out.

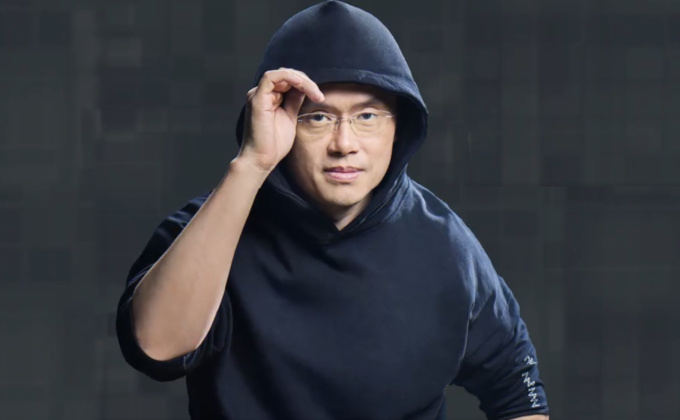

Image: The curse of the Forbes front cover.

Your subscriptions keep this site going. Sign up today!