By Amy Castor and David Gerard

- Send us money! Our work is funded by our Patreons — here’s Amy’s, and here’s David’s. Your contributions help greatly!

FTX was utterly screwed, and they knew it. Sam Bankman-Fried agreed to step down, finally convinced — at 4:30 a.m. local time on Friday November 11, so you can guess it was one heck of a full and frank exchange of views — by his lawyers and his own father, Joseph Bankman of Stanford Law School.

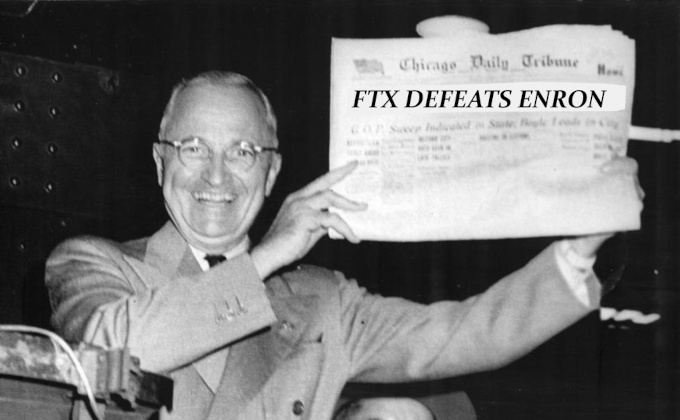

SBF’s replacement was the best possible adult to bring into in the room: John Jay Ray III, the guy who cleaned up Enron as well as many other financial disaster areas.

As new CEO of the wreckage, Ray filed for voluntary Chapter 11 in Delaware just hours later on the same Friday.

Ray filed his first-day declaration with the bankruptcy court on Thursday November 17. And it’s amazing: [Declaration, PDF]

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

Ray is not the police or a prosecutor, and he can’t charge anyone. But he knows how to point out events and circumstances that may warrant the attention of the law. Ray considers one of his goals to be a “comprehensive, transparent and deliberate investigation into claims against Mr Samuel Bankman-Fried.”

Ray becomes CEO of FTX at 4:30 a.m. Hours later, he files for Chapter 11. Hours after that, he watches in horror as $372 million in funds gets siphoned off the exchange by hackers. Welcome to crypto!

Four silos

Ray describes Sam Bankman-Fried’s empire as four silos. All of the numbers come from unaudited accounts as of September 30, 2022. Ray doesn’t trust any of the numbers because SBF prepared them.

Just because Ray separates the silos does not mean the companies were separately controlled. FTX and Alameda, for example, had no effective separation of control. As we wrote earlier, using customer funds to prop up your trading desk is illegal in nearly every jurisdiction, for good reason.

WRS silo — This silo contains FTX US. It should be solvent but SBF didn’t include customer liabilities on the balance sheet, which shows $1.36 billion in total assets.

Frances Coppola notes this is standard for exchanges because customer assets don’t belong to the exchange. The SEC has issued guidance saying exchanges should report customer assets on their own balance sheet with matching “safeguarding” assets — but the guidance is advisory only, and FTX certainly didn’t bother. [Twitter]

Alameda silo — The accounts show this silo as $8 billion in credit; but again, Ray doesn’t trust these numbers.

Ventures silo — This group includes Clifton Bay Investments, Island Bay Ventures, FTX Ventures, and so on. Clifton Bay has assets of $1.52 billion; FTX Ventures shows assets of $493 million. “I have not been able to locate financial statements for Island Bay Ventures Inc.” Assets only. Liabilities are not included.

Dotcom silo — This is FTX.com, the main business. SBF claimed that around $15 billion of assets were on the platform by the end of 2021, and “millions” of registered users. The September 30 balance sheet shows total assets of $2.25 billion. Also, a lot of the assets are FTX’s own worthless magic beans. Liabilities are not listed.

Ray notes that a lot of the smaller FTX subsidiary businesses are in fact solvent, and they’ll try to keep those going.

The new CEO is installing new directors for each silo — all restructuring experts. We expect to be using the phrase “financial hazmat team” a lot. FTX will get “appropriate corporate governance for the first time,” says Ray.

Where’s the cash?

The many FTX business have stashes of cash around the world. If you think FTX kept track of this stuff in any sensible way, you’d be incorrect.

FTX never had any official audits. They did their own accounting on each of the silos — supplying the numbers that Ray doesn’t trust.

FTX-as-was did use one actual audit firm, Prager Metis, to give them numbers for the Dotcom Silo. Ray notes that Prager Metis’s website proudly states they are the “first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.” LOL.

Ray has “substantial concerns” as to the accounts, “especially with respect to the Dotcom Silo.”

How well was the cash managed? Very professionally:

Employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis.

… Effective cash management also requires liquidity forecasting, which I understand was also generally absent from the FTX Group historically.

Who works here, anyway?

Ray’s team have been unable to prepare a complete list of who worked for the FTX Group as of the petition date, let alone the terms of their employment.

Ray has the core group of non-executive employees — who SBF has just screwed over, and they are not happy [WSJ, paywalled] — and is keeping them on so they can nail SBF to the wall. He is very thankful for their “extraordinary efforts” to this end.

Where are the cryptos?

FTX was sloppy as hell with securing the crypto assets:

Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).

Ray has hired Chainalysis, Kroll, and a “confidential cybersecurity firm” to work out who transferred assets out after the bankruptcy filing — and also “what may be very substantial transfers of Debtor property in the days, weeks and months prior to the Petition Date.”

Writing things down

When you’re trading billions of dollars in crypto, writing stuff down is annoying and tedious. In accordance with the opposite of all financial good practice, SBF told his staff to use disappearing messages:

Mr. Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same. The Debtors are writing things down.

Ray’s team are attempting to create a balance sheet and financial statements for Alameda and the ventures arm “bottom-up” by using what records they have of cash transactions.

Calling the cops

Ray has hired a detective team. He’s specifically brought on board a pile of cops:

The investigative effort underway is led by myself and a team at Sullivan & Cromwell that reports directly to me, including a former Director of Enforcement at the SEC, a former Director of Enforcement at the CFTC, and a former Chief of the Complex Frauds and Cybercrime Unit of the United States Attorney’s Office for the Southern District of New York.

“Finally, and critically, the Debtors have made clear to employees and the public that Mr. Bankman-Fried is not employed by the Debtors and does not speak for them. Mr. Bankman-Fried, currently in the Bahamas, continues to make erratic and misleading public statements.” Ray has also tweeted to this effect. [Twitter]

Emergency motion to consolidate bankruptcies

FTX Digital Markets Ltd., the company’s Bahamas subsidiary, filed a chapter 15 foreign bankruptcy in the Southern District of New York. Ray’s team is asking the court to move the chapter 15 case to Delaware to coordinate with the chapter 11 proceeding — because having two courts makes absolutely no sense. This is an emergency motion: [Motion, PDF]

It is critical to the efforts to end the chaos and to ensure that assets can be secured and marshalled in an orderly process that all proceedings related to the Debtors and their affiliates – including the Chapter 15 Case – take place in a single venue. That venue is this Court, the United States Bankruptcy Court for the District of Delaware.

Ray thinks the filing in SDNY was shenanigans by SBF and unnamed agents of the Bahamas government:

The filing of the Chapter 15 Case without advance notice and in the SDNY is a blatant attempt to avoid the supervision of this Court and to keep FTX DM isolated from the administration of the rest of the Debtors, which constitute the vast majority of the remainder of the FTX group.

Ray quotes text messages between SBF and Vox reporter Kelsey Piper the day before, which Piper published in full, as evidence of SBF’s bad faith. [Vox]

(Piper is herself in the same Effective Altruism quantitative-charity circles as SBF; but you can see why Piper took these messages to her editor, and why her editor said yes to running them.)

SBF disclosed to Piper his goal to “win a jurisdictional battle vs. Delaware” to have any proceedings occur in the Bahamas. He considers the Chapter 11 filing to be the worst advice he’d ever taken and that “everything would be ~70% fixed right now” if he hadn’t done that. We remain skeptical.

Ray was extremely unhappy with the weird transfers of funds from FTX to Bahamas residents after the bankruptcy. The Securities Commission of the Bahamas previously denied that it had authorized or encouraged funds to be removed from FTX. [Twitter]

Ray thinks the shenanigans were sanctioned at a high level:

The Debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors’ systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases.

The Emergency Motion will be heard Monday November 21 at 10:00 a.m. ET. [Order, PDF] Update: now to be heard Tuesday November 22 at 11:00 a.m. ET. [Order, PDF]

The Ray declaration and motion should put paid to the sudden blast of puff pieces in newspapers who should know better about SBF being a little uwu smol bean birthday boy who is just bad at counting. But it probably won’t.

What happened at QuadrigaCX looks mild in comparison to the box of snakes that Ray laid out in his declaration and motion. This is just the tip of this iceberg.

Regulators have been asleep since 2017, when they had full opportunity to shut down this sort of garbage. Maybe Ray’s declaration will help wake them up.

All the Wunderkinds should really be forced to take a GAAP year.

— Karthik Sankaran (@RajaKorman) November 17, 2022

Your subscriptions keep this site going. Sign up today!

My jaw hit the floor when I saw that Vox article yesterday, and wondered how quickly the legal consequences would come around to bite SBF.

Hearing now that his father is a lawyer, it’s tempting to wonder what role good-old-fashioned daddy issues play in his apparent goal to drive his lawyers mad with his public statements over the last week.

My postdoc advisor had very similar vibes to SBF (they both have MIT physics degrees), and from personal anecdote I would say these wunderkind types can have emotional drives and self-awareness with respect to the interpersonal realm that are as impoverished as their technical and intellectual passions are rich and intricate.

Couple of extra words in “FTX as was did use one actual audit firm”

(And considering what it’s referencing, the newspaper headline really ought to be ENRON DEFEATS FTX …)

FTX-as-was, i.e. pre-Ray.

Was SBF really this stupid? I mean the goal of white collar fraud is to have a system where YOU know what’s going on while outsiders are kept in the dark, but it appears here that SBF was actively committing fraud yet he himself didn’t realize the reactor was about to melt down. And not having an accounting department or basic financial controls? Those are like the core, most important things. You have to know where the money in your company is going at all times, or you risk a blowup. I could understand if he himself wasn’t aware of this initially, but being the CEO, one would think he’d have hired some professional help being as he’s running an operation entrusted with millions of people’s money (and even if not anything involving the public, professional help is still needed).

I am also a bit confused. I read Ray did the Chapter 11 bankruptcy but then I read SBF saying he regrets taking that advice, so did he do it as well…?

SBF was I presume browbeaten into going along with it by his lawyers and his father. They hired Ray as financial hazmat crew, saying “we’re broke, please steer us through ch11.”

I am guessing that his lawyers were about to quit – one of his personal lawyers has already quit, SBF is basically “Opposite Client” – and his father thought this was the only way to save his son at all.