A “stablecoin” is a token that a company issues, claiming that the token is backed by currency or assets held in a reserve. The token is usually redeemable in theory — and sometimes in practice.

Stablecoins are a venerable and well-respected part of the history of US banking! Previously, the issuers were called “wildcat banks,” and the tokens were pieces of paper.

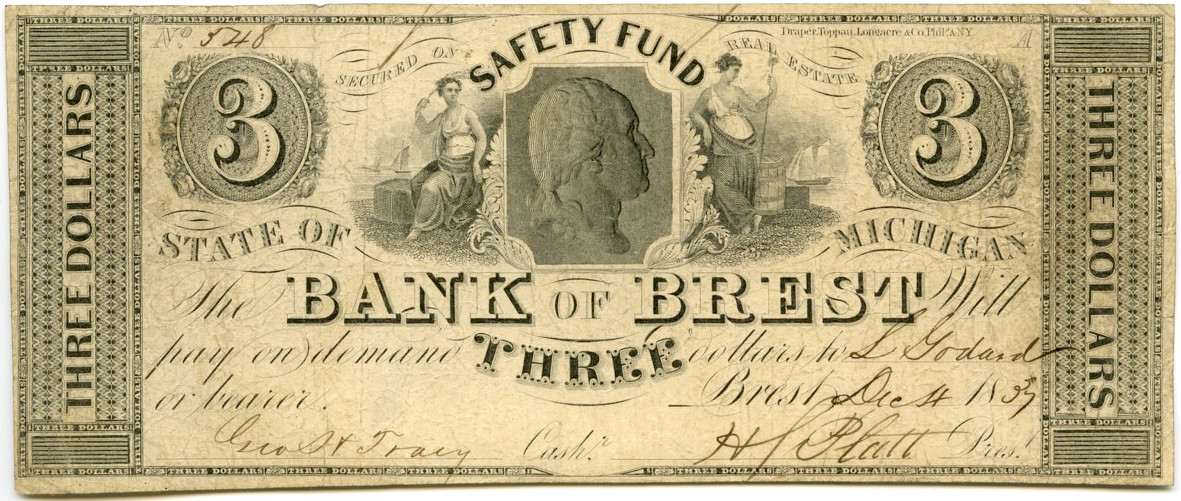

Genuine as a three-dollar bill — from the American Numismatic Society blog.

The wildcat banking era, more politely called the “free banking era,” ran from 1837 to 1863. Banks at this time were free of federal regulation — they could launch just under state regulation.

Under the gold standard in operation at the time, these state banks could issue notes, backed by specie — gold or silver — held in reserve. The quality of these reserves could be a matter of some dispute.

The wildcat banks didn’t work out so well. The National Bank Act was passed in 1863, establishing the United States National Banking System and the Office of the Comptroller of the Currency — and taking away the power of state banks to issue paper notes.

Advocates of Austrian economics often want to bring back “free banking” in this manner, because they despise the Federal Reserve. They come up with detailed theory as to how letting free banking happen again will surely work out well this time. [Mises Institute search]

On 15 March 1837, the “general banking law” was passed in Michigan. Bray Hammond’s classic “Banks and Politics in America” from 1957 (UK, US) tells how this all worked out (p. 601):

Of her free-banking measure, Michigan’s Governor said: “The principles under which this law is based are certainly correct, destroying as they do the odious features of a bank monopoly and giving equal rights to all classes of the community.” Within a year of the law’s passage, more than forty banks had been set up under its terms. Within two years, more than forty were in receivership. Thus America grew great.

Hammond quotes another source on the notes themselves: “Get a real furioso plate, one that will take with all creation — flaming with cupids, locomotives, rural scenery, and Hercules kicking the world over.” The ICO white papers of their day.

Update, 2022: the “furioso” quote is from Carter H. Golembe’s 1952 doctoral dissertation, “State Banks and the Economic Development of the West, 1830-1844.” Here’s the quote. Anyone want to go digging for the letter itself? [ProQuest]

An amusing description of the kind of note which the new banks issued is contained in a letter to John R. Norton from an official of the soon to be opened Bank of Superiors “Get a real furioso plate — one that will take with all creation — flaming with cupids, Locomotives, rural scenery and, Hercules kicking the world over … P.S. Let the Bills be of large size.” Letter, October 26, 1837, John R. Norton Papers, Burton Historical Collections.

After the Michigan law allowing free banking had been in effect for two years, Michigan’s state banking commissioners reported to the legislature on how it was all going.

The whole report is available as a scan in Google Books — Documents Accompanying the Journal of the House of Representatives of the State of Michigan, pp. 226–258. [Google Books] There’s also a bad OCR — ctrl-F to “Bank Commissioners’ Report.” [Internet Archive]

This is not your normal bureaucratic report from civil servants to the legislature. It’s a work of thundering Victorian passion, excoriating the criminals and frauds the commissioners found themselves responsible for dealing with.

We should have more official reports that you could do a dramatic reading of:

The peculiar embarrassments which they have had to encounter, and the weighty responsibilities consequent thereupon, clothes this duty with a new character. It becomes an act of justice to themselves, and to those who have honored them with so important a trust.

At the period the commissioners entered upon their labors, every portion of the state was flooded with a paper currency, issued by the institutions created under the general banking law. New organizations were daily occurring, and the public mind was everywhere agitated with apprehension and distrust. The state was in the midst of the evils consequent upon an excessive and doubtful circulation. Rumors of the most frightful and reckless frauds were daily increasing. In this emergency, prompt and vigorous action was imperiously demanded, as well by the public voice as the urgent necessity of the case. Upon a comparison of opinions, the commissioners united in the conclusion that their duty was of a two fold character. The first, and most obvious one, was to take immediate and decided measures in ascertaining and investigating the affairs of every institution suspected of fraud, and closing the door against the evil without delay. The second was a duty of far more difficult and delicate a nature, and involving the assumption of a deep responsibility.

The report outlines the problems in each particular district, and lists the local troubled banks. The commissioners tried to distinguish fraudulent banks from merely inept ones, and help the second sort get back on their feet for the public good.

Most of it’s tedious detail. But there’s considerable parallels to our wonderful world of crypto:

The loan of specie from established corporations, became an ordinary traffic, and the same money, set in motion a number of institutions. Specie certificates, verified by oath, were every where exhibited, although these very certificates had been cancelled at the moment of their creation, by a draft for a similar amount; and yet such subterfuges were pertinaciously insisted upon, as fair business transactions, sanctioned by custom and precedent. Stock notes were given, for subscriptions to stock, and counted as specie, and thus not a cent of real capital actually existed, beyond the small sums paid in by the upright and unsuspecting farmer and mechanic, whose little savings and honest name were necessary to give confidence and credit. The notes of institutions thus constituted, were spread abroad upon the community, in every manner, and through every possible channel; property, produce, stock, farming utensils, every thing which the people of the country were tempted, by advanced prices, to dispose of, were purchased and paid for in paper, which was known by the utterers to be absolutely valueless. Large amounts of notes were hypothecated for small advances, or loans of specie, to save appearances. Quantities of paper were drawn out by exchange checks, that is to say, checked out of the banks, by individuals who had not a cent in bank, with no security, beyond the verbal understanding that notes of other banks should be returned, at some future time.

The banking system at the time featured barrels of gold that were carried to other banks, just ahead of the inspectors:

The singular spectacle was presented, of the officers of the state, seeking for banks in situations the most inaccessible and remote from trade, and finding at every step, an increase of labor, by the discovery of new and unknown organizations. Before they could be arrested, the mischief was done; large issues were in circulation, and no adequate remedy for the evil. Gold and silver flew about the country with the celerity of magic; its sound was heard in the depths of the forest, yet like the wind, one knew not whence it came or whither it was going. Such were a few of the difficulties against which the Commissioners had to contend. The vigilance of a regiment of them would have been scarcely adequate, against the host of bank emissaries, which scoured the country to anticipate their coming, and the indefatigable spies which hung upon their path, to which may be added perjuries, familiar as dicers’ oaths, to baffle investigation.

Bray Hammond’s book elaborates on these stories:

Their cash reserves were sometimes kegs of nails and broken glass with a layer of coin on top. Specie exhibited to the examiners at one bank was whisked through the trees to be exhibited at another the next day.

Banknotes increased liquidity— they helped value flow faster through the economy. Who benefited from this increase in liquidity? Mostly the fraudulent banknote issuers:

It has been said, with some appearance of plausibility, that these banks have at least had the good effect of liquidating a large amount of debt. This may be true; but whose debts have they liquidated? Those of the crafty and the speculative — and by whom? Let every poor man, from his little clearing and log hut in the woods, make the emphatic response by holding up to view, as the rewards of his labor, a handful of promises to pay, which, for his purposes, are as valueless as a handful of the dry leaves at his feet. Were this the extent of the evil, the indomitable energy and spirit of our population, who have so manfully endured it, would redeem the injury. But when it is considered how much injury is inflicted at home, by the sacrifice of many valuable farms, and the stain upon the credit of the state abroad, the remedy is neither so easy nor so obvious. When we reflect, too, that the laws are ineffective in punishing the successful swindler, and that the moral tone of society seems so far sunk as to surround and protect the dishonest and fraudulent with countenance and support, it imperatively demands that some legislative action should be had, to enable the prompt and rigorous enforcement of the laws, and the making severe examples of the guilty, no matter how protected and countenanced.

Passing around the corporate shell after you’ve scoured it has long been the fashion:

So that the singular exhibition has been made of banks passing from hand to hand like a species of merchandize, each successive purchaser less conscientious than the preceding, and resorting to the most desperate measures for reimbursement on his speculation.

The stablecoins of the day depreciated horribly, even while the institutions were still up and running, and it was the innocent members of the public stuck with the tokens who paid:

Under the present law, the order in which the means and securities are to be realized and exhausted, will protract the payment of their liabilities to an indefinite period, and make them utterly useless to the great body of the bill holders, whose daily necessities compel them to sell at an enormous loss. The banks themselves, through their agents, are thus enabled to buy up their circulation at an immense depreciation, and their debtors to pay their liabilities in the notes of banks, purchased at a great discount.

The daily advertisements for the purchase of safety fund notes in exchange for land and goods, and the placards every where to be seen in the windows of merchants and brokers, is a sufficient argument for the necessity of the measure proposed.

The Commissioners pause here to examine the rationale for having free banking at all — principles of freedom, versus how it actually worked out in practice. They quote William M. Gouge’s A Short History of Paper-money and Banking in the United States, 1833, p. 230: [Google Books]

A reform will not be accomplished in banking, as some suppose, by granting charters to all who apply for them. It would be as rational to abolish political aristocracy, by multiplying the number of nobles. The one experiment has been tried in Germany, the other in Rhode Island.

Competition in that which is essentially good, in farming, in manufactures, and in regular commerce, is productive of benefit ; but competition in that which is essentially evil, may not be desirable. No one has yet proposed to put an end to gambling by giving to every man the privilege of opening a gambling house.

This story reminds me of recent stablecoin “attestations,” and documents waved at apparently credulous journalists:

The Farmers’ and Mechanics’ bank of Pontiac, presented a more favorable exhibit in point of solvency, but the undersigned having satisfactorily informed himself that a large proportion of the specie exhibited to the commissioners, at a previous examination, as the bona fide property of the bank, under the oath of the cashier, had been borrowed for the purpose of exhibition and deception; that the sum of ten thousand dollars which had been issued for “exchange purposes,” had not been entered on the books of the bank, reckoned among its circulation, or explained to the commissioners.

What do you do with bankers so bad you can’t tell if they’re crooks or just bozos? You put their backsides in jail, with personal liability for making good:

Upon officially visiting the Berrien county bank, the undersigned found its operations suspended by his predecessor, Col. Fitzgerald.

On investigation of its affairs, with that gentleman, much was exhibited betraying either culpable mismanagement, or gross ignorance of banking.

Col. Fitzgerald, however, with the usual vigilance and promptitude characteristic of all his official acts, had, previous to my arrival, caused the arrest of some of the officers of the institution, under the provisions of the act of December 30th, 1837; and required of the proprietors to furnish real estate securities to a considerable amount, conditioned to be released on the entire re-organization of the bank, and its being placed on a sound and permanent basis, or suffer a forfeiture of the lands pledged, which, together with their assets in bank, individual responsibility and the real estate security, given in conformity to law, must in the worst event, be more than sufficient to satisfy and pay all their liabilities.

In crypto, not even the frauds are new. Fortunately, we have suitable remedies to hand — such as the STABLE Act. Put the stablecoin issuers under firm regulation.

Your subscriptions keep this site going. Sign up today!

Perhaps you’ll be interested in my 2003 article: How Wildcat Notes were Distributed: The Carpet-Baggers

The term ‘carpet-bagger’ does not refer to Northerners migrating south after the civil war but refers to the fact that circulators of wildcat notes traveled with a carpet bag full of their dubious offerings. The idea was to transport notes from inaccessible Town A to inaccessible Town B where the distributor purchased whatever goods and livestock that he could, assuming that anyone from Town B accepted the notes.

When the notes get to Town B’s bank the bank happily takes the notes for debt – but not for coin – and the bank pays the notes out to their unsuspecting customers in lieu of coin whenever and wherever possible. This way of business carries on until all of the carpet-bagger’s currency is in circulation in Town B. [A reverse of this very situation is likely played out in the reverse direction, eg a Town B carpet-bagger distributes Bank B’s dubious notes in Town A.]

While the business of the town is carried on in this way quite legitimately for some period of time, eventually it becomes worthwhile for Town B’s bank to replenish it’s specie simply to ensure it’s own liquidity when Town B customers begin to demand coin, for example with a tightening of credit. In this case the Town B bank opts for the very simple expedient of refusing to honor Town A’s bank notes and forces holders to sell the notes at a significant discount to a local broker for specie. The local broker and the bank then split the difference with regard to these transactions and the bank then replenishes it’s coin.

While the scenario described above seems complex, the underlying principle is quite simple and can be reduced in money terms to a usurious form of interest charged on the bank’s customers, where usury is an exorbitant or unlawful rate of interest. Usury was illegal in all states until the Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp’s supreme court decision reinstated the abuse in 1976; the modern analogy concerns credit swaps and is not illegal. The old credit swap system was very common during coin shortages when banks and their customers were forced to exercise their wits amidst an improvised local monetary crisis, and useful when paper notes could be exchanged for real goods and services, until credit tightening created demand for coin.

A simpler but riskier proposition worked in larger metropolitan areas in the East, this idea was simply to transport notes from a far-off bank to a broker in another state who was willing to accept the notes at a significant discount. The risk here involved acceptance of the notes, as this was never guaranteed. As technology improved we can see how counterfeiting evolved into a significant industry by 1860, but it was not counterfeiting alone that constricted the economy of the United States. The major impediment to financial progress was greed and self-interest within a developing capitalist society which was largely unregulated, and incapable of policing itself in order to ensure the ascendance of the common financial good, the problem addressed beginning with the Treasury Act of 1863.

In conclusion we see that the term ‘wildcat’ began with highly dubious banking practices engendered by coin shortages, poor communications and bad roads characteristic of the early nineteenth century. The end of the Civil War, telegraphic communication and railroad development all occurred at approximately the same time, along with the beginning of the Industrial Revolution, and even though wildcat banks would disappear, dubious banking practices did not and wildcat mines, oil, and many other types of questionable investments would take the wildcat bank’s place in history with significant modern examples easily identifiable today. @newsypaperz