A new piece for Foreign Policy! James Palmer pinged me on Tuesday to write something explaining the recent meteoric price rise of Dogecoin. I spent a day procrastinating, then I started off with the Dogecoin section from Attack of the 50 Foot Blockchain, wrote a tour de force in an hour on Wednesday and sent it in. He ran it with minor copyedits today. [Foreign Policy]

I’d like to particularly thank my Patrons — you’re marvellous co-conspirators. In particular, Jonathan Rynd — I lifted “the worst of humanity” directly from him. And I think “the worst of humanity” is a simple and uncontroversial description of Ryan Kennedy.

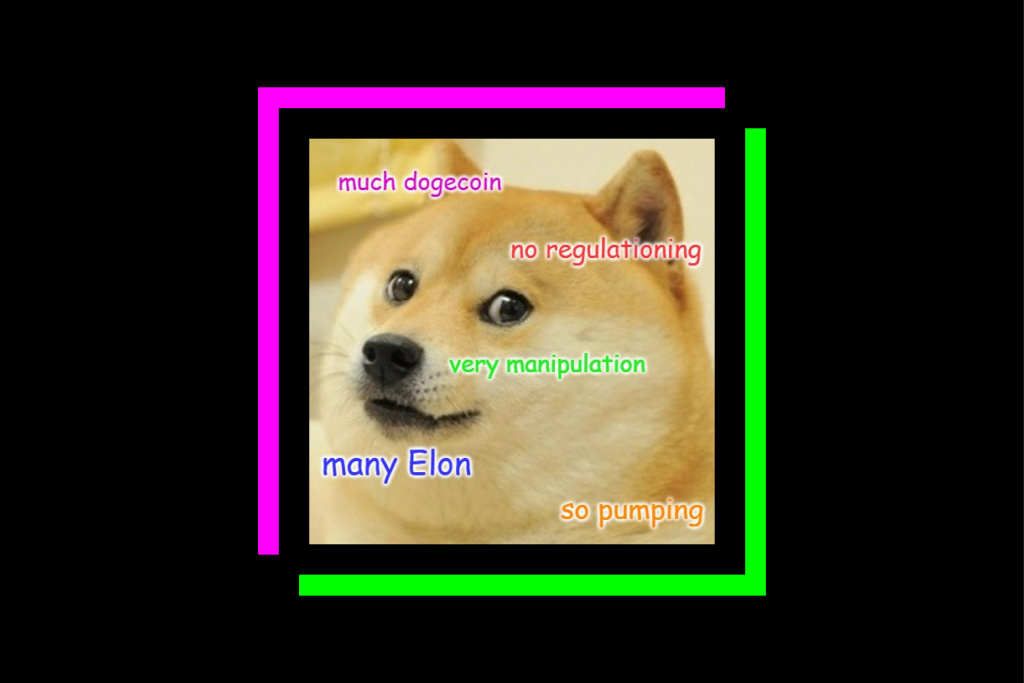

I think James had way too much fun making the illustration:

Your subscriptions keep this site going. Sign up today!

Peter Schiff has opined that Musk’s Bitcoin stunt may be a ruse for kindling a new trend (i.e., a bubble) in Dogecoin (which is a technically superior version of Bitcoin and more worthy of the “digital gold” epithet). What say you?

closest I’ve seen is this tweet, where he doesn’t use the words “digital gold”: https://twitter.com/PeterSchiff/status/1358773452975599619

I’m pretty sure Schiff thinks all cryptos are dross, even if some are less worse than others.

Yep, he thinks all cryptos are worthless and that only gold is real (naturally), though he says that Dogecoin is better than Bitcoin (in part because it has at least a little more in common with gold) and that the Bitcoiners who are putting down Dogecoin are unwittingly

undermining Bitcoin because the two things are fundamentally the same.

https://www.youtube.com/watch?v=86m2OPbYYy0

BTW, I think the “Old Man Yells at Bitcoin” meme represents clever marketing/propaganda/gaslighting tactic for BTC – that it’s where all the youthful (and presumably financially savvy) hipsters are at, and that those who aren’t on board are decrepit dinosaurs who not not only behind the times but also on the wrong side of history.

Do you see any plausibility in the notion of Dogecoin becoming the next big thing in the crypto scene? 😀

Hi there, wondering if you have ever looked at Monero. It still uses proof of work, so is energy costly, but it’s also a CPU algorithm, and most people who mine it are using spare cycles on their normal hardware that has a separate, primary usecase. Generally speaking, the level of wasted energy is vastly decreased, and it basically eliminates the waste of manufacturing silicon specifically to do dumb hashes.

It also solved the fungibility problem, in that it’s not possible to distinguish one coin from another (and thus find yourself under suspicion merely for what people before/after you do with the coin you sent), and doesn’t have an arbitrarily stupid block size limit that would prevent it from actually being used.

Currently it has a bit of a stigma as being a dark web coin, but in reality that mostly is just a proving ground for it’s fungibility and default consumer data protections.

Also, thanks for your investigative work on Tether. I’m finally starting to understand what has *actually* been driving these markets, and make an exit soon. I hate that it’s so terribly fraudulent, and that the idea of what Bitcoin could have been, essentially was co-opted by a set of fraudulent corporations.

That’s literally not how computer CPUs work – there’s no “spare” pool of computation.

CPUs are extremely good at shutting down parts of the chip when not in use. Since CPU speeds stopped going up, saving every scrap of power is one of the main points of competition.

So if you mine Monero, you’re using electricity you wouldn’t be using if you weren’t mining Monero, and shouldn’t pretend otherwise.