- On Tuesday evening, 27 February 2018, I’m speaking at the Financial Times’ event Bitcoin after the bubble: is the crypto revolution here to stay? “Now the peak of the mania has passed, join us to discuss what’s next for bitcoin, blockchain and the crypto revolution with David Gerard, author of the ‘Attack of the 50 Foot Blockchain’, Alex Batlin, founder and CEO of Trustology, and previously head of emerging business and technology and global blockchain lead at BNY Mellon, and Hannah Murphy, our FT reporter in London covering crypto.” Looks like there’s still tickets available. I’ll be fighting my way uphill through the snow to be there!

- SEC to ICO promoters: “Look, guys, could you please slow down with this garbage? Thanks.”

- Russia to ICO promoters: “You call tokens currencies and not securities? Fine, currencies they will be.” Promoters will be required to redeem tokens for cash for five years. And have 100m rubles in assets (about $1.7m) on hand before they start. (HT Ciaran Murray)

- It’s not just the SEC that ICO promoters need to worry about — buyers can sue privately to get their money back. Including personal liability for the promoters.

- Twitter Allowed Cryptocurrency Scammers To Hijack Verified Accounts To Take People’s Money. The scammers didn’t actually hijack the real account — they created a new account and got that verified fraudulently.

- IOTA is susceptible to replay attacks, and they’re not going to fix it. Fortunately, this doesn’t matter, because nobody actually uses the network and the price goes up when the network’s not working.

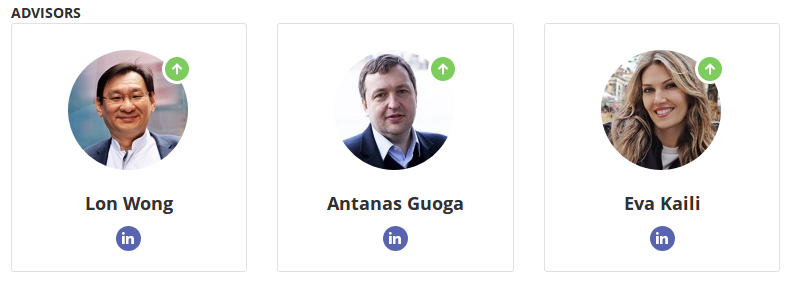

- Greek MEP Eva Kaili, who put forward that absolutely garbage EU motion advocating blockchains, turns out to be an ICO advisor, for Bankera. So is Lithuanian MEP Antanas Guoga. There’s a register where you can check MEPs’ financial interests! You have to go physically to Brussels or Strasbourg to look it up. Looking into this possible conflict of interest further …

- NIST’s Information Technology Laboratory has published Draft Report 8202: “Blockchain Technology Overview.” It has … a number of deficiencies. Jorge Stolfi has duly ripped it to pieces.

- Michael Seemann: “Why do all blockchain technologies remain in the project phase and none of them finds a market? The answer is that Blockchain is more an ideology than a technology. Blockchain is the libertarian utopia of a society without institutions. If we do not share the libertarian basic assumption that people should mistrust institutions, the blockchain is just the most inefficient database in the world.”

so blockchain hasn’t come up with any meaningful technology yet but here are thwelveteen super interesting v̶a̶p̶o̶r̶w̶a̶r̶e̶ technologies that will solve evereything and make blockchain eventually work. just wait until they are actually developed!!11 https://t.co/AUk8C3kJNh

— Michael Seemann (@mspro_en) February 22, 2018

- I question one premise of this Guardian article — that blockchains are in fact good, let alone revolutionary — but I thoroughly approve of the first six words and the site they link to.

https://twitter.com/stevelord/status/966974973268152321

Your subscriptions keep this site going. Sign up today!

You have to admit, I bet you never thought, when you decided to specialize in All Things Block, that it was going to turn out to be such an entertaining subject! Not many IT people get to wake up every day to a new avalanche of entertaining idiocy! ?

If it paid better, I could literally spend all day every day doing nothing but writing about this stuff. I have twenty-four half-finished draft blog pieces here …

Will the talk be posted online for all of us thousands of miles away?

No idea! I’m hoping it’ll be recorded.

Unrelated to this post, but see the link below to an article about Steve Wozniak being scammed out of some bitcoin. The author lists seeming sensible precautions, but includes this one: “Only buy and sell on trusted sources”.

Uh, wait a second. I thought the entire idea behind bitcoin was that trust wasn’t needed. But the reality is that instead of just trusting a few regulated financial entities, you have to evaluate the trust of every possible party to your transactions? Kind of makes me think I should just stick with the financial institutions.

https://www.marketwatch.com/story/steve-wozniak-had-70000-in-bitcoin-stolen-after-falling-for-a-simple-yet-perfect-scam-2018-02-28?siteid=yhoof2&yptr=yahoo