Coinbase drops margin trading — because Bitcoin doesn’t scale

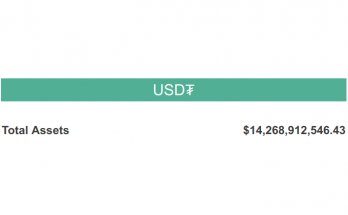

Coinbase told the CFTC that their internal systems use a ledger in an ordinary database … because the Bitcoin blockchain couldn’t possibly scale to their transaction load.

Attack of the 50 Foot Blockchain

Blockchain and cryptocurrency news and analysis by David Gerard

Coinbase told the CFTC that their internal systems use a ledger in an ordinary database … because the Bitcoin blockchain couldn’t possibly scale to their transaction load.

How the Invisible Hand of the Market turned out to be SoftBank putting a Visible Thumb on the Scale of the Market.

Everybody is excited by the novelty of it all, and think that with so many different games, they can surely find one where they can win.

I recorded a video podcast with Rachel McIntosh from Finance Magnates yesterday, and it’s up already!

Last chance to buy under $100k!

I told you so. Thanks everyone, for this week’s game of “Bitcoin: Moon or Toilet”!

Number go up! This is totally organic market activity! People just really like Bitcoin 40% more than they did last week!

Finance journalists need to stop treating crypto as an efficient market that responds to concerns. It’s a thinly-traded unregulated playground for whales, out to wreck the margin traders.

How the eye-watering margin leverage on crypto exchanges works in practice, and what happens when things go wrong.

If you know what you’re looking at, the GDAX depth chart is absolutely gripping. It’s like an action thriller movie for very dull people. If you ever wondered why I don’t trade in cryptos …