Guest post by William Quinn

In 2020, John Turner and I published a history of financial bubbles: Boom and Bust: A Global History of Financial Bubbles (Cambridge University Press, 2020). We had briefly written up the 2017 crypto bubble in the conclusion, assuming it had run its course … but a few months later, it bubbled again, even harder than before.

At first people wanted to know if it was really a bubble, and I usually answered that it was somewhere between a bubble and a fraud. The early stages of the boom phase looked very artificial — not much retail interest, but lots of tethers being issued. The word “bubble” implies something more organic.

Now that the 2021–22 crypto bubble is bursting, people want to know if it’s like anything we’ve seen before. So let’s go through the candidates …

Tulipmania

Tulipmania is something of a sore spot for financial historians. The popular narrative is based on Charles Mackay’s Extraordinary Popular Delusions, but lots of the details turned out to be false — partly because Mackay kept mistaking Dutch satire for real news.

The boring explanation for Tulipmania is that:

- Bulb prices rose in 1636 when rare and beautiful flower patterns were discovered, and fell later that year as these bulbs reproduced and became more common (this pattern recurred when new patterns were discovered in the 18th and 19th centuries).

- A second boom and bust can be explained by a legal change that relieved traders of the obligation to follow through on agreed purchases of bulbs.

This isn’t quite a full debunking. It seems likely, albeit hard to prove, that tulips became temporarily fashionable and rare bulbs became an object of speculation. If so, there’s still some truth in the popular story.

But that still makes it fairly sensible as bubbles go. Rare tulips are a potentially valuable commodity, and you could make reasonable arguments to justify high prices. People weren’t generally buying tulips with borrowed money, and there’s no confirmed instance of anyone going bankrupt due to tulip losses. Participation seems to have been fairly small. There was no economic or financial crisis afterwards.

Tulipmania made far too much sense to be compared to the crypto bubble.

The South Sea Bubble of 1720

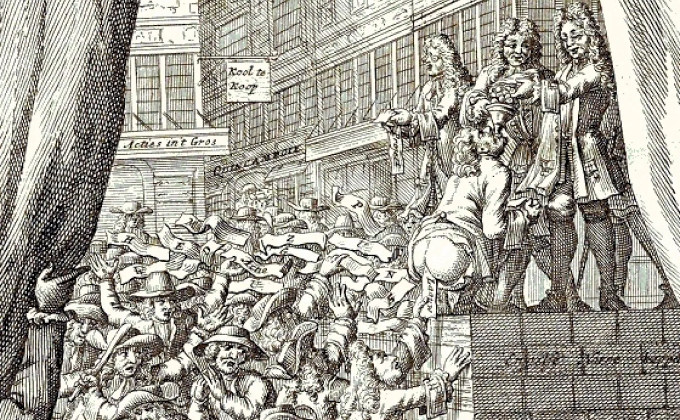

Original known as the South Sea Scheme, this bubble was the result of an elaborate government plan to reduce the national debt by convincing the public to trade their lucrative government bonds for South Sea Company shares. Economic historian Brad DeLong recently compared it to the crypto bubble.

The South Sea Bubble was created deliberately, and the methods were similar to those used by crypto exchanges in 2020–21. The UK government created liquidity, offered generous leverage to investors, and heavily advertised the scheme. Promotional materials often used faux complexity to obscure the straightforwardly bad nature of the investment.

But the South Sea Bubble was a fundamentally political phenomenon. Its purpose was to solve a policy problem, and it went through a long process of being authorised by Parliament. Investors were almost entirely drawn from the moneyed elites, and the Bubble Act was passed to prevent speculation from spilling into other investments. The bursting of the bubble caused the government to collapse, and the new government partially reimbursed losses.

There were some similarities, but it’s just a totally different genre of bubble.

The Mississippi Bubble of 1718–20

This was the French precursor to the South Sea Bubble — much larger, and much more economically damaging.

The whole episode was the brainchild of John Law, a wildly intelligent financial wizard who escaped to Europe from a Scottish prison. Like the South Sea Scheme, the most significant element was the conversion of outstanding government debt into Mississippi Company shares.

If I had to choose a historical precedent for the crypto bubble, it would be probably this one. The key feature in common was that the market was deliberately created with the intention of causing a bubble.

We describe the conditions under which bubbles occur using the Bubble Triangle: plenty of marketability and liquidity, abundant money and credit, and lots of speculation. During 2021, the crypto exchanges facilitated all of these: they provided liquidity, used stablecoins to create a new flexible money supply, extended margin loans to traders, and hosted speculative trading.

This level of centralised control over a bubble is unusual. It’s especially hard to find a precedent for stablecoins: the creation of a completely new form of money, under the control of exchanges, that allowed them to generate their own monetary stimulus. But this is quite similar to what John Law did during the Mississippi Bubble when he introduced bank notes into the coin-based French economy.

On the other hand, this was one of history’s most economically meaningful bubbles. The Mississippi Company controlled an enormous share of French commerce. It was heavily overvalued, but it did produce significant positive cash flows. The collapse of the scheme had significant economic consequences.

In this sense they’re completely different: one of the distinctive features of the crypto bubble is how disconnected it is from the real economy. We can never completely rule it out — contagion mechanisms are complicated — but it’s almost inconceivable that its bursting will cause an economic or financial crisis.

The Dot-com Bubble

An exciting new technology broke into the mainstream during a period of low interest rates. Early adopters, who were overwhelmingly young men, became millionaires overnight. Investment poured liberally into the sector, causing prices to skyrocket amid waves of early IPOs. Things got somewhat out of hand, but the core technology remained valuable, and companies that launched during the bubble went on to change the world.

This is a very flattering comparison, and is most often invoked as a pro-crypto argument. The problem is that crypto and blockchain, unlike the internet, are simply not very useful. For more details, I highly recommend the rest of David’s blog and both of his books — they’re really very good.

Other bubbles

We can probably rule out any housing bubbles. These are usually slow-burning political phenomena with heavy bank involvement and severe economic consequences.

The 1928–29 US stock market bubble has some similarities. The summer of 1929 was a bit like the winter of 2021 — lots of ordinary people became highly leveraged day traders, and most of them lost money. But US stocks have historically been an extremely good investment, so buying in September 1929 wouldn’t have been a total disaster as long as you managed to hold through the Depression.

The Beanie Baby Bubble was very similar to the NFT craze, especially in how the early stages of the boom were astroturfed. It’s not such a good comparison for crypto as a whole.

What if there is no precedent?

Most aspects of the crypto bubble have been seen somewhere before, but its most important feature is fundamentally new. Bitcoin:

- Has no use-value independent of the willingness of others to accept it.

- Produces no cash flows, and is not even represented as something that could ever produce cash flows.

- Incurs mining costs that can only be paid in fiat, making the investment ecosystem negative-sum.

Not all major cryptocurrencies are exactly like this, but most are close. These are uniquely terrible characteristics for an investment. Every previous bubble I’ve encountered has involved either a commodity, a collectible, or an asset with associated cash flows.

Why hasn’t there been a bubble in an asset like this before? Because historically, producing a financial asset with no associated cash flows and marketing it as an investment would have been considered fraud. And a fraud and a bubble are two different things.

But Bitcoin is not a fraud, because a fraud needs a perpetrator. Bitcoin was created as a sincere — if somewhat unhinged — political project, and operates independently of its creator. It’s a bad investment in the same way that a fraud is a bad investment, but it’s not a fraud.

In a twisted way, this is actually quite innovative. J.P. Koning conceptualises Bitcoin not as a bubble, but as an improvement on the traditional Ponzi scheme (or, as Preston Byrne called it, a Nakamoto Scheme). The cash flows are the same — later investors pay out early investors. But in a traditional Ponzi scheme, the person running it can abscond with everyone’s money, or the authorities can shut it down. With Bitcoin this is theoretically not a problem.

Of course, in practice most people use exchanges, and therefore face the exact same two risks. Still, gun to my head, I’d rather invest in Bitcoin than in a regular Ponzi.

So we have two possibilities:

- Crypto was a stupider bubble than any previous bubble

- Crypto was a smarter Ponzi than any previous Ponzi

And the truth is probably somewhere in the middle.

Your subscriptions keep this site going. Sign up today!

In my view, the best analogy is with the mid-Victorian railway bubble.

https://dgwbirch.substack.com/p/the-crypto-winter-might-be-very-good