Guest post by Martin Walker

The leaders of “Big Crypto” seem to have a huge problem understanding the basic concepts of conventional finance — such as balance sheets, auditing and cash flows.

Changpeng Zhao, a.k.a. “CZ”, of the Binance cryptocurrency exchange, recently described how they managed over $580 million of FTT crypto tokens: “We never touched it, we actually kind of forgot about it.” Sam Bankman-Fried has expressed endless confusion about the management of assets by the FTX cryptocurrency exchange and the Alameda hedge fund.

Even before the collapse of FTX, Sam had some unusual ideas about the methods the crypto industry uses to generates value:

… the smart money’s like, oh, wow, this thing’s now yielding like 60% a year in X tokens. Of course, I’ll take my 60% yield, right? So, they go and pour another $300 million in the box and you get a psych and then it goes to infinity. And then everyone makes money.

Cynical people, like most of the mainstream media and the Securities and Exchange Commission (SEC), have finally started coming around to the idea that much of Big Crypto is run by people who are recklessly incompetent and/or criminal. Perhaps some of them are. But it is worth trying to understand how the billionaires (and recently ex-billionaires) developed their ideas about the financial world.

Back in 2016 I co-wrote a paper that pointed out that cryptocurrencies such as Bitcoin are “an asset without a liability.” In other words, “created out of nothing defying the laws of double entry bookkeeping.” Financial assets are always someone else’s liability. If they are not another party’s liability, who is going to pay the returns on the asset that ultimately gives it value? Nobody, hence they have no fundamental value.

Big Crypto firms have been buying and selling “nothing” for so long, mostly in return for different lumps of “nothing”, that many have genuinely come to believe that taking nothing, giving it a name — and sometimes a story — combined with a little bit of trading back and forth with friends, gives “nothing” enormous value.

Whether huge valuations for “nothing” tokens came from simply pumping up the market price of old school cryptocurrencies or creating complex DeFi (Decentralised Finance) structures, the belief in the value of nothing makes is easy to lose sight of the fact of the underlying reality: it is the inflow of real money rather than “the technology”, “the community”, “the network” or “freedom” that gives crypto assets value.

A crypto enthusiast struggling with the idea that financial assets have matching liabilities must find the concept of a balance sheet quite mind blowing. Unfortunately, the misunderstanding of basic bookkeeping is reinforced by fundamental misunderstandings about banking and economics.

The leaders of Big Crypto, including those regularly interviewed on the likes of CNBC, mostly seem to learnt about banking and finance by repeating fairy tales to each other ultimately based and ancient tweets and blogs about Austrian economics. Most of them seem to genuinely believe that banks “create money out of thin air”, selfishly enriching themselves and defrauding the public by creating inflation. If they had some understanding of balance sheets, they might comprehend how making a loan creates both an asset for the bank (the loan) and a liability (the funds placed in the borrower’s account) and that the bank is not creating money for itself out of nothingness, with even the amount credit creation controlled by the requirement to have sufficient capital.

Strangely, given the contempt for inflation generating fiat money, Big Crypto genuinely does create “money” out of thin air. Their preferred way of dealing with the resulting dissonance is based on further misunderstanding. They believe having a fixed supply of any given token — representing “nothing” — protects against inflation. Even as some major cryptocurrencies such as Ethereum and Dogecoin do not have a fixed supply.

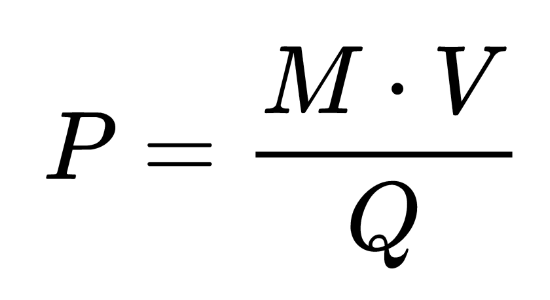

Perhaps if they studied some basic monetary economics and learnt all four letters of the Quantity Theory of Money equation:

In plain English, the price level (P) is only kept constant — i.e., no inflation — if the speed at which money (V) is spent is constant and there is real expenditure on goods and services (Q). Since there is no real expenditure of crypto on goods and services, it really does not matter if the money supply is fixed.

Which takes us to the crypto industry’s struggle with the concept of auditing. CZ stated about audit firms that “Many of them don’t know how to audit crypto exchanges.” With the crypto industry largely living outside the fundamental laws of finance and economics, what hope do auditors have to apply their old-fashioned ideas about assets, liabilities and balance sheets? Very little — but not just because of the crypto industry’s struggle to understand the basics.

One of the tenets of the Crypto faith is that everything is transparent “because it is on the blockchain.” Audits are not really necessary, and, if they have to be done, they involve complex mathematical analysis. Unfortunately, blockchains do not make things transparent in the old-fashioned way auditors like. A certain amount of crypto may be held at a particular address on the blockchain — but that does not mean it is under the control of the party being audited. An auditor cannot simply see an asset in the accounts and reconcile it to a bank statement.

In the crypto world, the best guarantee that you own the crypto you clam is to move some crypto from an address to another and hopefully back again — as Craig Wright notoriously failed to. Unfortunately, even this gives limited assurance. A conventional audit can check who has authorisation to move funds from a bank account. In the crypto world, anyone who has seen the private keys related to crypto funds can take them, and there is no central party to ask if they are authorised or even reverse the transaction.

Hopefully now the reader has a little more sympathy with the poor confused leaders of Big Crypto. If any of them do sadly end up in prison, the least society could do for them is provide some basic accounting and economics course to them. Something sure to aid rehabilitation. Perhaps taking the right courses could be made a condition of parole to encourage more diligent study.

Your subscriptions keep this site going. Sign up today!

The other problem with Crypto is that there is no net cash flow into the whole Crypto business (coins, exchanges, saleries etc). Unlike the Government Bond business where Coupon flows are billions of dollars, or the oil business where demand for travel creates an equivalent demand for jet fuel and gasoline. For gullible me to make money on my coins I have to persuade someone else even more gullible to buy my little piece of computer code at a higher price. So the cash flow situation of the business as a whole is zero in, zero out. Which means that it’s dog eat dog within the business. Which must shrink in the end.

And here is something I wrote earlier, years earlier

https://martincwwalker.medium.com/impossible-finance-the-perpetual-zero-coupon-bond-eaf4460d80ef

“For gullible me to make money on my coins I have to persuade someone else even more gullible to buy my little piece of computer code at a higher price.”

This is in fact the “Greater Fool Theory” unfortunately there are still many greater fools left!

Martin Walker’s inability to understand Thermodynamic Economics.

The ‘Asset’ is ‘Captured (stored) Universal Energy’ – created when Proof of Work computers do their so-called ‘Mining’.

The ‘Liability’ is best thought of as the ‘Reduction of Universal Entropy’ but – is perhaps more understandable as a transfer of Earth’s Energy into codes valued by humans. The codes are imbued with great value because they took a lot of energy to generate.

If it takes ‘Proof of Work-Cryptocurrency Mining’ to bring us closer to recognising the liability human existence is imposes upon this Planet (and Universe) then – I say – double down – Go wild and – Do even more of it.

I am only letting this comment through because you are incurably insane and hopefully people pointing and laughing at you will be effectively therapeutic.

I couldn’t work out how to comment on the main article, so I am commenting here. I have two points of discussion to raise. First for me double entry bookkeeping is from “net assets = shareholders funds” and is about limited liability and ownership of funds. Our current method of creating money is indeed debt based so there is a liability as you say, but I dont believe that that is only way to create money if you are willing to be innovative and step outside compliance. My second point is around velocity and here I say that BTCs focus on digital gold rather than exchange of value is indeed most frustrating – but again I think valid.

Buy the dip!

> The ‘Asset’ is ‘Captured (stored) Universal Energy’ – created when Proof of Work computers do their so-called ‘Mining’.

Cool. Where can i redeem Bitcoin for energy?

I will not point and laugh at someone who thinks using energy “captures” that energy. Entropy will not point and laugh either. It’s already increasing faster than necessary, by the existence of that comment alone, and that’s all it needs to chuckle wryly as it keeps its books perfectly balanced.

This was humour right?

for clarity: i, a person who has worked with some of the top financial experts and companies in the world over 20 years, am pointing and laughing at you. the best is the idea that there is a FIXED AMOUNT OF ENTROPY AND WE ARE LESSENING IT but why am i wasting my time.

pointing.

laughing.

at you.

> A conventional audit can check who has authorisation to move funds from a bank account. In the crypto world, anyone who has seen the private keys related to crypto funds can take them

You could design an air-gapped system that keeps keys in a hardware security module and generates manufacturer-signed attestations confirming that the key will never leave the physical chip. This effectively turns the keys into a physical asset, authorization to which auditors can verify.

HSMs that support this exist (your smartphone likely has one), though implementing and auditing the rest of the system would require a lot of work. Of course, crypto exchanges don’t do this, as they’re too busy desperately trying to convince the public that their “proof of reserves” means anything and that full audits are outdated and unnecessary.

Ok, here’s an accountant’s two cents on the issue:

1) Bitcoin and Ethereum presently require huge amounts of cost to be mined. Real money spent on equipment and energy. Ethereum is slowly moving away from that, but if you think of those two coins (I don’t care about the rest) as being gold that has to be mined first, then that’s your liability right there. Why do we get paid to mine e.g Bitcoin? Because that’s the reward we get for validating and posting pending transactions into the blockchain (which is itself unchangeable).

2) Assets are valued at the lower of cost or net realizable value, so if someone is willing to pay real cash for a coin, as determined by the exchanges, then that’s its value. Same as the resale price of your car.

3) Crypto is no different to real feit currencies. Dollars are only worth as much as someone else is willing to pay for them. Same as art pieces, same as gold or silver. Same as Deutsche Mark’s after WW1, and we all know how that went.

The counterparty to the US dollar is the US Government as the proxy for the American economy and its citizens.

Bitcoin’s counterparty is the voluntary users and holders of BTC who believe in the currency.

The US compels it’s citizens onto the dollar whether an individual likes it or not. That is the effect of designating a currency as legal tender. You must accept it as remuneration for debt. You must pay your taxes in it. You must value all barter transactions against it. You have no choice. The state has the monopoly on legal violence. If you choose to ignore these requirements, especially the tax ones, you’re headed to jail.

BTC cannot compel anyone onto itself as currency. It must survive perpetually only by voluntary adoption. I personally think it will fail, but it’s death will be slow and it may live on perpetually as a sort of novelty.

“if you think of those two coins as gold”

Well that is what an economist would call a “strong assumption”. You don’t even need to be a Goldbug to disagree with that.

That’s not a liability, because ain’t no one going to find value in your burned out antminer when the bubble pops.

You might need to go back to accountant’s school, or give us a bit more than two cent’s worth.

I’ve recently been shopping for crypto mining speculative fire sales, during the last week of 2022.

I’ve gone into a few SEC docs to chase after liabilities like crypto backed loans and the umbrella of collateral. As more and more of the miners go bankrupt, I’ve been somewhat curious about how this mess will end up, after consolidation occurs. I wonder about the future value of antminer rigs, but, I can’t help think, this house of crypto cards is going to have unprecedented contagion.

I’m starting to slowly grasp the connection between debtor in possession crypto bankruptcies and unrecognized impaired earnings connected to pension fund misappropriation. I have no doubt, that some rocket scientist was supercharging leverage with a state pension. That’s gotta be on the horizon for 2023 along with the discovery that lots of mortgages are linked to collateral held by entities that are off the radar, which are connected to leverage, connected to crypto-squared cod subsidiaries that are connected to coins that were used to purchase thousands of bit mining rigs, which are being used as collateral by penny stock entities.

oh yeah, I mean we know they constructed a mini-2008 where everyone is in hock to everyone else. The question is indeed the contagion. Known pension fund crypto losses are small compared to the size of fund, and are mostly indicators of poor judgement rather than an actual disaster for the fund – but I wouldn’t be surprised either at some idiot achieving amazing leverage on zombie crypto firms that’s yet to come out.

I was looking at Wisconsin Investment Board and their exposure to crypto. They’ve been excited about the thesis that disruptive technology can pay off in the long run. I haven’t gone backwards to see what types of bets they were playing with around Dotcom bust or Great Recession, but maybe there’s a way to smooth out 80+% losses, over 20+ years?

Furthermore, this is one pension fund, among a huge galaxy of interconnected commingled puzzle of insanely leveraged events, likely to explode very soon, after they recognize impaired losses.

SWIB held 1.85 million shares of the ARK Innovation ETF valued at $73.8 million as of June 30, a share level essentially unchanged from the 1.84 million shares valued at $122.3 million reflected in its 13F report for the quarter ended March 31. It held 552,100 shares of the ARK Genomic Revolution ETF valued at $17.4 million the report for the June 30 quarter showed, up from 510,500 shares valued at $23.4 million as of the report for the quarter ended March 31.

One more small thing. There are new updated accounting standards that require crypto to be properly valued. I won’t go into specifics, but pension funds can’t just bury massive losses and carry forward incorrect valuation.

FASB a few months ago clarifying this issue for all the pension fund managers, bankers and holders:

“Today, entities that hold crypto assets and do not follow specialized industry guidance in U.S. GAAP or certain regulatory guidance measure those assets at historical cost less impairment. In practise, crypto assets are impaired to the lowest observable fair value within a reporting period. Those impairment losses are presented in comprehensive income and cannot be reversed if there are subsequent increases in value. The board heard that generally that measurement model does not provide useful information to financial statement users because the underlying economics of these assets is not appropriately reflected in financial statements. Also, accountants have said it is costly to identify the lowest observable price during a reporting period for the purpose of testing for an impairment.”