By Amy Castor and David Gerard

- Our work is funded by our subscribers on Patreon — here’s Amy’s, and here’s David’s. Your monthly contributions help us greatly!

A hearing in the Celsius bankruptcy was held over Zoom at 11 a.m. on November 1, 2022. Amy sat through all three hours and took notes. [Amended agenda, PDF]

Celsius is pretty much dead. A lot of today’s arguments were over the spare change in the stiff’s pockets.

The unexploded bomb under the entire proceeding is the forthcoming examiner’s report on what the heck happened here. The examiner, Shoba Pillay, will look into possible fraud. This includes whether Celsius operated as a Ponzi scheme — paying early investors with money from later investors.

An examiner’s report is due in December. If Pillay’s report indicates criminal activity, all bets are off.

No, secret Celsius employees do not get bonuses

A KERP is a “key employee retention program.” This is bonus money that a bankrupt company gives to select employees so they don’t despair and walk off the job. Insiders — founders, directors, and those in control of the company — are prohibited from receiving KERP bonuses

Celsius’ KERP proposes to distribute $2.96 million among 62 “essential” employees. Celsius currently has 274 employees, down from 900 at the beginning of the year. It’s not clear what they are all doing right now — other than responding to investigations.

The Unsecured Creditors’ Committee (UCC) supports Celsius’ KERP motion. The UCC is seven individuals who lost big in Celsius, and imagine Celsius will emerge from the ashes. They want to keep Celsius as a fully functioning company in case a buyer comes along, or Celsius ever actually files a reorganization plan — which it hasn’t yet. [Doc 1021, PDF; Doc 1187, PDF]

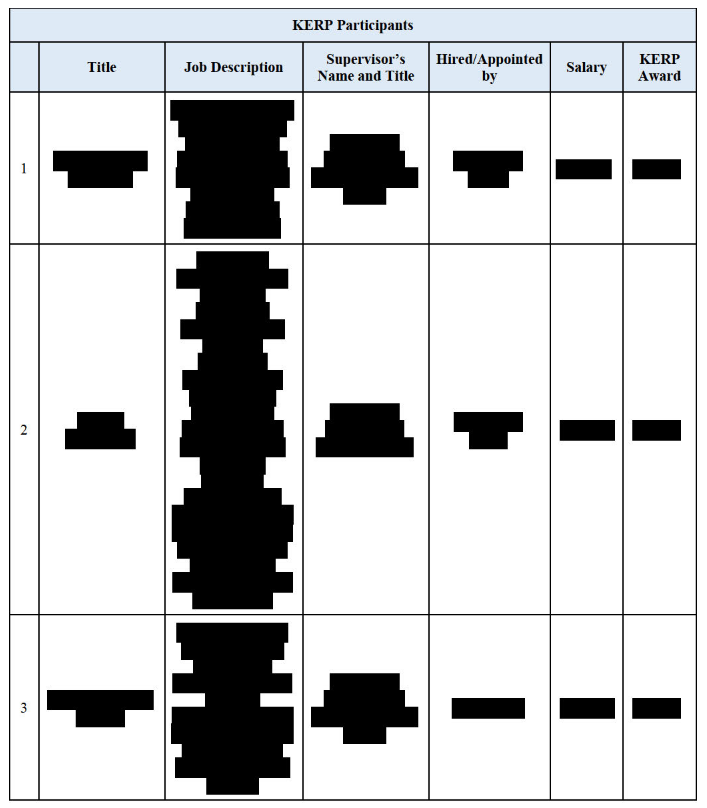

Judge Martin Glenn doesn’t have an issue with KERPs in general. The problem is that Celsius also wants to redact names, titles, salaries — any meaningful information at all — about the proposed KERP participants. This is novel. [Doc 1020, PDF]

See for yourself — pages 30 to 55 of the KERP motion are a list of names and job functions, and every single one is blacked out. [Doc 1021, PDF]

Judge Glenn was “shocked” by the sealing motion. Of all the KERP motions he had ruled on over the years, Judge Glenn said he had never seen one which proposed to seal everything.

“I mean, you’ve got to be joking,” Judge Glenn straight out told Kirkland’s Dan Latona, who was presenting on behalf of Celsius.

Has Celsius learned nothing? When they previously tried to redact the names of creditors, Judge Glenn told them he was not about to rewrite the bankruptcy code for crypto. Despite that warning, Celsius goes and files something where everything is blacked out. [Doc 910, PDF]

Judge Glenn denied the KERP motion and the KERP sealing motion without prejudice — so Celsius can try again. He was okay with some information being redacted — just not all of it. Celsius must confer with the UCC and the US Trustee on what can be redacted. [Order, PDF]

Kirkland had to have known Judge Glenn would shoot this down. We suspect Celsius pushed them into it, and Kirkland didn’t push back, because Celsius is their client and they’re getting paid millions — from the creditors’ money.

Examiner expands her work plan — and the judge says the P-word

Next were the motions from the examiner, Shoba Pillay, to approve a work plan and to expand the scope of the investigation. [Doc 1013, PDF; Doc 1112, PDF]

Pillay read through more than 400 filings from pro se creditors (ones without lawyers, representing themselves) and spoke to state regulators. She now wants to expand the scope of her work to look into Celsius’ own CEL token, and how CEL was represented to investors. You could get a higher interest rate from Celsius if you were willing to take it in CEL tokens.

Pillay also wants to look into how Celsius marketed itself to customers. Creditors claim Celsius misled them about the safety of their investments, and the manner in which their deposits would be treated.

The UCC was the lone objector to portions of the expanded scope, with Greg Pesce of White & Case (for the UCC), arguing it would duplicate work and cost creditors more money.

Of course it will! You can’t get anything done this fast without duplicating work.

The point of the examiner is to be a neutral party. She doesn’t have a fiduciary responsibility to any party. That’s the value of her report.

Judge Glenn said that right now, the court is happy to rely on the examiner for investigations.

If Pillay can’t complete her work, Celsius is just going to get subpoenaed by the SEC and dozens of state regulators anyway. Those investigations and proceedings are probably not stayed, and the cost to the estate would be substantially higher.

“Isn’t your constituency better off if it is the examiner for now? It doesn’t prevent the state regulators or the SEC or the US attorney from launching whatever they’re going to do. But aren’t you better off if it is focused through the examiner?” Judge Glenn asked.

Layla Milligan, the assistant attorney general of Texas, weighed in on the examiner’s expanded scope, saying the more information that’s publicly available, the better. “Sometimes sunlight is the best disinfectant,” she said.

A few of the pro se creditors brought up the need to look into whether Celsius operated as a Ponzi scheme — if the company was paying existing investors with money from new investors.

Judge Glenn asked the lawyers for the UCC and the examiner if they were looking into whether Celsus was a Ponzi.

“The committee is looking into whether Celsius did things that would have made it a Ponzi scheme,” said UCC lawyer Greg Pesce. “We don’t know that today. We are going to keep doing that as part of our investigation.”

Examiner’s lawyer Vincent Lazar said that a number of the facts are already covered within the scope of the examination. “We would need to expand it a little.”

Celsius has been dragging its feet in responding to examiner requests. In her work plan, Pillay said that if she is going to meet the court’s deadlines for delivering her reports, then “the pace of access to documents will need to be accelerated.”

Lazar said that Pillay was on track to deliver the interim report on deadline and that the final report can be completed on schedule with a possible “very short extension.”

We imagine Pillay has people working around the clock to get these reports out on time.

In her work plan, Pillay estimates that the total fees for the examiner and her counsel, Jenner & Block, will add up to between $3–5 million.

Judge Glenn approved both examiner motions. He directed the lawyers for the UCC and the examiner to confer on who will focus on the “so-called Ponzi schemes” to avoid overlap.

Pro se motions — the creditors speak!

There were six motions from pro se creditors.

Judge Glenn has been good about giving creditors an opportunity to speak in the hearings — and he expects Kirkland lawyers to take the pro se motions seriously. The creditors are paying their salaries, not Celsius.

Kwok Mei Po was an Earn customer, whose Earn accounts were suspended, and who asked if her crypto could be returned to her. Kirkland Associate Tommy Scheffer argued her motion should be denied.

When Judge Glenn asked if Scheffer had written up specifics on her claim and reasons for her suspension in his objection, he said no.

“You can’t simply blow off pro se creditors, I am not going to put up with it,” Judge Glenn said. “You may not like having to respond to pro se creditors, but I do expect full responses.”

Judge Glenn took all of the pro se motions under submission. One from Victor Ubierna de las Heras (requesting particular Rule 2004 discovery) and two from Daniel Frishberg (cost savings and insider clawbacks) were subsequently denied. [Doc 1266, PDF; Doc 1267, PDF; Doc 1269, PDF]

Who owns the stablecoins?

Celsius has $23 million in 11 types of stablecoins. It wants to sell these to come up with cash to fund its operations. In its 15 September motion, Celsius doesn’t specify which stablecoins it holds, how much it wants to sell, or what operations it wants to put the money toward. [Docket 832, PDF]

One big question is: does Celsius own these coins? They have to prove they own the coins in order to sell them.

Creditors who deposited stablecoins say that they own the stablecoins, as secured creditors, so they should get back 100% of them. Celsius and the UCC say the stablecoins are just part of the unsecured bankruptcy estate, like the rest of the remaining crypto.

Some of the stablecoins were in Celsius “Earn” accounts, where you could deposit cryptos and get up to 18% interest. (See our explanation of the types of Celsius account.) “We believe the Earn coins are Celsius assets,” Koenig told the court, and that this was “clear and unambiguous.”

The Celsius terms of service for Earn accounts say that all crypto deposited, including stablecoins, is owned by Celsius, who then have a liability to the depositor. But some depositors put stablecoins in under previous terms or deposited them with a different Celsius corporation. It’s a mess.

Kirkland attorney Chris Koenig for Celsius said they’ve been working with the various parties — the Trustee, the UCC, the ad-hoc groups, and state regulators — to address the objections, but they need more time to negotiate.

The court will address the issue of the ownership of Earn accounts — which held other crypto as well as stablecoins — on 5 December.

Adjourned matters

Two motions were adjourned.

Celsius wants to set a bar date — a deadline for when proofs of claims have to be submitted — of December 13. They also want the court to approve their claim form. This motion will be heard as part of the hearing on 15 November. [Doc 1019, PDF]

Bradley Condit, former Celsius controller, brought a civil action against Celsius and its former CFO, Yaron Shalem, on 28 June 2022 — two weeks before Celsius filed for Chapter 11. This action was automatically stayed by the bankruptcy.

Judge Glenn has allowed Condit’s case to proceed solely insofar as it would be paid out from Celsius’ employment practices liability insurance policies — and not from the bankruptcy estate.

This motion was supposed to be heard on 1 November — but it’s now been adjourned to an undetermined future date. [Doc 684, PDF; Doc 1216, PDF; Doc 1246, PDF]

The “Bar date hearing” is November 15; the next omnibus hearing is December 5.

Your subscriptions keep this site going. Sign up today!

“You can’t simply blow off pro se creditors”. That is what I want on my next coffee mug.

“We believe the Earn coins are Celsius assets,” Koenig told the court, and that this was “clear and unambiguous.” That is so f@@ked up. Is he living in some alternate universe?!? I hope they goto jail for this!

Keep up the good reporting David and Amy! Greetings from The Netherlands

Thanks for this recap! Is there a group from international creditors? Wondering about the presence of non US citizens in all this mess. I open my account in Switzerland, anyone here the same?

I know there’s various chat groups for international creditors, various ad-hoc committees have been mentioned in pro se creditors’ filings previously. None of these groups are official, but the judge says here to take the pro se creditors seriously.

Impress with such consolidated report of Celsius Ch 11 Court proceeding/hearing. Thanks and keep up good work.

What about the custody (non-earn) account and that ad-hoc representation?