This past weekend, I went to Nashville, to hang out with financial regulators! That’s what people flock to Nashville for, right?

The event was the North American Security Administrators’ Association (NASAA) Annual Meeting, with senior regulators from all the US state and Canadian provincial regulatory bodies.

The panel

I was on the panel “Protecting Investors and Consumers in the Age of Digital Assets” on Monday 19 September. [NASAA]

The speakers were me, Alexis Goldstein (Consumer Financial Protection Bureau) and Deb Meshulam (DLA Piper), a lawyer advising crypto clients. The moderator was Jake van der Laan () — it was Jake who invited me to this conference, and I figured if it was Jake it’d be good (and it was).

The audience was a room full of senior-level state and provincial regulators.

My bit was my basic stuff: don’t worry about the tech, look at the financial instrument, and the people and the flows of cash.

The key technical innovation of cryptocurrency is that you can create new unregistered penny stocks at the push of a button. Alexis had some figures — there’s about 7,000 publicly traded equity stocks in the US … and somewhere over a million DeFi tokens.

So you can spam regulators with so many violations that they can hardly keep up, and the “industry” attempts to achieve regulatory escape velocity. This worked for Uber, but that didn’t really work out so well for everyone else either.

Celsius and Voyager were the large and disastrous examples on everyone’s minds.

I pointed out that anything offering 20% interest rates to retail is going to be a Ponzi scheme — so just make a list and go after them. Alexis repeatedly reminded the regulators that they can and should go after the Ponzinomic schemes.

The panel went down well, and I chatted to a lot of people afterwards. Regulators have to speak nicely in public and nail down their cases 100% in court — but you will be unsurprised to hear that some are super-pissed at Celsius, and would very much like to put CEO Alex Mashinsky’s backside in jail.

The general lesson for innovative financial entrepreneurs is: if you rip off enough of the public, you don’t get just the SEC after you, but sixty-odd state and provincial regulators as well. Celsius and Voyager have met that bar.

There should be video publicly available in due course.

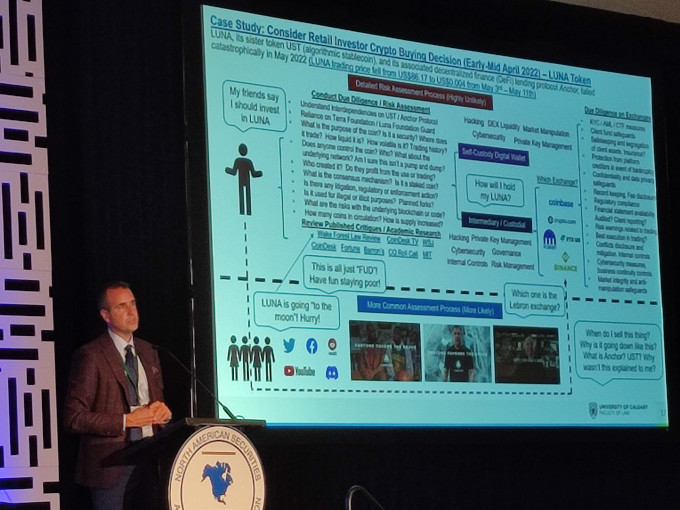

The other crypto-related panel was straight after mine — Ryan Clements from the University of Calgary gave a talk on Terra/Luna, and how the most pathological members of the cryptocurrency community harassed him for his October 2021 paper “Built to Fail: The Inherent Fragility of Algorithmic Stablecoins.” [Wake Forest Law Review]

I thought I’d been strident, he left me in the dust. Prof Clements is quite annoyed. We had a good chat afterwards about this nonsense.

Travel notes

I hate travelling and lost a day getting over the jet lag. Destinations are pretty cool, though. If you’d like me to come to your thing, I’ll probably try to say yes — but I need everything taken care of, expenses for the lot (and I’m not expensing the plane nor the hotel), and my wife is much happier if I get a nice lump of money for appearing.

Vodafone UK roaming doesn’t work for voice in Nashville, because AT&T aren’t quite up to the task of running a phone system — which is a heck of a thing to say about literally the original phone company:

Welcome, you are roaming on AT&T. Due to network technology compatibility, traditional voice calls will not work. Please use data, SMS, and app based calling.

This turns out to be known to Vodafone — though when they assured me they did roaming, they didn’t link the fine print that said it probably would’t work. [Vodafone]

(Vodafone tried to charge me for the roaming, and I got it reversed on the grounds that they didn’t provide the actual service.)

I brought my netbook which I ostensibly bought for travel, and actually just wrote Libra Shrugged on. I am forced to admit it sucks as a netbook. Next time I’ll bring the Chromebook, it browses faster and holds a charge.

Regulatory capture

The pic above is me with Jake. Country music is the only thing there is to do in Nashville, but there’s so much of that one thing. On a working Monday afternoon, Broadway was still packed with people, and every honky-tonk bar had a blaring country band with deafening drums.

It turns out the South is hot — it was 33°C (and 37°C the next day). Jake and I found Old Red, a honky-tonk with air conditioning whose country band didn’t have drums.

Went to the Johnny Cash Museum shop, got myself a shirt. I am as tired as I look in this picture.

On the Monday evening, NASAA held a reception at the Country Music Hall of Fame. I didn’t get a photo, but the sign “Taylor Swift Education Center” seemed ominous.

Your subscriptions keep this site going. Sign up today!

Wait, if crypto is digital cash, is there a cover band yet called Johnny Crypto? Johnny Tether? It’s kind of like the real thing only not nearly as good!

Well, Johnny Bitcoin only managed one note every ten minutes and uses difficulty adjustments on side tasks to ensure that the “one note every ten minutes” pace is kept, raising the difficulty if the speed picks up, lowering it if the pace drops. So understandably, almost everyone who likes Cash simply ignores Bitcoin , as it is suitably tedious trying to listen to a song being played at somewhere in the region of 500 times slower.

With a name like NASAA, I assume the attendees knew a thing or two about things going to the moon…

One talk mentioned “NASA” and the guy quickly added “the space agency”

I suppose your next panel should be on Shiba Inu pedigree at the Nihon Ken Hozonkai (Japanese Dog Association)?

Also I for one am looking forward to a cover version of Ryan Clements’ “Built to Fail” from Lana Del Rey.

Re: phone troubles. In my experience, nothing beats a good SIP service. You can use one number for everything, call or SMS via any wifi or cell data connection, etc. I wish there were “flip phones” that run SIP over 4G/wifi, but failing that, a smartphone with an app will do.