by David Gerard and Amy Castor

NBA Top Shot was an NFT project that launched just before the 2021 Bitcoin bubble. It was run by Dapper Labs, creators of CryptoKitties, under license from the National Basketball Association, the top league in US basketball.

Top Shot has been about the only really successful sports NFT project to date, and the only successful NFT project outside the crypto trading market.

Top Shot claimed to be about the cards — but it was all about the trading market. The platform was hugely popular in early 2021 … until traders tried to get their money out, and discovered how slow Dapper could be.

Quite a few big Top Shot traders got into Bored Apes and similar collections, because at least you could get your ether off OpenSea.

Trading cards should be at the bubblegum level, not the trader bro level.

Bubblegum cards

Collecting sports cards is fun! Completing the set of something is satisfying in its own way.

The company behind a trading card completely controls what cards are available, in what quantities. We’re talking about a commodity that exists solely to create an artificial scarcity. But children enjoyed collecting and trading the cards for much of the twentieth century.

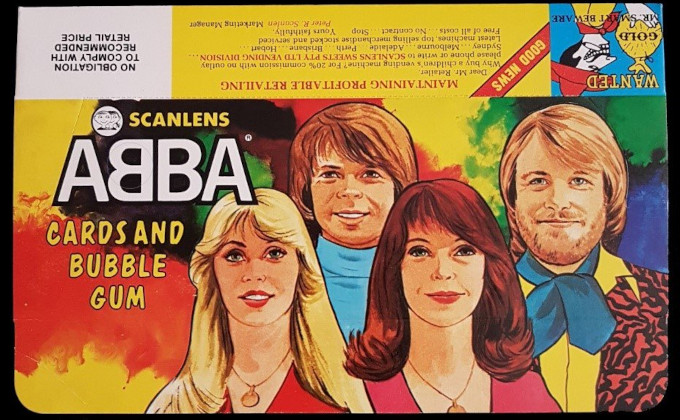

David remembers the ABBA bubblegum cards in Australia in 1976, when ABBA were the most popular band in the country. Scanlens did a lot of football and cricket cards, but the ABBA licence was a major hit when he was nine. There were 72 cards, in pink or blue versions. Getting a complete set was hard, ‘cos number 13, “Mysterious ABBA,” was kept scarce. [Jeff Allender’s House of Checklists]

The kids didn’t think about money from card trading, and no way were their parents going to spend more than pocket change on pop band cards. Everyone promptly forgot all about the cards the next year.

Of course, collectors are still wild for the ABBA cards. A complete set sold for AUD$477 in 2008. [Popsike]

Money ruined everything in the 1990s — X-Men comic books with six different front covers, Bart Simpson non-collectible figurines, and sports cards. The baseball card market bubbled in the late 1980s, and oversaturated and collapsed by the mid-1990s. [Slate, 2010]

The sports card market recovered somewhat in recent years, with rich buyers paying hundreds of thousands of dollars for a card just from nostalgia — though that brought with it a plague of big-ticket fakes. Pandemic lockdown didn’t help at all. [Yahoo! News, 2020; KWCH-12, 2021]

But on the blockchain

There were several early attempts to promote NFT sports trading cards to the general public. Major League Baseball promoted MLB Champions — on the public Ethereum blockchain — in 2018, working with crypto game developer Lucid Sight. You could buy little totally-not-Funko-Pops of your favourite baseball players. [MLB Champions] Hashletes did National Football League players in 2018 but it was never popular, and shut down after a year. [Forbes, 2019; Medium, 2021]

NBA Top Shot was conceived and announced in 2019. A beta went live in June 2020, and the public launch was in October 2020. [press release; press release; press release]

Top Shot took off where pretty much all other sports NFT projects had failed. Top Shot rode on the Bitcoin bubble of 2021 — but it also rode on the many other guys frantically promoting NFTs as art, such as Metakovan’s early NFT efforts.

The cards are called “Moments” — short videos on the Top Shot website, pointed to by NFTs on Dapper’s private Flow blockchain. That is, the blockchain bit adds nothing — it might as well be an SQL database.

The Moments are sold in packs. Packs are $9 for common cards, $99 or $249 for three common cards and one rare card, and $999 for the possibility of a “Legendary” card. Do you feel lucky?

If you collect an entire set, you can get free airdrops. Buying expensive cards makes you eligible to buy other expensive cards you can’t get otherwise. [NBA Top Shot]

Some packs are questionably randomised. Collectors complain it feels like buying expensive loot boxes in a video game. [Top Shot; Reddit; Twitter]

You could even buy a Top Shot in person at some NBA Summer Games in 2021. [Decrypt]

Dapper and the NBA make their money from sales of packs — and from a 5% fee on every transaction in the marketplace. This is split between Dapper, the NBA and the National Basketball Player’s Association (NBPA).

The NBPA money is divided across the whole league, like other merchandise deals — it doesn’t go to the player in the specific Moment. Some players have invested in Dapper, are working with Top Shot, or just trade on Top Shot themselves. [HoopsHype; NBA Top Shot]

Top Shot talks a lot about how you “own” your Moment. You really buy very limited rights to almost nothing. You can move “Legendary” cards to a MetaMask wallet hooked to the Flow blockchain — but the Terms of Use mean Top Shot can disassociate your NFT from your Moment any time they feel like. [NBA Top Shot; NBA Top Shot]

Opportunities!

The October 2020 launch was reasonably well publicised. NBA Top Shot attracted some sports card collectors. A lot of users came from fantasy sports league totally-not-legally-gambling sites. The siren call of getting rich quick lured quite a few people into Top Shot’s negative-sum casino.

An SB Nation survey showed that the vast majority of basketball fans weren’t interested in Top Shot — they thought it was obviously an artificial fad. Many compared Top Shot to Dutch tulip bulbs. [Bullets Forever]

Overwhelmingly, users joined Top Shot for the buzz from day-trading — gambling, but don’t call it gambling. Top Shot promoted itself as being about collecting sports cards, but the entire structure favoured the trading market. Collectors were rapidly pushed out.

“I am definitely not a sports fan”, Robyn Batnick, a high school guidance counsellor married to a financial advisor, told the Financial Times. “The players and the moves? They mean nothing to me. I look at it as a game, and I’m like, I want to play!” [FT, 2021, paywalled]

“It’s not about the money, it’s about the chemicals in your brain,” Robyn’s husband Michael said.

Some users, like Daniel Hurtado, had been into trading cards as kids — then they stumbled onto Top Shot. Hurtado told Sports Illustrated about the experience: as well as making money, he was after the rush of winning at gambling. [Sports Illustrated, 2021]

Roham Gharegozlou of Dapper Labs told Sports Illustrated: “We’re not building a product for day traders or a product for people that want to cash in, cash out. We’re building a long-term business.”

Somehow, a product for day-traders who were in it for the money was precisely what Gharegozlou had painstakingly constructed. Must all have been a terrible accident.

Also, Gharegozlou owns more Moments than anyone. “I consider it like Satoshi’s wallet. I don’t plan on selling anything ever.” [Action Network, 2021]

The prices for “Moments” peaked around late February 2021. That was also when Beeple was about to sell his $69 million NFT at Christie’s. NFTs were in the news.

New users flooded in to make some money … to be disconcerted when they tried to cash out.

Where’s my money?

NBA Top Shot was notoriously bad at actually paying out traders’ money. Top Shot completely failed to scale to the flocks of new users — because all Know-Your-Customer (KYC) was manual. The media is loaded with stories about traders who were rich on paper, but just couldn’t extract their money from Dapper Labs.

You could buy in with a credit card — 80% of traders just bought with a credit card, not cryptos — but you needed to provide full KYC to cash out. This is known in crypto trading as the “KYC scam” — it’s a favourite with insolvent crypto exchanges.

Dapper hadn’t hired enough staff to process withdrawals. But the company also held onto customers’ money for an arbitrary waiting period — originally thirty days, later extended to six to eight weeks. Dapper claimed that this was necessary to prevent fraud, including chargebacks on credit card purchases of Top Shots.

Even when a customer was allowed access to what was supposedly their own frickin’ money, Dapper would cap withdrawals, starting at $1,000 per day. Dapper charged $25 for a wire transfer, and would take days to weeks to process each transfer. Dapper’s Identity Verification FAQ said: “most withdrawals are processed within 21 days but others may take 40 days or more.” [NBA Top Shot, 2021]

Traders would do deals and trade cash offline for transferring a Moment. Top Shot also oversaturated the market with Moments.

Customers worried about protesting too loudly, for fear Dapper would shut down their account in retaliation — and keep all their money. “Michael” told CNN that he had been waiting months to access his $40,000 balance, and had filed a complaint with the Consumer Financial Protection Bureau. [CNN, 2021]

As of March 2021, only 17,175 of the site’s 270,000-plus Top Shot owners could withdraw their money at all.

Another customer told CNN: “I haven’t gotten the money, I don’t think I’ll ever get the money. I’ve accepted that I’ll never see it.”

In January 2022, user “FreeHongKong” — named in honour of the NBA’s problematic history of suppressing US players’ protests about the Chinese government — tried to cash out, and submitted their passport for identity verification. They were promptly banned for “providing false or misleading information during the verification process.” CoinDesk asked Dapper for comment, and the account was unlocked several hours later. [CoinDesk]

Basketball card securities

NBA Top Shot is still around. As of January 2022, prices were down 95% on March 2021. There are a lot less of the frantic traders. [Bloomberg]

Dapper worked with many other sports leagues through 2021, trying to build more walled-garden virtual card trading markets. None have taken off.

Dapper also auctioned off some very expensive five-year season pass tickets as NFTs — one per NBA team. These went for prices on the order of $50,000 to $60,000. [NBA Top Shot]

Sports cards wouldn’t usually be securities under US law — but actively promoting a market in sports cards might constitute an investment contract. A class-action suit was filed in May 2021 by Jeeun Friel alleging that Moments are securities, because they can only be sold in a secondary marketplace that Dapper promotes, completely controls, and profits from. The case is still in progress. [Frankfurt Kurnit Klein & Selz; case docket]

Going ape

NBA Top Shot traders loved the site — but they were in it for the money. Despairing of being at the sharp end of Dapper’s KYC difficulties, and with the NFT bubble being promoted all around them, quite a few of the largest traders moved on to Bored Apes and OpenSea.

Some of the big Top Shot traders became big NFT traders. Dingaling, Pranksy and J1mmy.eth started buying up Bored Apes early, when they were selling for .08 ETH each. This lured in other Top Shot traders.

Pranksy minted over 1,000 Bored Ape NFTs — 10% of the entire Bored Ape collection — and flipped every one of them on OpenSea. Those who missed out minting their own Bored Ape bought on the secondary market from Pranksy, still getting in relatively early for a good price.

Those who bought Bored Apes early are holding on to them for passive income. They’ve gotten rich off things like the APE token and additional NFT airdrops in the projects. Many are still holding, hoping prices will continue to rise.

With projects like Bored Apes, it’s very important to give holders incentives to hold. Otherwise, the buyers will quickly learn that most of the profits are just on paper. Very few people outside of crypto trading are going to spend $250,000 on a cartoon monkey. As with Top Shot, you can’t cash out so easily.

The NFT of Sisyphus

Amy and David are trying to write a book about NFTs. Amy started it and abandoned it, because she thought NFTs were so stupid they would just go away on their own. They didn’t, and David suggested they restart the project as a collaboration.

We like each other’s writing and trust each other, and we know the subject thoroughly, which is why we hate it and want it to die in a fire. David’s been trying to write this Top Shot chapter for a month, and it’s just been a grind. Evidently we’re holding it wrong or something.

A lot of the stuff in our lengthy outline is awful stories about awful people pulling reprehensible frauds. Maybe we need more dumb crooks. They make everything funnier. Or hopelessly misconceived corporate initiatives like the National Post capitalist facepalm collection.

Anyway, nobody cares about painstaking detail — they want cool and funny stories, and colourful characters, so we guess the task is to make the important stories cool and funny. This is proving harder than expected. We’ll get there! Might survive it!

Also, David is trying to write a proposal for a book on El Salvador’s Bitcoin misadventure for commercial publishers. Should be wild.

Your subscriptions keep this site going. Sign up today!

Thanks to Simon Spichak for some comments and details from the sports collector’s viewpoint.

“Roham Gharegozlou of Dapper Labs told Sports Illustrated: “We’re not building a product for day traders or a product for people that want to cash in, cash out. We’re building a long-term business.”

Somehow, a product for day-traders who were in it for the money was precisely what Gharegozlou had painstakingly constructed. Must all have been a terrible accident.”

That’s a little unfair. More likely, he saw a business model in sports-trading-cards-as-NFTs and was too stupid to notice that it was at the intersection of the fantasy sports gambling den, the trading card bubble environment, and the cryptocurrency/NFT bucket shop, and therefore expected to mostly attract legitimate collectors rather than gamblers, speculators, and day-traders.

lol, no. He built the market to work in a particular way. Dapper aren’t new to this game.

Looking forward to both books.