I keep being taken for some sort of raving SJW commie when I talk liberalism 101. So let’s liberal liberally for a bit.

Many crypto people will disagree, because they’re into deeply wrong crank economics. But let’s proceed.

(This was originally a Twitter thread, which took off, so I thought I’d post a version here too.) [Twitter]

“PlayDumb” asked in the FT Alphaville Unofficial Telegram group: “What is the ONE trend that stands out for you over the last 10yrs in finance and markets, in general?”

The one trend that stands out for me in finance and markets over the past decade is: increasing desperation to achieve returns.

Interest rates are in the toilet — so investors are susceptible to questionable, and increasingly desperate, schemes.

We get a proliferation of nonsense in attempts to magick up returns — Softbank pouring ridiculous amounts of money into companies with no path to profit, SPACs (which are literally “A company for carrying on an undertaking of great advantage, but nobody to know what it is“), and so forth.

(The crypto market’s frantic posturing to claim that crypto funds are totally real and valid financial institutions is a pitch to the desperate investor market, in the hope that crypto nonsense can be sold to the desperate as sufficiently resembling regular finance nonsense. This is one of the pitches for DeFi, for example.)

Arguably, this is the past twenty years. The 2008 financial crisis came from the same desperation, as financial engineers tried to achieve returns by constructing ever-more-elaborate Jenga stacks of collateralised debt obligations — which collapsed as soon as the number showed the slightest sign of going down.

Or, indeed, the past forty years — the problem with neoliberalism is that you eventually run out of other people’s public institutions to asset-strip.

The non-rentier economy — the one where people live, that does things — is in the toilet because of rentierism. That Adam Smith fellow had quite a few pointed words on the subject of landlords’ parasitical effects on an economy in The Wealth of Nations, and the rise of rentiers is Thomas Piketty’s basic thesis in Capital in the Twenty-First Century (UK, US).

Politicians in the UK and US subsist on political donations from rentiers. This has given them a forty-year ideological bias against just supporting the non-rentier economy, and against remembering why rentierism is bad for an economy.

The US response to the COVID-19 pandemic is a perfect example. They could have supported the non-rentier economy with regular stimulus cheques and so on. But instead, they put unlimited Federal Reserve money into the stock market — that is, a thing that exists only as a derivative of the real economy. The people were still screwed, but the government could brag how number is up.

If you feed your rentiers, because they make bigger political donations, they parasitise your non-rentiers. The trouble there is that the non-rentiers are where the money comes from for the interest rates the investor class desperately need.

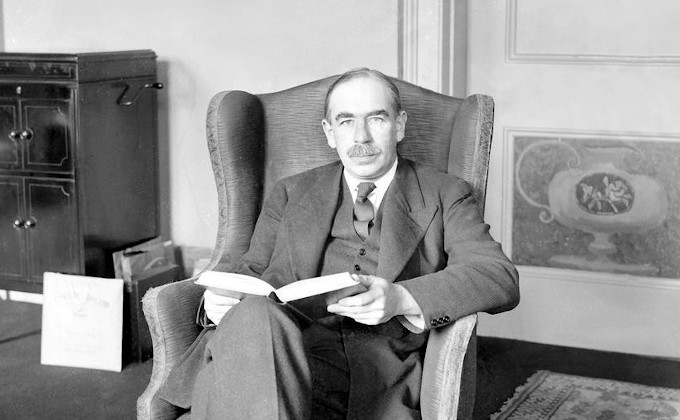

Now, that’s literally just basic liberal economics. Because Keynes — who was a successful capitalist investor — was just completely right. Neoliberalism is based in ideological objection to Keynes, and never mind that it doesn’t work. Be more Keynes — Hayek was wrong.

Guillotine GIFs at the polite end, and people setting fire to stuff at the impolite end, are unfortunate but trivially predictable consequence of several decades’ blatant abuses. So I would suggest doing things that lead to much less of those. This will directly lead to investment returns going up.

Your subscriptions keep this site going. Sign up today!

It is not just the hunt for a return on money but the substitution of money in place of values and ideology that has changed. There is an attempt to quantify everything. Political decisions are being based on purported rates of return, a logarithms and data analysis and it is nearly all phoney. Recommend the Talking Politics interview by David Runcimen with Adam Curtis https://podcasts.apple.com/gb/podcast/talking-politics/id974670140?i=1000516214004

As a rentier, living off a stock portfolio that will hopefully continue to pay for renting my 2-bedroom apartment, I completely agree. The alternative would be to try and get rehired at 57.

You could write books! My writing income in 2020-21 made a total of (looks at number) yes well, perhaps we can get out with the kids and work on this “revolution” thing

Rent-seeking is a well-described economic behaviour and it can be summarised fairly well by defining a ‘rent’ as extracting value created by others.

A rent is *not* a fair return on an investment: the stock market investors here might be in the clear, if they are adding value by putting capital at risk and extracting a return than equitably divides the value created by the enterprise, among all stakeholders.

If it doesn’t… Well, it’s a rent.

That is to say: someone’s taking all or most of the value in a transaction – or even parasitising and impoverishing the other participants – by exploiting a positional advantage that allows them, the rent-seeker, to impose inequitable or even injurious terms.

The key distinction between purchasing a rent, and making a productive investment, is that the latter is all about bringing risk capital to the table and facilitating the creation or growth of an enterprise in which others bring value, too – management skills, technical skills, tools, materials, marketing skills and customer relationships – in order to create more value than we all brought to the table.

Value is being created: that’s the definition of a productive enterprise and a productive investment.

And, again, it’s not a fair trade if the value we create is distributed inequitably:that’s just another rent, and a coerced transaction that is only different to robbery if the law permits it.

Not all property is theft, not all transactions exact a rent, and not all investments are rent-seeking: the concept of fairness, an equitable distribution of the value among those who created it, is the key.

And it’s not a free market, nor a free trade, if one participant can impose inequitable terms on the others: they are not choosing freely to enter into the transaction, on those terms.

Oddly, Libertarians fail to grasp the fundamental concepts of freedom underpinning market economics, as they are expressed here (and by Keynes): and you will never get them to engage with the essential point of a genuinely free market.

You can easily get them to admit that they regard those who starve on a less-than-living wage, or go bankrupt from medical bills and die of an untreated illness, as having chosen freely, and fully deserving of their consequences.

…And, underpinning all this, there is the concept of value.

Good luck, getting Libertarians and free-market fundamentalists to describe a theory of value: there are several, all with some degree of validity, but they all need a bit more intellectual depth than declaring money is value and vice versa. .

My advice is to formulate your own definition and refine it over the course of a lifetime.

Meanwhile, the relentless erosion of investment returns represents a secular shift in the deployment of capital away from productive enterprises, where value is created, into rent-seeking activities that extract it inequitably and in doing so, diminish or destroy it.

For further reading about the pursuit of diminishing returns in such an economy, look up the phrase ‘Flight to Garbage’, intended as a play on ‘Flight to Quality’ or ‘Flight to Safety’ but now used unironically, as a popular and successful investment strategy on its own terms.

Successful, that is, for some.

Good to see the conversation branching out to the broader problem of the rentier economy, of which crypto is merely the most vulgar and blatant example, the apotheosis of the idea that putting your hand in the next guys pocket is as equally valid a means of living as creating things of value.

Crypto may be notable in having such a high proportion of rent-seeking and such low percentages of actual wealth generating use cases but it is still dwarfed by the overall amount of rent-seeking in the classic monopoly of land and the now burgeoning monopolies on the digital/data commons, which might not have the same obscene energy externalities as PoW crypto but have equally disturbing, if harder to quantify social and economic externalities.

In many ways crypto-rentiers are more forgivable because they’re only rent-seeking on other rent-seekers. No crypto is actually a useful or necessary currency for trade so they don’t stand between you and anything (save for externalities of energy, hardware, financial stability and regulatory arbitrage). Things like land, internet search, online payments, social media, ecommerce etc are all vital parts of the modern economy and so there is no escaping these more ‘respectable’ rentiers (who sweeten their rents with some actual value creation) for the vast majority who are not content to live in a cave.

There has been a failure in the tech industry to properly defend digital commons and open standards and for engineers to be too eager to work on dark patterns simply because they come with better VC share options. The ubiquity of design on the web that intentionally degrades the user experience in the name of “engagement” (read:advertising/data revenues) speaks volumes to the fact that self-regulation has failed to stop the race to the bottom of the brain stem.

Concepts like BBS, IRC and RSS have been whittled away in favor of centralized gatekeeping platforms that not only seek to monetize the commons in a pathologically amoral manner, but also accumulate dangerously large and asymmetric power over the flows of information and communication in society, of which control over will be one of the great battlegrounds of the 21st century.

It may have been that these old, more open protocols were too clunky and inconvenient for the average person, but it was not inevitable that we had to surrender these commons in exchange for the usability and sleek interface of a Facebook or Reddit . Wikipedia still stands out as a rare city on the hill of what the rest of the web could be like if it wasn’t so ruthlessly captured by rentiers. And that is purely by the fluke that rentiers haven’t found a way to co-opt the huge value of a community driven encyclopedia.