The price of Bitcoin dropped 7% on Tuesday 31 July — and a large margin trade on Hong Kong’s OKEx cryptocurrency exchange went so badly that the trader not only blew their margin, they lost more money on the trade than they had put up as collateral.

Margin trading

Margin trading is when you borrow to multiply the effect of your trading — so rather than just having $100 to trade with, you can borrow and trade with $200, using the $100 as collateral. If your trade pays off, you’ve done really well!

If your trade doesn’t pay off — or even if the price dips enough that it looks like it won’t pay off — the lender forces you to liquidate the whole position and pay them back immediately, and you lose your collateral.

Crypto prices are ridiculously volatile. Volatility attracts traders, but anyone who trades cryptos on margin is exceedingly foolish — you’ll get margin-called remarkably often.

But margin trading on cryptos is incredibly popular — because too often, there’s only a fine line between “crypto trader” and “gambling addict.”

How OKEx futures work

OKEx offers its own futures contracts on the price of Bitcoin. These are in units of USD$100, but are settled by delivery of the bitcoins to the trader’s OKEx account. The contracts run weekly, closing 16:00 Hong Kong local time (HKT) every Friday. Margin is 10× or 20×.

(These are completely unrelated to the CME or CBOE Bitcoin futures — which are run in a much more orderly fashion, with maximum leverage around 2×.)

At settlement time, the losers supply the profits of the winners. If the losers don’t have enough funds, someone gets short-changed.

When a trader’s margin gets called, the exchange submits a market order at the price they blew their margin at. If that order isn’t filled before the futures contract expires … the exchange takes a loss.

Fortunately, OKEx has a mechanism to deal with that — they have an “insurance fund,” supported by “the premiums after forced liquidations,” and contributions directly from OKEx’s own funds.

If that’s not sufficient — they take the money from traders whose trades didn’t go bad! They call this “societal loss”:

OKEX Futures uses a “full account clawback” system to calculate the clawback rate. The system’s margin call losses from all three contracts will merged and clawbacks will be calculated according to each user’s entire account profit, instead of calculating each contract’s margin call loss and clawback separately. Only users that have a net profit across all three contracts for that week will be subject to clawbacks. Clawbacks will only occur if the insurance fund does not have enough funds to cover the system’s total margin call losses.

This is an unusual system, not found outside crypto trading. OKEx requires customers to pass a test on their terms of service before they can trade futures.

This socialisation of losses allows the exchange to offer ridiculous levels of margin at little risk to themselves — which attracts more traders and trades, and thus more trading fees.

Timeline of events

Per OKEx’s incident report (archive), an unknown trader placed a huge order of USD$416,851,500 — that’s nearly half a billion dollars — at 02:00 HKT, 31 July (18:00 UTC, 30 July). This was a “long” position, meaning they bet the price would go up.

OKEx’s risk management alerting system flagged the order, due to its size — but didn’t automatically block it. Instead, their risk management team contacted the client, asking them “several times” to reduce the size of the position.

The customer refused, so their account was frozen to prevent further increases — but the position was not removed.

The Bitcoin price went down over the course of the day, from approximately $8020 to $7750. OKEx forced the liquidation of the position at 20:17:14 HKT (12:17:14 UTC) on 31 July.

Socialising the losses

The spectacle of the rich guy getting wrecked caused gales of schadenfreude-filled laughter from their fellow traders.

Unfortunately, the trade had gone badly enough that the trader’s losses were greater than their collateral. The unfilled long liquidation resulted in an open loss of about 950 BTC.

The “societal loss” clawback mechanism has been triggered previously — but this seems to be OKEx’s biggest clawback yet.

The massive unfilled Long liquidation of $415 Million has an open loss of -950 BTC that will hurt profitable BTCUSD contract traders of all maturities on @OKEx_ Futures

Social loss clawback may end up being biggest in the history of @OKCoin , will @starokcoin intervene? pic.twitter.com/6tnmmSA0vB

— Whalepool (@whalepool) July 31, 2018

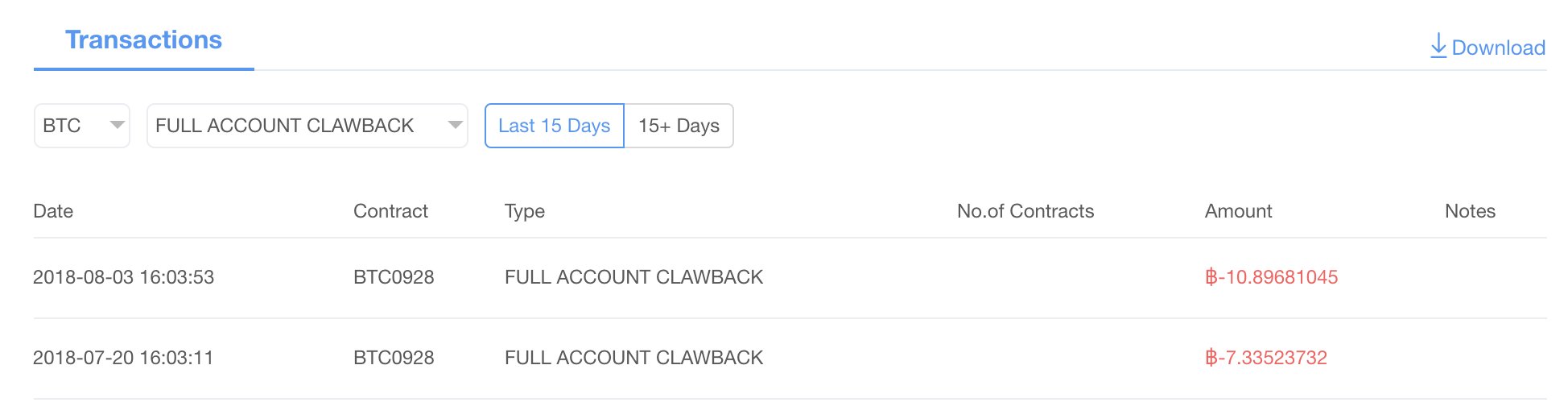

The insurance fund had only 10 BTC — about $80,000 — in it at the time. OKEx quickly put in another 2500 BTC — about $18 million — themselves. This still led to a haircut of $9 million, taking 18% of the profits of the successful traders in that week’s futures contracts.

The traders are, understandably, screaming. Here’s a tweet (archive) (warning: contains salty language) from “ibankbitcoins,” with a screen shot, and here’s their Reddit comment thread.

Obvious questions and comparisons

There are a number of obvious questions:

- How did an order this size go through?

- OKEx’s terms of service for futures trading note that they can freeze accounts and liquidate positions as needed. Why didn’t they?

- What customer is so important to OKEx that they’ll risk them breaking the system before they act?

It’s worth noting that we don’t know anything about this customer. We don’t have evidence they … exist. I mean, they probably do! I don’t really think OKEx is defrauding people in this manner. We just have no evidence that this isn’t OKEx applying a haircut to their customers. That’s what “unregulated” means.

More than a few have been struck by the similarity to what Bitfinex did after they were hacked in August 2016, as I detail in chapter 8 of the book:

Usually a theft of this magnitude heralds an exchange disappearing or shutting up shop with apologies, or local regulators noticing its existence and swooping in. Bitfinex considered going into bankruptcy, which might leave customers waiting years for a payout. But as the supplier of

gamblingtrading facilities not available elsewhere, Bitfinex felt there was sufficient demand for their services that a drastic action would be considered acceptable to their users: rather than have some customers take a 100% loss, they assessed a 36% “haircut” on all customer deposits — including non-Bitcoin deposits. Depositors whose coins had been hacked would be compensated with money from depositors who hadn’t: “we are leaning towards a socialized loss scenario among bitcoin balances and active loans to BTCUSD positions.” The company would then try to trade its way out.You might think that compensating your customers using money from other customers, while the owners don’t take a hit, would be against the rules in any reasonable financial system. Particularly as bankruptcies usually pay depositors and creditors first and equity holders last. But welcome to Bitcoin.

The consequences for the future: nothing

There won’t be significant consequences going forward.

OKEx say they’ve learnt valuable lessons from this, and are working to make the clawback mechanism kick in less often — they’d prefer their customers to be happy with them.

But the bottom line, from OKEx Head of Operations Andy Cheung, is:

Cheung also admits that there has not been too much fallout from their clawback mechanism, nor damage to the futures trading sentiment.

Nothing will stop a trader — or *psst* gambling addict — in search of volatility. And nothing will stop their suppliers.

OKEx type occurrences set the entire industry back/make us look like amateurs. Quite frankly the vast majority are. Creating margin out of thin air/operating like a CRB only facilitates market manipulation and gives regulators a stronghold to be overly cautious/restrictive. Sad!

— Pull the Wire (@WashedUpTrader) August 3, 2018

cry is short for crypto

— Buttcoin (@ButtCoin) August 9, 2018

Thanks to Amy Castor for prodding me to finish this one, and top-quality editing suggestions.

Your subscriptions keep this site going. Sign up today!

>They call this “societal loss”

I am glad to know that the techno-libertarians are on succeeding in their building of the society without the need to rely on those terrible centralized entities that force people to share societal effects of their actions

One nice thing I can say about crypto markets is that nobody involved gives a hoot about the weirder bits of Bitcoin ideology. This is why centrally-controlled coins and tokens trade in the same markets as the ideology-coins.