Yet another Canadian crypto exchange goes down — this time, the Einstein exchange in Vancouver, British Columbia, Canada, which was shut down by the British Columbia Securities Commission (BCSC) on 1 November.

Yesterday, 18 November, the news came out that there’s nothing left at all — the money and cryptos are gone.

The BCSC investigates

Here’s an affidavit from Sammy Wu of the BCSC — asking that the Einstein companies be put into receivership.

The BCSC had been investigating Einstein since May 2019 — after multiple complaints from customers who couldn’t access their funds, going back to January 2018.

One Einstein user, Reddit user LezzBeFriendz, was even told on 15 October to stop emailing for their money, or Einstein would close their account:

As you have been told several times by several of my team members, by constantly emailing in you are further slowing down our processing times and causing further delays in your withdrawals.

Einstein’s problem was that it didn’t have all the customer funds it claimed to. Withdrawals were processed from the pool of crypto and fiat deposits — Einstein could only process withdrawals if there were enough deposits on hand. And … Einstein was deficient in both fiat and cryptos.

On 9 October, the BCSC demanded Einstein supply financial information, fiat and crypto balances by 30 October.

Einstein told the BCSC that it had been trying to sell itself to a US company, but the deal had fallen through — so they had planned to shut down in 30 to 60 days. Einstein claimed to have sufficient crypto on hand to satisfy withdrawal requests.

This is unlikely. BCSC had looked over Einstein’s books in September — and worked out they had CAD$16 million in outstanding liabilities to customers.

There had been rumours for much of 2019 that Einstein was going to cut and run. Customers and companies had started filing suits to get their money back.

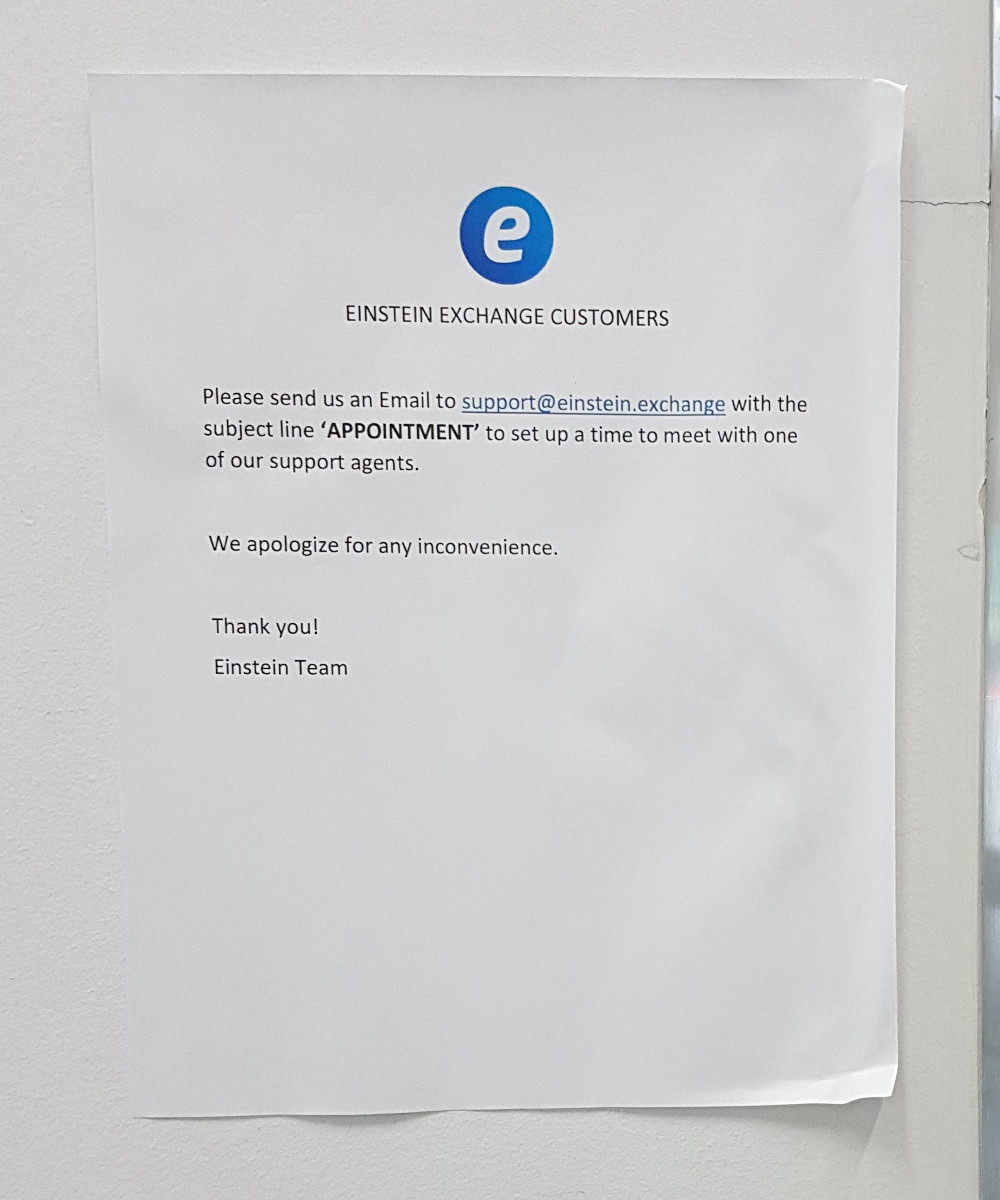

On 30 October, Reddit user 11coast posted a notice stuck to the door of Einstein’s closed office: “Please send us an Email to support@einstein.exchange with the subject line ‘APPOINTMENT’ to set up a time to meet with one of our support agents.” The notice had apparently been there for at least two weeks.

Shut down

On 31 October, BCSC asked Einstein’s lawyers to tell them by the next day where fiat and crypto balances were kept. “Two hours later, Einstein counsel notified me that they no longer represent Einstein.”

On 1 November, Wu visited the Einstein offices — “the elevator is locked for all floors. I called Gokturk’s number listed on the website and the recording said all their agents are not available.”

Michael Gokturk of Einstein told the receivers, Grant Thornton, that he thought Einstein owed customers CAD$8 million to $10 million — not the $16 million the BCSC had worked out.

Gokturk attributed the losses to frauds with credit cards and bank drafts. He said that the majority of the loss was in cryptos.

What happened to the cryptos? Einstein had been keeping keys in hardware wallets — but it had also been using other crypto exchanges for “storage.” And totally not for day trading, no no.

Grant Thornton was appointed as interim receiver on 1 November — but after an interim report on 14 November, they applied to be discharged as receiver on 18 November.

Grant Thornton contacted various banks in Canada and the US. Summary: all the money’s gone.

“The Interim Receiver does not believe that the Einstein Group has any assets of substantial value” — i.e., not enough to pay the receiver — CAD$30,000 in cash, $15,000 in crypto, some computers, mining rigs, furniture … and three Bitcoin ATMs.

What happens next?

The BCSC has control of the empty shell of the company — and will likely continue investigations into just what happened.

It’s not clear what happened to all the money — if Gokturk was even more crooked than is usual and acceptable for the crypto space, if he was just incompetent … or if he foolishly thought that one more day trade could make up the gap in funds.

(HT Evan Thomas.)

Addendum from Evan:

“One point of clarification — BCSC does not have control of the shell. The receiver is discharged and has to return all of Einstein’s property.

“The exception is the cash. Grant Thornton was directed to hold the cash and notify agencies responsible for employment and tax matters. Those agencies may have a claim on the cash. Subject to those claims, Grant Thornton can apply the cash to its expenses.

“The upshot is that what remains of any cash is subject to priority claims before claims of users are even considered.

“Presumably BCSC is still investigating but they don’t have control of anything.

“This is the court order discharging the receiver, which has all the details.”

Your subscriptions keep this site going. Sign up today!

It’s almost as if regulation and third-party verification has a useful purpose.

Well on the brightside he is not building an orphanage in India and he is alive to ask questions of. Pro tip he will face no questions and receive no sanctions because the money and crypto are gone to his private accounts which he will claim was hacked and therefore he has no control and no liability. Its a pattern we have seen before. There are no consequences for doing this and therefore it will be done again and again.