Which whale dumped enough Bitcoins to crash the price in December, January and February? It looks like it was the Mt. Gox exchange’s bankruptcy trustee, Nobuaki Kobayashi, selling the remaining coins to reimburse creditors.

Kobayashi has sold about $400 million worth of Bitcoin and Bitcoin Cash — the latter being the free BCH that was given to every BTC holder as of 1 August — since late September, as he told a creditors’ meeting on Wednesday morning: 35,841 BTC sold for 38,231,389,537 JPY and 34,008 BCH sold for 4,756,654,806 JPY.

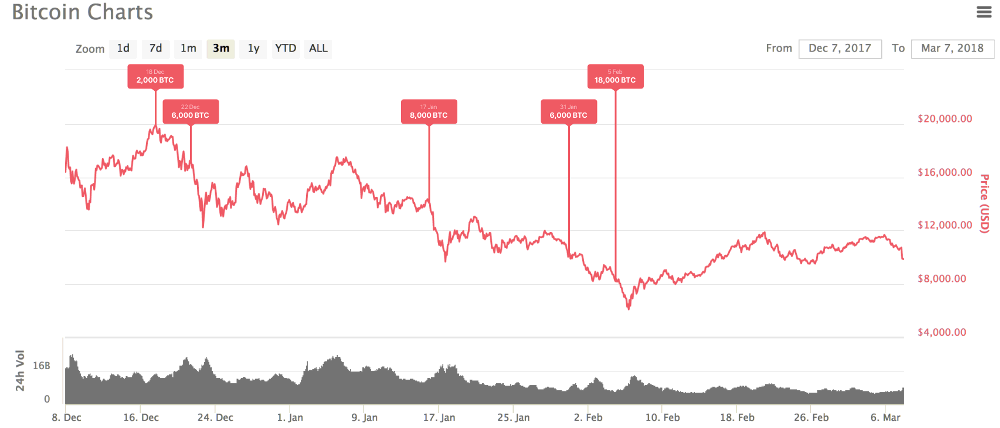

The effect on the price was clearly visible. Reddit user riverflop posted this diagram to /r/cryptocurrency, correlating the Mt. Gox Bitcoin selloffs with the Bitcoin price:

It seems odd to have sold the coins via a public exchange — rather than via auction or via the murky over-the-counter (OTC) markets. Kobayashi maintains he did this to get the best price he could.

Both Mark Karpelès, proprietor of Mt. Gox at the time of its 2014 collapse, and the Kraken exchange directly advised the trustees not to sell the coins this way:

Kraken advised trustee against selling on market (https://t.co/mjvytwAZ7J) and so did I.

There isn't much I can do and I learned about the sale with everybody else when first reading the status report at the start of the creditors meeting.

— Mark Karpelès (@MagicalTux) March 8, 2018

The important takeaway is that Bitcoin is still ridiculously thinly traded, and trivial to manipulate. “Market cap” is still a completely bad and bogus number — here we see hundreds of millions of dollars in imaginary “value” disappearing because a single large holder needed to cash out.

Tether apologists will claim that a hundred million tethers used for purchases couldn’t move a market cap the size of Bitcoin — but one lawyer repeatedly crashed the price with sales around that size.

This news seems to have spooked the market, with the price dropping and the usual pumpers not bothering to push it up — because Kobayashi is a Bitcoin whale, but one who doesn’t care what the Bitcoin price is, only about recovering the claimed cash for the creditors.

The fun part is that the sold bitcoins might make the creditors 100% whole in claimed JPY value — leaving a surplus. In Japanese law, any funds left over in the estate of a bankrupt company go to shareholders — which means 88% to Tibanne Ltd., i.e., Mark Karpelès.

Expect more price plunges — per the report to creditors, Kobayashi’s going to be selling off the other 80% of the bitcoins.

Your subscriptions keep this site going. Sign up today!

I’m glad Mark will continue to be rewarded for doing nothing wrong. First with a free* diet plan/food cleanse courtesy of the Japanese government, and now with 88% of the proceeds of his own hard work.