I spent the last few days watching the GDAX BTC/USD depth chart wobble from side to side. It’s very soothing.

(For help understanding what you’re seeing at that link: How to read a crypto market depth chart.)

me: “f’n hell”

wife: “Are they at it again?”

me: “I’m watching the Tedious Crypto Nerd Channel. They’re running a comedy special.”

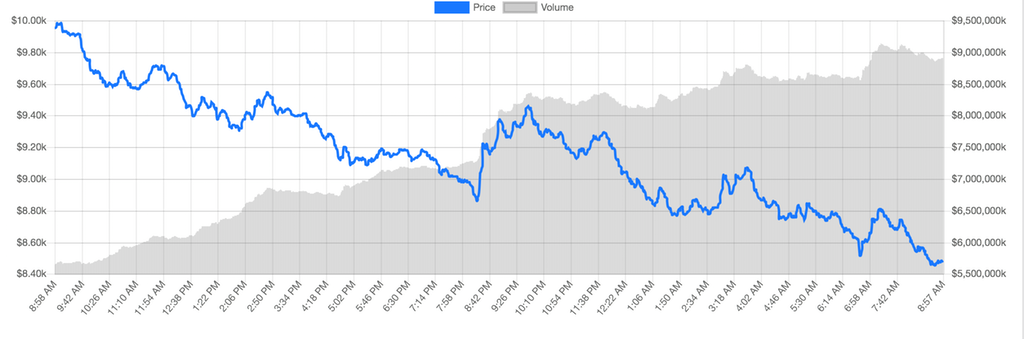

It could have been any reason — worries about Tether, regulatory problems, South Korea, India, anything that would set off an already-skittish market — but everyone decided Thursday and Friday was the day to cash out while they could. Here’s price versus volume:

GDAX live during a crash is wild. It’s the one to watch, because it’s the actual dollar exchange with volume. It’s like an action thriller movie for very dull people.

A “wall” is an offer to buy or sell a large pile of coins at a given price, and for the price to progress past that point the “wall” needs to be completely fulfilled.

A lot of orders are placed and removed by bots. If you never intended to fulfill the order, and just placed it to make it look like there’s a strong wall on a price, this is called “spoofing.” Spoofing has been illegal since Dodd-Frank in 2010, but since it requires proving intent, it doesn’t get prosecuted much. So it’s absolutely standard in crypto trading.

You can watch the spoofing bots putting up and taking down buy and sell walls in real time. Sometimes they’re too slow and the wall gets nibbled at before they can pull it, popping it up again $100 higher/lower. Never believe any wall on a crypto depth chart, except the immediately next one. And don’t believe that either.

As I tweeted on Thursday:

bitcoin go “WHEEEEE!” I just watched the 254 BTC “YOU SHALL NOT PASS” wall at $9000 get eaten into by the price, then the spoofer pulled the bid and the price immediately dropped to $8954. Next wall is at $8905. Whoops, just popped! Next is $8800.

Also, making a bid or ask offer is free on GDAX — the exchange charges the traders who take them. So you’ll occasionally see a buy and sell wall, 1 cent apart, holding the price steady for a time. The depth chart looks like bulldozers facing off.

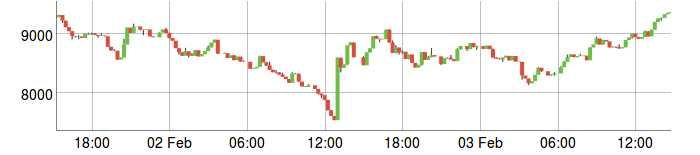

This crash was pretty much arrested by the pump around 1300 UTC Friday that pushed the price up $1000 in literally minutes. Someone spent over one million dollars of actual money on that pump. You can see the green candles here, that’s someone pouring money in:

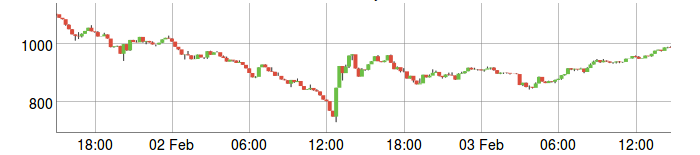

They did a pump on ether at the same time:

You should at all times assume the crypto marketplace is being manipulated to hell. If you ever wondered why I don’t trade in cryptos …

Your subscriptions keep this site going. Sign up today!